Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Gold has always been one of the most trusted investment options for Indians. Gold has earned a reputation as a store of value. It comes in various forms, such as jewelry, coins, and bars. Modern financial products like Gold Exchange Traded Funds (ETFs) also provide gold exposure. With changing market conditions, many investors face the crucial decision of choosing between Tata Gold ETF and Physical Gold.

This article will explore the benefits, drawbacks, and comparisons between investing in Tata Gold ETFs and physical gold. By the end, you’ll have a clearer understanding of which option aligns with your investment goals. This will consider the latest trends in the gold market.

What is Tata Gold ETF?

Tata Gold ETF is a financial product that tracks the price of gold. It offers investors a convenient and cost-effective way to invest in gold without physically owning the asset. Listed on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), Tata Gold ETF allows investors to buy and sell units of the fund just like any other stock.

The ETF works by pooling investors’ money to buy physical gold, which is securely stored by a custodian. Each unit of the Tata Gold ETF represents a specific amount of gold. Its value fluctuates with the current price of gold in the market. This makes Tata Gold ETF an attractive option for those who want to invest in gold. It eliminates the challenges of storing and securing physical gold.

Key Features of Tata Gold ETF:

- Backed by Physical Gold: Tata Gold ETF invests in physical gold, providing investors with exposure to the price movements of gold.

- Liquidity: Unlike physical gold, which may be harder to sell quickly, Tata Gold ETF can be traded on the stock exchange, making it highly liquid.

- No Storage Issues: Since the gold is stored with a custodian, investors do not have to worry about storage, security, or insurance.

- Cost-Effective: Gold ETFs typically have lower management fees compared to the premiums and making charges associated with physical gold purchases.

In summary, Tata Gold ETF offers an efficient and hassle-free way for investors to gain exposure to gold. It provides liquidity, transparency, and lower costs compared to physical gold.

What is Physical Gold?

Physical gold refers to tangible gold assets that you can physically hold and store. This includes gold in the form of coins, bars, or jewelry. Unlike financial instruments like gold ETFs, which represent ownership without physical possession, physical gold is a tangible asset. It can be kept in your home, bank vault, or other secure locations.

Key Features of Physical Gold:

- Tangible Asset: Physical gold allows investors to hold an actual item of value. It’s a concrete asset compared to paper or digital assets.

- Cultural and Emotional Value: In many cultures, including India, gold holds significant emotional and cultural value. It is often used in weddings, festivals, and as a symbol of wealth.

- Hedge Against Inflation: Gold is considered a safe haven during economic instability. It provides a hedge against inflation and currency devaluation.

- No Reliance on Financial Markets: Unlike gold ETFs or stocks, the value of physical gold is not directly affected by market fluctuations. This makes it appealing for long-term wealth preservation.

Types of Physical Gold:

- Gold Coins: Typically smaller denominations, which can be easily bought and sold. Some are produced by governments and may come with certification of authenticity.

- Gold Bars: Larger units of gold, usually purchased for bulk investment purposes. They offer better value per ounce compared to coins but require secure storage.

- Gold Jewelry: Often purchased for both investment and personal use, but typically carries additional premiums due to design and making charges.

In summary, physical gold is a long-standing, traditional form of investment, valued not only for its ability to retain value over time but also for its cultural significance and appeal as a tangible asset. However, owning physical gold requires careful consideration of storage, security, and potential premiums over the market price.

Tata Gold ETF vs Physical Gold: Which Is the Better Investment Option?

Gold has long been considered a safe haven for investors seeking stability and long-term wealth preservation. In India, investors traditionally gravitate towards physical gold such as coins, bars, and jewelry. However, with the rise of financial products like Gold ETFs, a new method of investing in gold has emerged, offering greater convenience and flexibility.

When it comes to choosing between Tata Gold ETF vs Physical Gold, both investment options come with their unique set of advantages and challenges. While physical gold provides the tangible security of owning the metal, Tata Gold ETF offers liquidity, cost-effectiveness, and the ease of digital transactions. Each has its merits depending on the investor’s preferences, financial goals, and investment strategy.

Liquidity and Accessibility

- Tata Gold ETF: Gold ETFs can be bought and sold during market hours on the NSE and BSE. This provides high liquidity, meaning investors can quickly enter or exit their position.

- Physical Gold: Buying and selling physical gold is less liquid, as it may involve finding a buyer or visiting a jeweler.

Storage and Security

- Tata Gold ETF: With ETFs, there’s no need to worry about physical storage. The gold backing the ETF is securely stored by a custodian, reducing the risk of theft.

- Physical Gold: Storage of physical gold requires secure lockers, home safes, or bank vaults, which can incur additional costs and security concerns.

Costs and Fees

- Tata Gold ETF: While ETF management fees are relatively low (typically around 0.5% to 1% annually), there are broker charges when buying and selling. However, there are no premiums like in physical gold.

- Physical Gold: The price of physical gold often includes making charges, premiums, and taxes, which can add up, especially when buying jewelry.

Cultural and Emotional Value

- Tata Gold ETF: While it offers financial benefits, gold ETFs do not carry the same cultural or emotional value as owning gold jewelry or artifacts.

- Physical Gold: Beyond investment, physical gold has cultural significance in many parts of India, especially during festivals and weddings. It’s often viewed as a symbol of wealth and prosperity.

Taxation

- Tata Gold ETF: Gold ETFs are subject to capital gains tax, short-term capital gains (STCG) for holdings under three years, and long-term capital gains (LTCG) for holdings over three years.

- Physical Gold: Physical gold also faces capital gains tax, but it may carry additional tax implications, especially when purchasing jewelry.

