Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomTop 10 Strongest Currency In The World

Understanding the strongest currency in the world goes far beyond just comparing exchange rates. Traders, investors, and global businesses analyze currencies based on economic stability, foreign reserves, and demand in international trade.

In this article, we break down the top 10 strongest currencies in the world, why they hold such value, and what drives their strength in 2025.

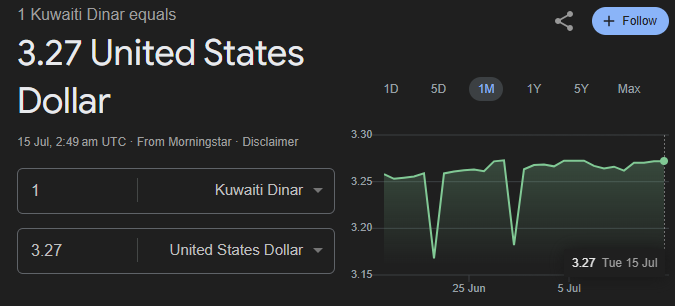

Kuwaiti Dinar (KWD) – Approx. 3.25 USD

The Kuwaiti Dinar is the strongest currency in the world by face value. Its strength comes from Kuwait’s massive oil exports, which make up over 90% of its revenue. The country operates under a budget surplus, has low inflation, and pegs its currency to a basket of international currencies, ensuring stability. Tight capital controls and limited global circulation keep the KWD insulated from speculative pressures, maintaining its high value against the US Dollar.

Bahraini Dinar (BHD) – Approx. 2.65 USD

The Bahraini Dinar is the second strongest currency globally. Like Kuwait, Bahrain’s economy is heavily driven by oil exports. The BHD is pegged to the US Dollar at a fixed rate, which provides predictability in foreign trade and investment. Despite being a small nation, Bahrain maintains strong financial regulation and operates as a financial hub in the Gulf region, adding to the credibility and strength of its currency.

Omani Rial (OMR) – Approx. 2.60 USD

The Omani Rial ranks third due to its high oil revenue, strict monetary controls, and pegged exchange rate system. Oman pegs the Rial to the US Dollar at a fixed rate of around 2.60 USD, creating a stable environment for investors and traders. Additionally, the Omani government has taken steps to diversify its economy, ensuring long-term currency strength and macroeconomic stability.

Jordanian Dinar (JOD) – Approx. 1.41 USD

The Jordanian Dinar stands out because of its strong central bank policy and fixed exchange rate to the US Dollar (1 JOD ≈ 1.41 USD). While Jordan is not an oil-rich country, the government maintains strong fiscal discipline and low inflation. The central bank’s long-standing commitment to currency stability enhances investor confidence, which supports the Dinar’s value.

British Pound Sterling (GBP) – Approx. 1.28 USD

The British Pound (GBP) is one of the most traded and oldest currencies in the world. It derives strength from the UK’s developed financial system, London’s role as a global financial hub, and strong investor trust in UK institutions. Despite Brexit challenges, the Pound remains resilient due to deep market liquidity, strong legal systems, and relatively high interest rates compared to other major economies.

Cayman Islands Dollar (KYD) – Approx. 1.20 USD

The Cayman Islands Dollar is pegged to the US Dollar and benefits from the Cayman Islands’ reputation as a global financial center. With a zero-tax regime and stable government policies, the KYD remains in high demand for legal offshore banking and investment. The strong regulatory environment and low public debt contribute to its continued value and stability.

Euro (EUR) – Approx. 1.10 USD

The Euro is the official currency of 20 European Union countries, making it one of the most widely used and traded currencies in the world. Its strength stems from the economic power of the Eurozone, including Germany, France, and Italy. The European Central Bank maintains a balanced approach to inflation and interest rates, making the Euro a reliable global reserve currency.

Swiss Franc (CHF) – Approx. 1.13 USD

The Swiss Franc is considered a safe-haven currency, widely respected for its financial stability, neutral political stance, and low inflation. Switzerland has one of the highest GDPs per capita and a robust export economy, particularly in banking, pharmaceuticals, and manufacturing. The Swiss National Bank carefully manages monetary policy, often attracting capital during global uncertainty.

