Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomSumitomo Pharma Stock: Is It a Buy Now?

Sumitomo Pharma Co., Ltd. has earned a strong reputation as a global leader in the pharmaceutical industry. With an expansive portfolio that spans psychiatry, oncology, cardiovascular diseases, and urology, Sumitomo Pharma continues to make significant strides in the healthcare market. Beyond its innovative drug offerings, the company’s strong financial performance and expanding market presence make its stock an attractive option for investors.

This article will explore Sumitomo Pharma stock, analyzing its current market performance, growth potential, and the key drugs driving its future success, including Gemtesa, ORGOVYX, and LATUDA.

Sumitomo Pharma Stock’s Strong Performance

Looking at Sumitomo Pharma’s stock performance over the past few years, it’s clear the company has demonstrated a strong growth trajectory. In the past five years, Sumitomo Pharma stock has gained approximately 45%, reflecting the company’s successful innovation and solid financial health.

Despite fluctuations in the global market, Sumitomo Pharma’s stock has consistently shown resilience, outperforming many competitors in the pharmaceutical sector. As of early 2026, the company boasts a market capitalization of over $20 billion, an indicator of its strong position in the industry.

In 2025 alone, the stock surged by 15%, which is notable considering the broader pharmaceutical sector’s mixed performance during the same period. This continued growth reflects investor confidence in Sumitomo Pharma’s ability to innovate and bring successful products to market.

Key Growth Drivers: Sumitomo Pharma’s Breakthrough Drugs

Sumitomo Pharma’s growth is largely driven by the success of its flagship drugs, including Gemtesa, ORGOVYX, and LATUDA. These treatments address a variety of common and complex medical conditions, and their market performance has directly impacted the company’s financial results.

Gemtesa (vibegron)

Launched in 2021, Gemtesa is revolutionizing the treatment of overactive bladder (OAB) and benign prostatic hyperplasia (BPH). The drug’s strong sales performance has contributed significantly to Sumitomo Pharma’s revenue growth.

In 2025, Gemtesa generated approximately $500 million in sales, with projections suggesting the potential for this number to double by 2027. The growing demand for OAB treatments positions Gemtesa as a key player in the urology market, boosting the stock’s potential.

ORGOVYX (relugolix)

Approved in 2021, ORGOVYX offers a groundbreaking oral treatment for advanced prostate cancer, providing a convenient and effective alternative to injectable therapies.

As prostate cancer rates continue to rise globally, ORGOVYX is expected to see significant long-term sales, with analysts forecasting annual revenue could reach $1 billion by 2028. This promising outlook further solidifies Sumitomo Pharma’s market position and enhances its stock value.

LATUDA (lurasidone hydrochloride)

As a widely prescribed medication for schizophrenia and bipolar depression, LATUDA continues to be a core contributor to Sumitomo Pharma’s revenue.

In 2025, LATUDA brought in $2.5 billion in sales, and with rising awareness of mental health conditions globally, the drug is poised for sustained market leadership. Its steady sales contribute to the overall strength of Sumitomo Pharma’s portfolio.

These key products showcase Sumitomo Pharma’s diversified portfolio, providing multiple revenue streams that strengthen the company’s stock performance.

Financial Performance and Stock Valuation

Sumitomo Pharma’s solid financial health is a key consideration for investors. For the fiscal year ending March 2025, the company reported $5.8 billion in revenue, reflecting an 8% year-over-year growth. This growth was largely driven by the success of its major products, especially Gemtesa and ORGOVYX.

The company also maintains a robust balance sheet, with total assets of $12 billion and a debt-to-equity ratio of 0.3, which is relatively low compared to industry standards. This financial stability makes Sumitomo Pharma a low-risk investment, appealing to those looking for safe, long-term growth.

When it comes to stock valuation, Sumitomo Pharma is trading at a P/E ratio of 15, which is below the industry average of 18-20. This suggests that the stock may be undervalued, offering a potential upside for investors.

Analysts have set a target price of $60 per share, indicating an upside of around 25% from its current price. This makes the stock a compelling option for investors seeking growth in the healthcare sector.

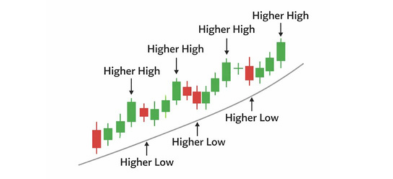

Uptrend Growth Over the Years

If we look closely at Sumitomo Pharma’s stock performance over the last five years, we can see a strong upward trend that showcases its resilience even during turbulent times. The stock has risen by 45% over the past five years, significantly outperforming many of its industry peers.

A breakdown of its recent performance indicates that Sumitomo Pharma had a standout year in 2025, with a 15% increase in share value, bolstered by the strong performance of its flagship drugs. Analysts predict continued growth for the next few years as Gemtesa and ORGOVYX continue to gain market share.

Risks and Considerations for Investors

While Sumitomo Pharma presents an appealing investment opportunity, there are several factors that investors should consider:

- Patent Expirations: As with any pharmaceutical company, Sumitomo Pharma faces the risk of patent expirations for some of its key drugs. While this could lead to increased competition from generic drugs, the company’s strong pipeline of new treatments helps mitigate this risk.

- Regulatory Challenges: Pharmaceutical companies are heavily regulated, and any changes in regulatory policies could affect Sumitomo Pharma’s ability to bring new drugs to market. However, the company has a solid track record of navigating regulatory challenges, minimizing the potential for negative impacts on its stock.

- Market Competition: The pharmaceutical market is competitive, and Sumitomo Pharma faces competition from both large multinational companies and smaller, specialized biotech firms. The company’s ability to maintain its competitive advantage will depend on its ongoing investment in research and development and its ability to continue bringing innovative products to market.

Why Sumitomo Pharma Stock is Worth Considering

Sumitomo Pharma’s combination of strong financial performance, innovative product portfolio, and promising growth drivers makes it an attractive investment for those looking to gain exposure to the healthcare sector.

With a competitive stock valuation and an outlook for continued innovation, Sumitomo Pharma presents significant upside potential. Investors looking for stability, growth, and exposure to the booming pharmaceutical market should consider adding Sumitomo Pharma stock to their portfolios.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.