When deciding between Tata Gold ETF vs Physical Gold, the right choice depends on your personal investment goals. Tata Gold ETF offers liquidity, security, and cost-effectiveness for those looking for a modern and hassle-free way to invest in gold. On the other hand, physical gold provides a tangible asset. It holds cultural significance and is often viewed as a store of value during uncertain economic times.

How to Invest in Tata Gold ETF

Investing in Tata Gold ETF is simple and straightforward. Here’s how you can get started:

Open a Demat and Trading Account

To invest in Tata Gold ETF, you need a demat and trading account with a registered stockbroker. If you don’t already have one, you can easily open an account with a broker of your choice.

Choose a Brokerage Platform

Choose a reliable brokerage platform or financial institution that gives you access to the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE), where Tata Gold ETF is listed. Many online brokers now offer easy access to buying and selling ETFs.

Fund Your Account

Deposit funds into your trading account. You can do this through bank transfers, net banking, or other accepted payment methods.

Search for Tata Gold ETF on the Stock Exchange

Once your account is funded, search for Tata Gold ETF using its ticker symbol on the stock exchange. For instance, on the NSE, you can search for its symbol TATAGOLD.

Place an Order

Decide how many units of Tata Gold ETF you want to buy and place your order. You can place a market order (buy at the current price) or a limit order (set a maximum price you’re willing to pay).

Confirm and Monitor Your Investment

Once your order is completed, the units of Tata Gold ETF will be credited to your demat account. You can monitor your investment regularly through your brokerage account.

Tata Gold ETF Prediction 2030

Predicting the exact future value of Tata Gold ETF by 2030 is challenging. However, analysts are generally bullish on gold prices. This directly impacts the performance of gold-backed ETFs like Tata Gold ETF.

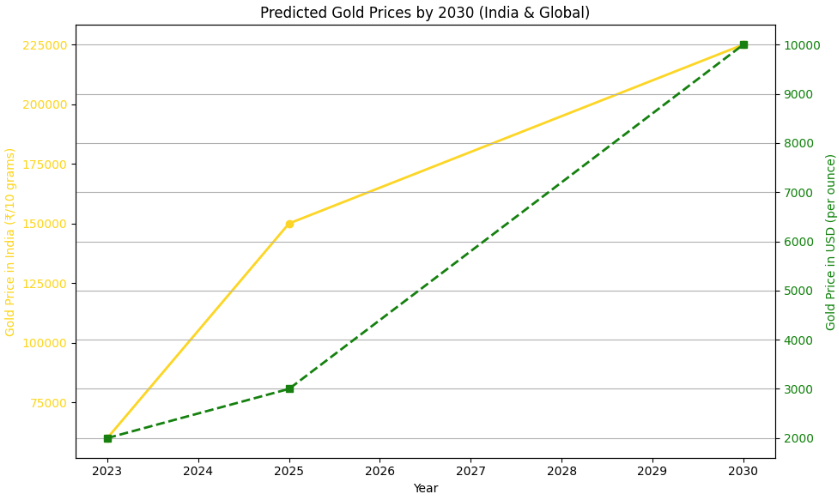

Many analysts predict that gold prices could appreciate significantly by 2030. This is due to ongoing inflationary pressures, economic uncertainty, and increasing demand for gold as a safe haven. For instance, gold prices in India might reach levels ranging between ₹1,40,000 and ₹2,25,000 per 10 grams by 2030.

With the demand for gold-backed ETFs rising as investors seek exposure to gold without the storage and security concerns, Tata Gold ETF is likely to benefit from this trend. Some models even forecast gold prices could rise dramatically, potentially exceeding $10,000 per ounce by 2030 in a high-growth scenario.

However, these predictions depend on several factors, including global inflation, interest rates, and market stability. While the outlook is positive, gold price volatility remains a consideration for long-term projections.

Conclusion

Investing in precious metals, such as gold and silver, is a strategic way to diversify your portfolio. It helps hedge against inflation and protect wealth. Whether you choose to invest in Tata Gold ETF for its liquidity and convenience or opt for the tangible value of physical gold, each option offers unique advantages. However, for those seeking flexibility, transparency, and cost-efficiency, Tata Gold ETF often stands out as the preferred choice in 2026.

At Ultima Markets, we offer a comprehensive platform for trading precious metals. We provide competitive spreads and low fees. Our platform supports a wide range of precious metal CFDs, including gold and silver. This allows you to trade with ease and flexibility. Whether you’re a beginner or an experienced trader, Ultima Markets provides an ideal environment for diversifying your investment strategies.

If you’re new to precious metal trading, you can start with our demo account. It’s a great way to get hands-on experience. With a demo account, you can practice trading in a risk-free environment, familiarize yourself with our platform, and gain valuable experience before transitioning to a live account. It’s the perfect opportunity to test strategies and develop your trading skills without the pressure of real money.

Open a demo account with Ultima Markets today and start trading with confidence!

FAQs

Yes, investing in Tata Gold ETF can be a good option for those looking to gain exposure to the price movements of gold without the hassles of storage and security. It offers liquidity, transparency, and cost-efficiency, making it ideal for both short-term traders and long-term investors.

Many analysts predict that gold prices could appreciate significantly by 2030 due to ongoing inflationary pressures, economic uncertainty, and increasing demand for gold as a safe haven. For instance, gold prices in India might reach levels ranging between ₹1,40,000 and ₹2,25,000 per 10 grams by 2030.

To invest in Tata Gold ETF, you need a demat and trading account with a registered stockbroker. Once your account is set up, you can buy units of the ETF through your broker just like any other stock. Simply search for Tata Gold ETF on the exchange and place your order.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.