Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow to Invest and Hedging with Swiss Franc

Swiss Franc remains a popular choice for global investors’ asset allocation due to its exceptional safe-haven attributes. However, mastering Swiss Franc investment techniques requires thorough understanding of its nature, market positioning, and trading strategies.

What Is Swiss Franc

Swiss Franc (CHF) is the official currency of Switzerland and the Principality of Liechtenstein. Due to Switzerland’s political neutrality, robust economy, and prudent central bank policies, CHF consistently ranks among the foremost safe-haven currencies in financial markets.

During financial crises or geopolitical turmoil, CHF demonstrates its safe-haven attributes, standing alongside gold and Japanese yen as one of the world’s three major safe-haven assets with a firm market standing.

Swiss Franc Safe-Haven Attributes and Market Positioning

During major financial turmoil, CHF consistently shows significant appreciation. For instance, during the 2008 financial crisis, USD/CHF exchange rate surged over 30%, making CHF a highly sought-after asset.

Through Ultima Markets’ trading account, investors directly access CHF forex trading to capture real-time market dynamics and opportunities.

Swiss Franc vs. Gold: Safe-Haven Differences

While both are safe-haven assets, Swiss Franc and gold differ significantly. Gold is a physical asset with superior inflation resistance; CHF offers higher liquidity, making it more suitable for short-term hedging and flexible fund allocation.

Swiss Franc Exchange Rate Analysis & Investment Strategies

Taking USD/CHF as an example, the exchange rate has fluctuated between 0.85-0.95 since 2023, reflecting market confidence in CHF’s stability.

Using technical analysis tools like Moving Averages (MA) and Relative Strength Index (RSI), investors can monitor real-time market dynamics on Ultima Markets’ platform to precisely time entry/exit points.

Optimal Swiss Franc Trading Hours

The prime trading window for Swiss Franc aligns with European market hours (Taipei Time 2pm-11pm), offering high liquidity and volatility ideal for short-term investing and hedging.

Swiss Franc vs Major Currencies

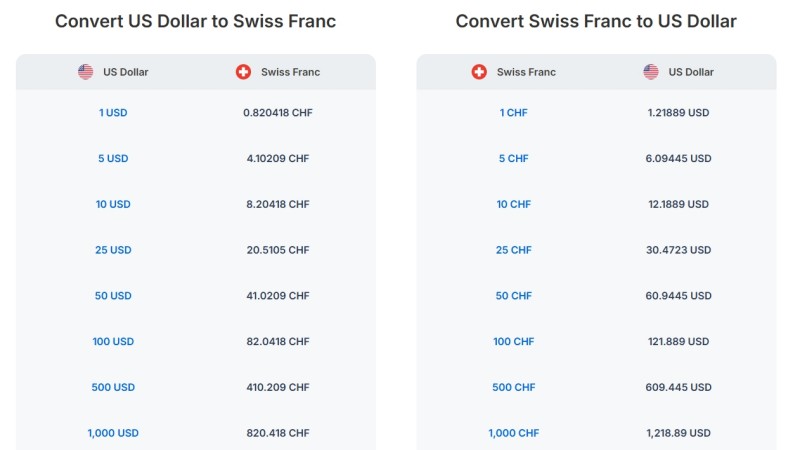

Below table compares CHF rates against key currencies, aiding investors keep track of exchange trend:

| Currency Pairs | Latest Exchange Rate (Reference) |

| USD/CHF | 0.90 |

| EUR/CHF | 0.98 |

| GBP/CHF | 1.13 |

| JPY/CHF | 0.0065 |

*Date of Information: June 2025, for reference only.

Advantages of Trading Swiss Franc via UM Platform

Ultima Markets (UM) delivers real-time quotes and highly competitive spreads, enabling fast execution and stable trading. Additionally, the platform offers demo accounts for practice and professional analytical tools for market trend assessment.

Over the past three years, CHF exhibited moderate volatility with USD/CHF ranging between 0.85-0.95. UM’s platform provides instant market insights, enhancing trading efficiency while reducing market risks.

Swiss National Bank Policy Impact & Trading Strategies

The Swiss National Bank (SNB) prioritizes price stability. Its late-2022 rate hike to 0.5% triggered short-term CHF volatility. Using Ultima Markets’ demo account, investors can practice trading strategies pre/post-policy announcements to reduce real-world risks.

Swiss Franc and Inflation Relationship

Switzerland’s inflation rate remains among the world’s lowest (~1%-2%), forming a solid foundation for the Swiss Franc’s value and attracting sustained investor allocation.

How to do Asset Allocation with Swiss Franc

Experts recommend limiting Swiss Franc assets to 5%-10% of total portfolios to diversify risk, mitigate market volatility impact, and prevent single-market overconcentration.

Swiss Franc Hedging Strategies

Investors can leverage forex trading of Swiss Franc as a hedging tool against USD or high-volatility currencies. For instance, holding CHF reduces overall portfolio losses when USD depreciation risks rise.

Swiss Franc Investment FAQs

Q1: Why is Swiss Franc a safe-haven currency?

A1: Political stability, robust economic foundations, and prudent central bank policies make CHF a primary safe-haven currency.

Q2: What are the main risks of investing in Swiss Franc?

A2: Key risks include exchange rate volatility and central bank policy shifts, requiring close market monitoring.

Q3: Is Swiss Franc suitable for beginners?

A3: New investors should first practice via Demo Account trading to understand market trends before live funding.

Q4: How does Swiss Franc correlate with the Euro?

A4: CHF exhibits negative correlation with the Euro. When Eurozone economic risks increase, Swiss Franc becomes more attractive.

Conclusion

Swiss Franc’s stability and safe-haven attributes sustain its appeal among investors. By understanding exchange trends, central bank policies, and hedging strategies, investors can more effectively allocate assets.

Mastering Swiss Franc investment and hedging techniques positions investors advantageously in financial markets. CHF not only provides safe-haven protection but also lays a strategic foundation for long-term portfolios.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.