Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomTuro Cancels IPO After Years of Preparation

In February 2025, peer-to-peer car-sharing giant Turo officially scrapped its IPO plans, ending a three-year journey toward going public. The company filed a notice with the U.S. Securities and Exchange Commission (SEC) confirming that its board “does not wish to conduct a public offering at this time.”

Turo originally filed for an IPO in early 2022 and kept updating its S-1 filings throughout 2023 and 2024. Many investors expected the San Francisco-based startup to follow the path of Airbnb and Lyft, but instead, the IPO was withdrawn amid mounting challenges.

Why Did Turo Cancel Its IPO?

The decision to pull the plug wasn’t sudden. It reflected a combination of financial realities, safety concerns, and tough market conditions.

Slowing Revenue Growth

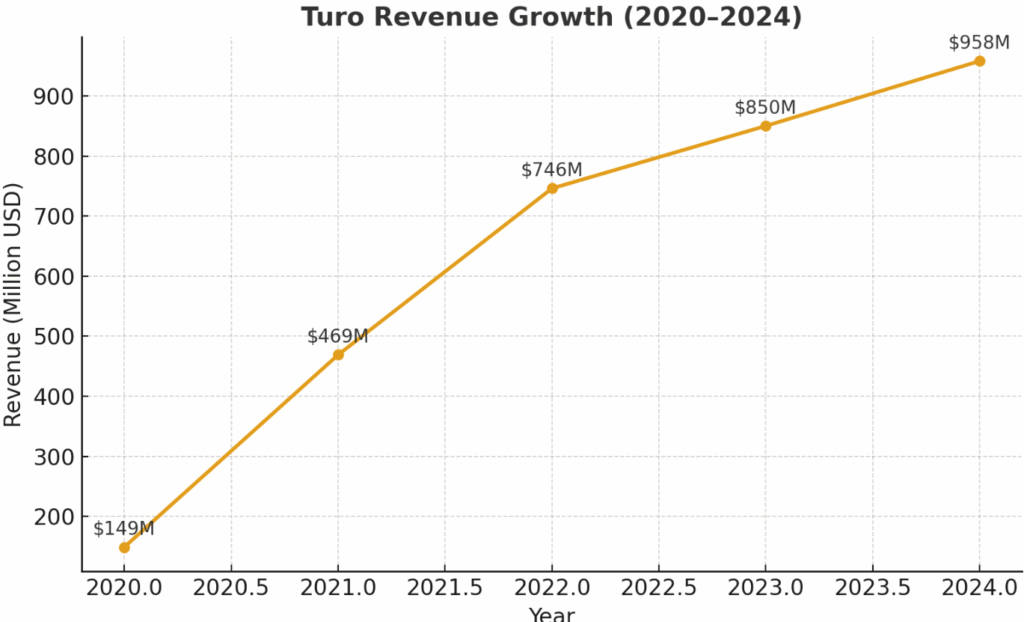

Turo’s growth exploded during the pandemic when supply shortages boosted demand for car-sharing. In 2021, revenues surged by over 200%. But by 2023–2024, revenue growth slowed sharply, raising doubts about its long-term scalability. In 2024, Turo reported $958 million in revenue, impressive but not enough to support a high IPO valuation.