US Dollar (USD) – Base Value of 1.00

The US Dollar is the most dominant global currency, used in over 88% of all forex transactions. It’s the primary reserve currency worldwide and the benchmark for pricing commodities like oil and gold. The USD remains strong due to the size of the US economy, deep capital markets, and the Federal Reserve’s global influence. Even though it’s not the strongest by face value, it is the most powerful in terms of usage and influence.

Canadian Dollar (CAD) – Approx. 0.74 USD

The Canadian Dollar, also known as the Loonie, is heavily influenced by commodity exports like oil, natural gas, and minerals. Canada’s stable political environment, strong banking system, and proximity to the US (its largest trading partner) support the CAD. It is a popular currency for carry trades and is considered relatively stable compared to other commodity-linked currencies.

| Rank | Currency | Code | Approx. Value (USD) |

| 1 | Kuwaiti Dinar | KWD | 3.25 |

| 2 | Bahraini Dinar | BHD | 2.65 |

| 3 | Omani Rial | OMR | 2.60 |

| 4 | Jordanian Dinar | JOD | 1.41 |

| 5 | British Pound Sterling | GBP | 1.28 |

| 6 | Cayman Islands Dollar | KYD | 1.20 |

| 7 | Euro | EUR | 1.10 |

| 8 | Swiss Franc | CHF | 1.13 |

| 9 | US Dollar | USD | 1.00 (Base) |

| 10 | Canadian Dollar | CAD | 0.74 |

Note: These values are approximate and may vary with market fluctuations. Rankings are based on exchange rates against the US Dollar, not overall economic power.

What Is the Strongest Currency in the World?

As of 2025, the Kuwaiti Dinar (KWD) is the strongest currency in the world in terms of face value against the US Dollar. 1 KWD equals approximately 3.27 USD, making it the highest-valued currency globally.

However, a strong currency doesn’t always mean a large economy. Instead, it reflects a mix of low inflation, stable government finances, and trade surpluses. In the case of Kuwait, its oil exports and tight monetary policies underpin the Dinar’s strength.

Why Is the Kuwaiti Dinar the Strongest Currency?

From a trader’s perspective, the strength of the Kuwaiti Dinar (KWD) is rooted in a combination of macroeconomic fundamentals and monetary policy stability:

Oil-Backed Economy

Kuwait is one of the top oil-exporting countries, with over 90% of government revenue derived from oil. This steady inflow of foreign currency (especially USD) through energy exports creates high demand for the Dinar, supporting its value on global markets.

Low Inflation and Fiscal Discipline

Kuwait maintains low inflation rates, often below global averages. Its government operates with a budget surplus or near-balanced budgets, avoiding the need for excessive borrowing. This strengthens confidence in the currency and reduces depreciation pressure.

Pegged Exchange Rate System

Unlike freely floating currencies, the Dinar is pegged to a weighted basket of major currencies, not just the USD. This allows Kuwait’s central bank to manage volatility, respond to external shocks, and maintain a stable and high exchange rate.

Limited Circulation and Capital Controls

The Dinar is not a globally traded reserve currency, and its limited international circulation helps protect it from speculation. With capital movement controls in place, the Kuwaiti central bank can better manage currency supply and stability.

What Makes a Currency Strong?

From a macroeconomic trading perspective, several drivers contribute to currency strength:

Trade Surpluses

Countries with strong exports (especially commodities like oil or metals) see more demand for their currency, pushing up value.

Interest Rates & Inflation

Currencies from nations with higher real interest rates (adjusted for inflation) often attract global capital, boosting demand.

Political & Economic Stability

Safe-haven currencies like the Swiss Franc (CHF) thrive during global risk-off sentiment due to their neutrality and robust financial systems.

Foreign Exchange Reserves

Nations with substantial FX reserves (like Switzerland and the Eurozone) can defend their currencies and reduce volatility.

Conclusion

The strongest currencies in the world led by the Kuwaiti Dinar, Bahraini Dinar, and Omani Rial highlight how macroeconomic stability, oil wealth, and sound monetary policies influence currency strength. While many of these high-value currencies are not widely traded due to limited liquidity, others like the British Pound, Euro, Swiss Franc, and US Dollar remain core components of global forex markets.

For traders and investors, understanding why these currencies are strong helps identify low-risk opportunities, spot economic trends, and manage currency exposure effectively.

Whether you’re trading reserve currencies or exploring opportunities in commodity-backed currencies, Ultima Markets equips you with the tools and insights to navigate global currency markets confidently.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.