Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomTurtle Trading Strategy Made Simple

Ever heard about the turtle trading strategy? The turtle trading strategy is described as a simple trend approach that enters on breakouts, sizes risk with ATR, uses 2N stops, and only adds to positions that already work. It helps beginners capture the middle of big moves while keeping losses small.

If you are new and tired of guessing tops and bottoms, you can try this strategy instead. Let price do the talking. Buy strength, cut weakness, risk a tiny fixed slice, and let the occasional big trend pay for a lot of small scratches. That is the turtle trading strategy in one line.

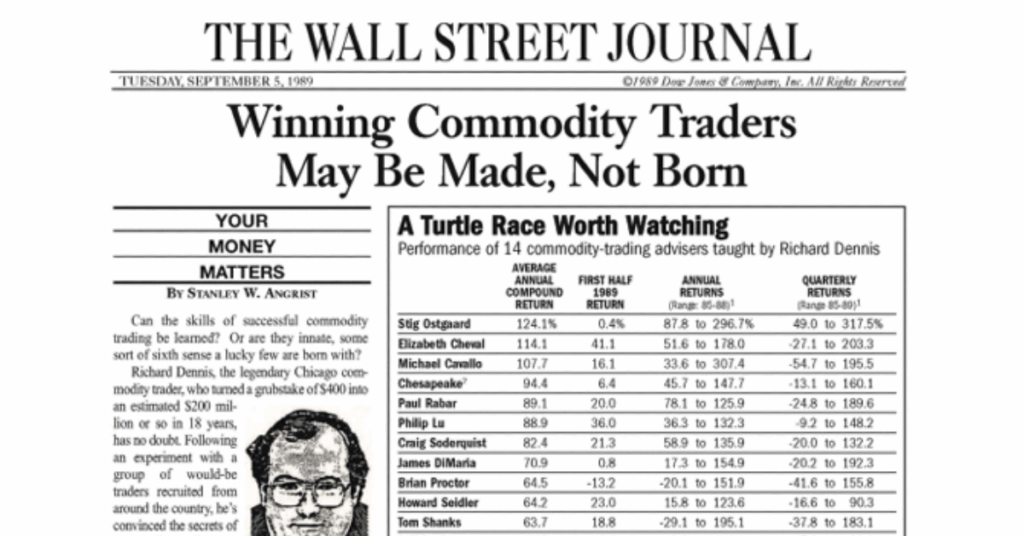

Why This Strategy Became Famous

In the 1980s a successful trader, Richard Dennis, taught a group of newcomers one mechanical system and funded them. The lesson was not that anyone can get rich overnight. The lesson was that clear rules plus strict risk control can beat constant prediction. That story turned “turtle trading” into a lasting reference point for beginners who want a repeatable plan.

What Is The Turtle Trading Strategy?

Turtle trading is a rules based trend following method. It waits for price to break from a multi week range, enters in the direction of the break, uses volatility based stops, and exits only on an opposite break or trailing rule. You do not predict. You execute the plan.

Start with daily charts. Intraday noise can overwhelm the edge and raise costs.

Turtle Trading Rules

Here is the full ruleset in one place so you can see the whole plan before we talk about risk sizing and portfolio control.

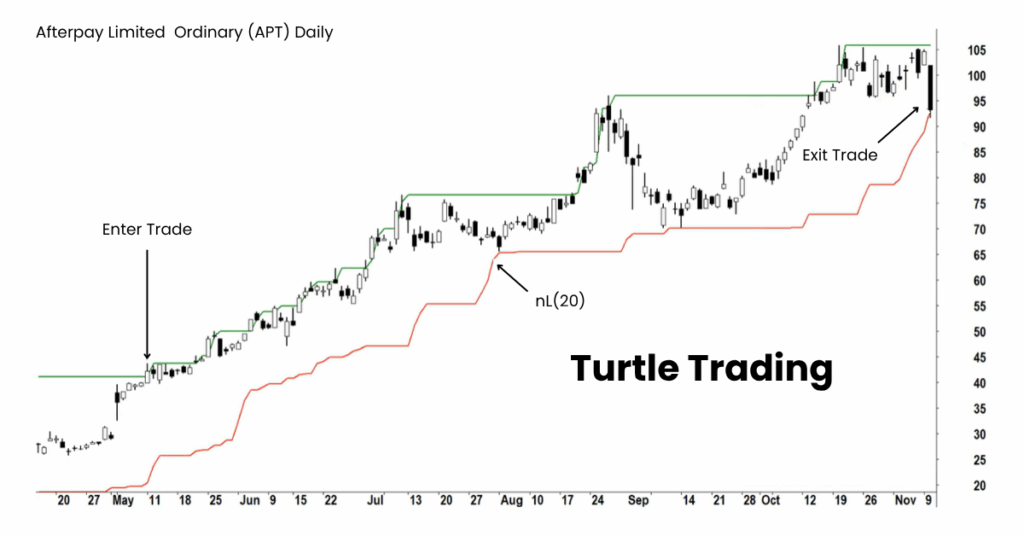

Entries

- System One

Long on a new 20 day high

Short on a new 20 day low

If the previous 20 day breakout was profitable, skip the next 20 day signal - System Two