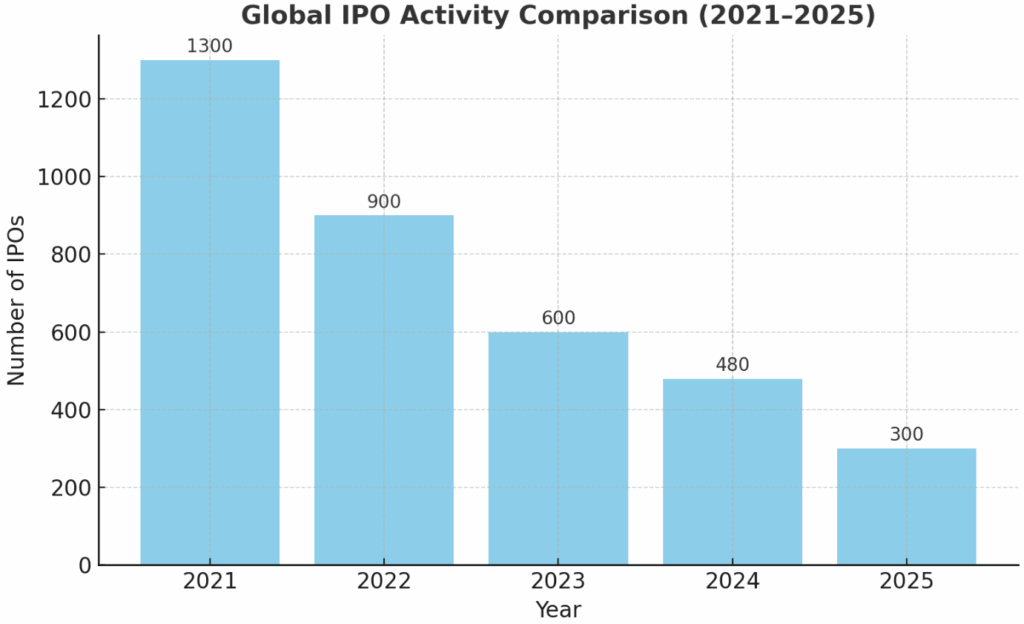

Unfavourable Market Conditions

Rising interest rates, persistent inflation, and global uncertainty have made IPO markets far less attractive. Investors are prioritizing profitability and resilience, not high-risk growth stories. Turo admitted that the IPO market was simply not favourable.

Reputational and Risk Pressures

In 2024, two high-profile incidents put Turo in the spotlight:

- A rented vehicle was used in a fatal attack in New Orleans.

- Another Turo car was linked to a Las Vegas explosion.

Though the renters passed background checks, these events raised red flags for investors about platform safety, insurance liability, and regulatory oversight.

Operational Reset

In early 2025, shortly after cancelling the IPO, Turo announced layoffs of around 15% of its workforce, or about 150 employees. Management said the goal was to focus on sustainable operations and long-term profitability rather than chasing a market debut.

What Was Turo’s IPO Valuation Before Plans Were Scrapped?

When Turo first filed for its IPO in early 2022, analysts estimated the company could be valued at around $2–3 billion. The IPO was expected to raise approximately $300 million in fresh capital, which would have helped Turo expand globally and invest in risk management and technology.

However, by 2024, slowing revenue growth and market volatility made those valuation targets harder to justify. With investors demanding profitability over pure growth, Turo’s expected valuation likely dropped below initial projections, one of the reasons management chose to step back rather than go public at a discount.

Who Owns Turo Now That the IPO Was Cancelled?

Even though the IPO has been cancelled, Turo remains backed by some of Silicon Valley’s most notable venture investors. Major stakeholders include:

- IAC (InterActiveCorp) – a large media and internet holding company.

- August Capital – early-stage venture capital firm.

- Kleiner Perkins – a well-known venture capital firm with investments in Uber, Airbnb, and other tech pioneers.

Because Turo is still private, ownership remains concentrated among these institutional investors, the founding team, and employees with equity. Retail investors cannot buy shares until Turo goes public in the future.

How Does Turo Make Money Without an IPO?

Turo operates on a peer-to-peer marketplace model, often called “Airbnb for cars.” Its primary revenue streams are:

- Commission Fees – Turo takes a percentage cut from each rental, charged to both the vehicle owner (host) and the renter.

- Insurance Partnerships – Turo offers liability insurance and protection plans, which generate additional fees.

- Service & Delivery Fees – Extras like vehicle delivery or premium protection add to revenue.

This model generated nearly $958 million in revenue in 2024, showing that while Turo did not go public, it is still a sizeable and growing business in the private market.

Is Turo Going to Go Public in the Future?

Currently, Turo has no active IPO plans. CEO Andre Haddad and the board have made it clear that “now is not the right time” to go public.

That doesn’t mean the door is permanently closed. If Turo can:

- Reignite strong revenue growth

- Prove consistent profitability

- Strengthen safety and risk management

- Wait for a more favourable IPO market

For now, however, Turo remains a privately held company, backed by venture investors like IAC, August Capital, and Kleiner Perkins.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.