Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomTop 10 Semiconductor Stocks to Watch For

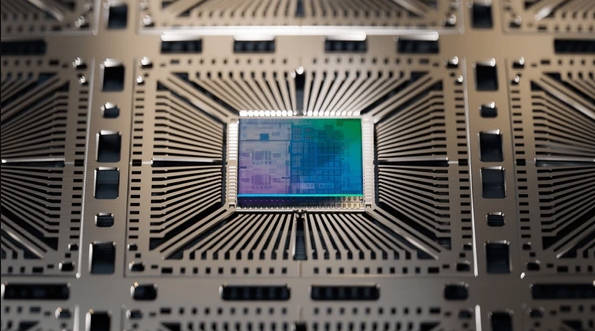

Semiconductor stocks sit at the centre of the digital economy. Chips power AI data centres, phones, PCs, cars, factories and the cloud. So the sector moves with each technology cycle, pricing shift and policy decision.

In late-2025 the story is dominated by three forces: AI-led demand, tight memory supply, and bottlenecks at the leading edge (lithography and advanced packaging). TrendForce expects conventional DRAM contract prices to rise 8–13% QoQ in Q4 2025 (and 13–18% when HBM is included), underscoring how AI is reprioritising capacity.

Why Semiconductor Stocks Matter Right Now

Two cycle “tells” are hard to ignore. First, tool availability at the leading edge is still the gatekeeper: ASML has shipped its first High-NA EUV systems and is guiding ~15% full-year 2025 sales growth, keeping lithography central to the next node transitions in logic and DRAM.

Second, localisation milestones don’t eliminate chokepoints. Nvidia and TSMC produced the first U.S.-made Blackwell wafer at TSMC’s Arizona fab. Symbolic progress, but finished AI chips still rely on CoWoS advanced packaging in Taiwan, keeping cross-border dependencies in play.

What Usually Moves Semiconductor Stocks

End-market demand

In this cycle, AI servers and accelerated computing pull the stack. GPUs/accelerators, HBM, optics and packaging often offsetting softer consumer and parts of auto/industrial.

Manufacturing technology

Progress to new nodes hinges on EUV shipments, yields and, increasingly, High-NA timing.

Policy and localisation

CHIPS-style incentives and export rules reshape where fabs are built, which tools are shipped, and how quickly products reach volume.

The Stack at a Glance

Design leaders capture demand but rely on foundries for wafer capacity.

Foundries convert designs into silicon and increasingly co-optimise packaging.

Memory suppliers (especially HBM) sit at the AI bandwidth bottleneck.

Equipment and materials are the “picks and shovels” that expand capacity and unlock new nodes.

Leaders To Watch In Semiconductor Stocks

A short, research-friendly list spanning design, foundry, memory, tools, materials and power. Use these as examples and not recommendations to frame the cycle.

Nvidia (NVDA): AI compute bellwether

Nvidia’s Q2 FY26 revenue hit $46.7B, with $41.1B from data centres, a simple proof point for AI’s pull on the entire stack. Watch Blackwell ramps and any shifts from export controls.

Taiwan Semiconductor (TSM): Leading-edge foundry scale

The first U.S.-made Blackwell wafer at TSMC Arizona marks progress on localisation, but advanced CoWoS packaging remains concentrated in Taiwan, so final delivery still crosses borders. That split is central to timelines and working capital for AI systems.

ASML (ASML): Lithography as the gating factor

With High-NA EUV now shipping and ~15% 2025 sales growth guided, ASML remains the key enabler for next-gen nodes in logic and DRAM. EUV intensity is rising on memory roadmaps too.

Lam Research (LRCX): Advanced packaging enablement

Lam’s new VECTOR® TEOS 3D deposits ultra-thick, void-free films (single-pass, >30–60 μm), tackling 3D stacking and chiplet integration challenges that define AI-class packaging. It’s a clean “picks and shovels” way to express packaging growth.

Applied Materials (AMAT): Broad tools exposure

AMAT posted record Q3 FY2025 revenue of $7.30B, reflecting demand for leading-edge logic/memory and advanced packaging steps even as China-related policy adds uncertainty into FY2026.

Entegris (ENTG): Materials scale for localisation

Entegris is expanding U.S. capacity with $700M for an Illinois technology centre and $700M for a Colorado Springs manufacturing hub (total $1.4B), a useful proof point that materials are following fabs.

Marvell (MRVL): Custom silicon and electro-optics

Marvell’s data-centre revenue reached ~74% of total in Q2 FY26 on custom compute and optics, showing how hyperscalers are diversifying beyond merchant GPUs with tailored silicon.

Qualcomm (QCOM): AI PCs and auto/edge diversification

Qualcomm is pushing AI-PC laptops (Snapdragon X2 Elite family) while growing automotive and IoT within QCT. It is useful to capture AI at the edge rather than only in data centres.

NXP Semiconductors (NXPI): Software-defined vehicles and edge AI

NXP completed the acquisition of TTTech Auto and announced a deal to acquire Kinara (edge-AI), reinforcing its SDV and inference story even as auto normalises cyclically.

Onsemi (ON): Intelligent power for AI infrastructure

Onsemi completed the acquisition of Vcore Power Technology, sharpening its position in AI data-centre power delivery while continuing to pivot toward intelligent power and sensing.

How To Research Semiconductor Stocks

1) Start with demand. Is your thesis about AI data-centre growth, AI PCs, autos, or industrial? For AI-led theses, track HBM and DRAM pricing (they’re rising into Q4 2025) and packaging capacity signals.

2) Follow the bottlenecks. Leading-edge availability (EUV shipments, High-NA timing) and advanced packaging often dictate ramps more than wafer starts themselves.

3) Validate localisation claims. The TSMC Arizona milestone is real, but if CoWoS or other advanced assembly sits in Taiwan, supply chains are still split.

4) Cross-check policy risk. Export controls and incentives can swing orders and delivery schedules for tools, materials and subsystems.

Key Risks To Weigh

Cycle reversals. Memory and device pricing can turn quickly as inventories normalise.

Execution at the leading edge. Yield slips or slower tool installs push out launches.

Geopolitics and regulation. Export rules and local content requirements reshape the P&L and timelines.

Valuation. AI enthusiasm can lift multiples beyond fundamentals; keep an eye on revenue mix, gross margin drivers and free-cash-flow conversion.

What To Watch Next

- Memory & HBM price updates into early 2026 (they remain the cleanest read-through for AI bandwidth demand).

- High-NA EUV adoption cadence across logic and DRAM.

- Packaging capacity and how fast suppliers convert 3D-stacking roadmaps into shipments (Lam’s TEOS 3D adoption is a good tell).

- Localisation progress beyond wafers. See if regions can onshore packaging at scale without cost blowouts.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.