Long on a new 55 day high

Short on a new 55 day low

Always take System Two as the catch all

Stops And Exits

- Initial stop at 2N from entry

- System One exit on a 10 day opposite breakout

- System Two exit on a 20 day opposite breakout

Pyramiding

- Add one new unit every 0.5N of open profit

- Keep units equal size

- Cap at four units per market

Portfolio Heat

- Up to six units in closely related markets

- Up to ten units in loosely related markets

- Up to twelve units total in one direction across the whole portfolio

Position Sizing With N

Before you can apply the turtle trading rules in real trades, you need to know how much to trade. The entry and exit rules tell you when to act, but without proper sizing, even a good signal can hurt your account.

That’s why position sizing is the backbone of the turtle trading strategy. Richard Dennis built it around a volatility measure called N, so every trade carries a controlled and consistent level of risk, no matter how wild or quiet the market is.

What N Means

N represents the Average True Range over 20 periods. It measures typical daily movement and turns volatility into a simple number you can use for risk management.

In practice

- High volatility with large N means smaller position size

- Low volatility with small N means slightly larger position size

Each trade risks a similar fraction of capital rather than a fixed number of lots or contracts.

Why It Helps Beginners

Using N automatically adapts your size to market conditions. It keeps risk per trade consistent and your emotions in check, even when markets get choppy.

How To Size One Unit

- Choose account risk per trade such as 0.5 to 1 percent of equity

- Calculate N as ATR over 20 periods

- Convert N to money using pip value or contract value

- Position size equals Account Risk divided by Dollar Volatility at 2N

Each unit is your standard building block. You add new units only when the trade moves in your favour. Keep this sizing process identical on every trade so your results stay consistent and objective.

Stops And Exits That Keep You Objective

This ties directly to the rules and explains how they work together. Think in layers. Your initial stop is 2N from entry. Your trailing exit is the opposite breakout window. Whichever triggers first closes the trade. Do not widen stops and do not move targets after entry.

Adding To Winners Without Averaging Down

This complements the entry rule with a growth rule that rewards proof. Add only when the market proves you right.

- Add one equal unit every 0.5N of open profit

- Stop after four units in the same market

- Keep the stop aligned so an exit closes the full stack together

This lets winning trends carry more weight while initial risk stays small.

Portfolio Caps And Simple Drawdown Rules

After you size a single trade, protect the whole account. These controls stop one theme from dominating risk and help you stay consistent during cold streaks.

- Treat gold and silver as closely related

- Treat Brent and WTI as closely related

- Treat major equity indices from different regions as loosely related

- Respect the six, ten, and twelve unit caps above

Drawdown step down

Reduce new position sizes by about twenty percent after each ten percent drawdown. Restore only after recovery. This protects both capital and confidence during cold streaks.

What Still Works Today

Kept short and practical so beginners can apply the rules now.

- Daily first. The edge shows better on daily swings than intraday noise

- Diversify smartly. Mix FX majors, metals, energies, agricultural futures, and broad equity indices

- Costs matter. Include spreads, commissions, and slippage in testing so your plan matches live execution

Strengths And Limitations

We will take a careful look at the strengths and limitations so you know what to expect before you start.

| Aspect | Strengths | Limitations |

| Psychology | Clear rules reduce second guessing | Many small losses can test patience |

| Risk | ATR sizing keeps per trade risk consistent | Equity swings are normal during ranges |

| Returns Profile | Outlier trends can drive long term results | You give back some profit to catch big moves |

| Execution | Easy to log, audit, and automate | Requires discipline to take every qualified signal |

| Portfolio | Caps prevent one theme from dominating | Poor diversification can still concentrate risk |

| Timeframe | Works well on daily swing setups | Intraday use often dilutes the edge and raises costs |

Conclusion

The turtle trading strategy gives beginners a practical way to follow trends without prediction. Enter on breakouts, size by volatility, add to strength, and protect capital with exits and portfolio caps. Keep risk tiny, stay consistent through the dull periods, and give yourself a real chance to catch the next major move.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.