Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomUnderstanding the Doji Candlestick

In the world of technical analysis, candlestick patterns are essential tools that traders use to gauge market sentiment and predict potential price movements. One of the most widely recognized and often used patterns is the Doji candlestick. This pattern, despite its simplicity, offers valuable insights into market indecision, and when interpreted correctly, it can help traders make more informed decisions.

What is a Doji Candlestick?

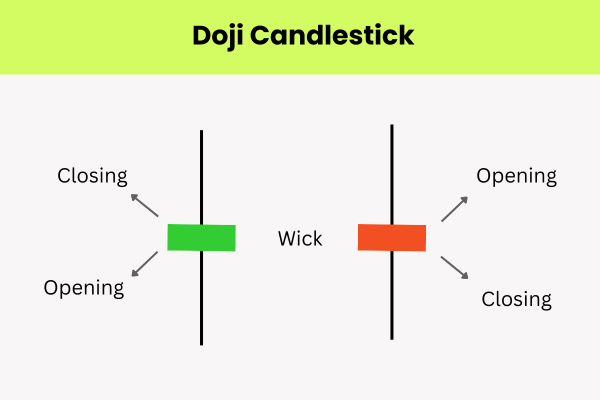

A Doji candlestick is a type of candlestick that forms when a security’s open and close prices are almost identical. This results in a candlestick with a small or almost nonexistent body, often accompanied by long upper and lower shadows (also called wicks). The Doji is unique because it visually represents indecision in the market, signaling that neither buyers nor sellers are in control.

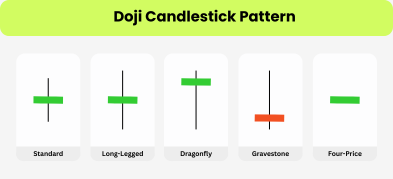

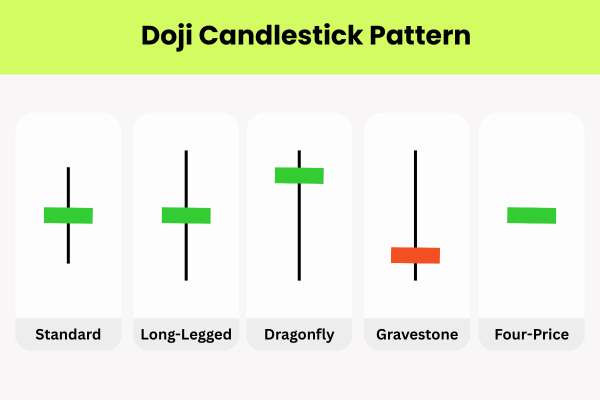

The Doji can appear in various forms, depending on the length of its shadows and the position of the open and close prices. Here are the most common types of Doji candlesticks:

Types of Doji Candlesticks

| Type of Doji | Description | Market Sentiment |

| Standard Doji | The open and close are almost identical, with relatively short shadows on both sides. | Indicates indecision, signaling that neither buyers nor sellers are in control. |

| Long-Legged Doji | This Doji has long upper and lower shadows, indicating significant market movement in both directions before closing near the open. | Represents high indecision, with market participants pushing the price in both directions. |

| Dragonfly Doji | The open and close are near the bottom of the candlestick, with a long upper shadow and little or no lower shadow. | Potential bullish reversal, indicating strong support at a lower price level. |

| Gravestone Doji | The open and close are near the bottom of the candlestick, with a long upper shadow and little or no lower shadow. | Potential bearish reversal, indicating strong resistance at a higher price level. |

| Four-Price Doji | This is a rare type of Doji where the open, close, high, and low prices are all the same, creating a very small or nonexistent body with no shadows. | Extremely rare and often signals an extremely balanced market, though difficult to interpret on its own. |

What Does a Doji Candlestick Indicate?

The Doji candle serves as a visual cue of market indecision. It suggests that, during the time frame of the candlestick, neither the buyers nor the sellers were able to dominate, resulting in a standoff where the price opened and closed at the same level or nearly the same level.

However, it’s important to understand that a Doji alone doesn’t necessarily signal a reversal. Instead, its true significance comes from the context in which it appears, including the candles before and after it.

How to Interpret the Doji Candlestick

While the Doji is often considered a neutral pattern, its interpretation depends largely on its position within a trend and the type of market environment. Here’s a breakdown of how to interpret the Doji in different scenarios:

1. In a Bullish Trend:

- If a Doji appears after a series of strong bullish candlesticks, it may signal that the market is losing momentum, and a potential reversal or consolidation could follow. The longer the preceding bullish candles, the more significant the appearance of a Doji becomes.

- The Gravestone Doji is especially notable here, as it can indicate that buying pressure is weakening, and the price may begin to fall.

2. In a Bearish Trend:

- If a Doji appears after a series of strong bearish candlesticks, it may indicate that the selling pressure is fading. This could be a sign of a potential reversal or at least a slowdown in the downtrend.

- The Dragonfly Doji is important here, as it may indicate that the price has found support, and the market may be preparing for a bullish reversal.

3. During a Consolidation Phase:

- If the market is in a range-bound or sideways trend, a Doji can signal that the market is in a state of indecision, with neither buyers nor sellers able to break out of the range. In this case, the Doji may indicate that the price is about to make a decision, either continuing in the same direction or breaking out.

Combining the Doji with Other Indicators

The Doji candlestick pattern is often more reliable when combined with other technical analysis tools. Traders frequently use it in conjunction with indicators such as:

- Support and Resistance Levels: If a Doji appears at key support or resistance levels, it may strengthen the case for a reversal or breakout.

- Volume: A Doji followed by a strong price move with high volume can provide additional confirmation that the market is ready to move in a particular direction.

- Moving Averages: If a Doji forms near a key moving average, such as the 50-day or 200-day, it can act as a significant signal of a potential trend reversal.

Risks and Limitations of the Doji Candle

While the Doji is a powerful tool, it has its limitations. A Doji alone does not confirm a reversal; it is merely a sign of indecision. Therefore, it’s crucial to wait for further confirmation before making trading decisions. Traders should always combine the Doji with other technical indicators to strengthen the probability of a successful trade.

Additionally, in highly volatile markets, Dojis can appear more frequently and may not always lead to clear trends. Traders should be cautious and ensure they are trading in a market that provides the appropriate context for the Doji pattern.

Conclusion

The Doji candle is a simple yet powerful tool in the trader’s toolbox. It signals indecision in the market, providing valuable insight into potential trend reversals or consolidations. However, like all candlestick patterns, the Doji should be interpreted in context and in combination with other indicators to improve the accuracy of predictions.

By understanding the Doji candlestick and its significance, traders can better assess market sentiment and make more informed decisions. Whether in a trending or sideways market, the Doji provides crucial clues to help traders navigate the complexities of the financial markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.