Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat’s STP Trading Model? Meaning & Benefits in 3 Mins

Have you ever wondered why your stop-loss orders mysteriously trigger during market volatility, with spreads widening without warning and causing costs to surge? —The root cause may lie in not understanding the essence of “STP meaning.”

The FX market continues growing, with global daily trading volume reaching US$7.5 trillion. In this fiercely competitive and rapidly changing market, the term “STP meaning” is increasingly searched and discussed by investors. Choosing the right trading model determines whether traders can effectively reduce costs, improve execution efficiency, and directly impact final profitability.

This article delves into the core mechanics of STP, analyzing how the true straight-through processing model eliminates dealing desk risks.

What Does STP Mean?

STP (Straight Through Processing), known as “Straight Through Processing” in Chinese, refers to trading orders being sent directly to liquidity providers such as banks and hedge funds without intervention from Market Makers, with execution prices determined by market quotes. This model’s key feature is transparency: brokers do not trade against clients but act solely as intermediaries, profiting from trading volume and spreads. This means:

- Zero Intervention: Your orders bypass brokers and reach the global FX market directly.

- No Conflict of Interest: Brokers earn only minor spread mark-ups without profiting against clients.

- Transparent Execution: Prices result from competitive quotes by multiple Liquidity Providers (LP), with floating spreads reflecting real market volatility.

In contrast, traditional Market Maker models may involve internal hedging of client orders based on the broker’s risk management, potentially raising price manipulation concerns. STP lets market forces determine prices, reducing potential conflicts of interest, explaining why professional traders and large institutions prefer STP brokers.

How Does STP Model Work? STP FX Trading Process

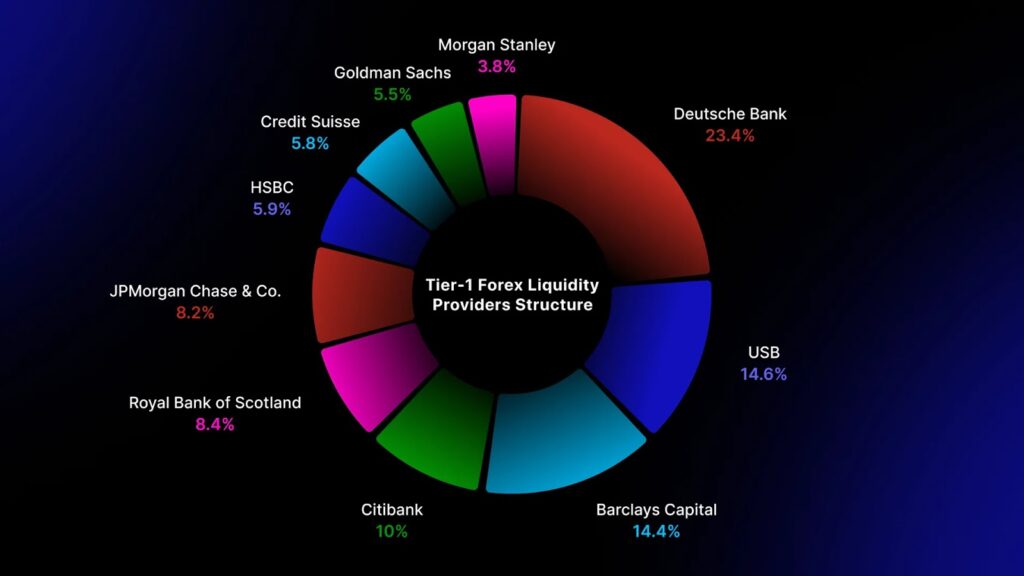

When you place an order with an STP broker, the platform sends your order directly through its internal automated system to multiple liquidity providers, such as Goldman Sachs, J.P. Morgan, and Citibank. The system selects the most favorable buy/sell prices for matching and executes the trade rapidly, with the entire process being fully automated and requiring virtually no manual intervention.

Thus, the STP trading workflow is:

Client order → Broker aggregates LP quotes → Matches optimal price → Executes via interbank market.

What is the Difference Between STP and ECN? How to Choose?

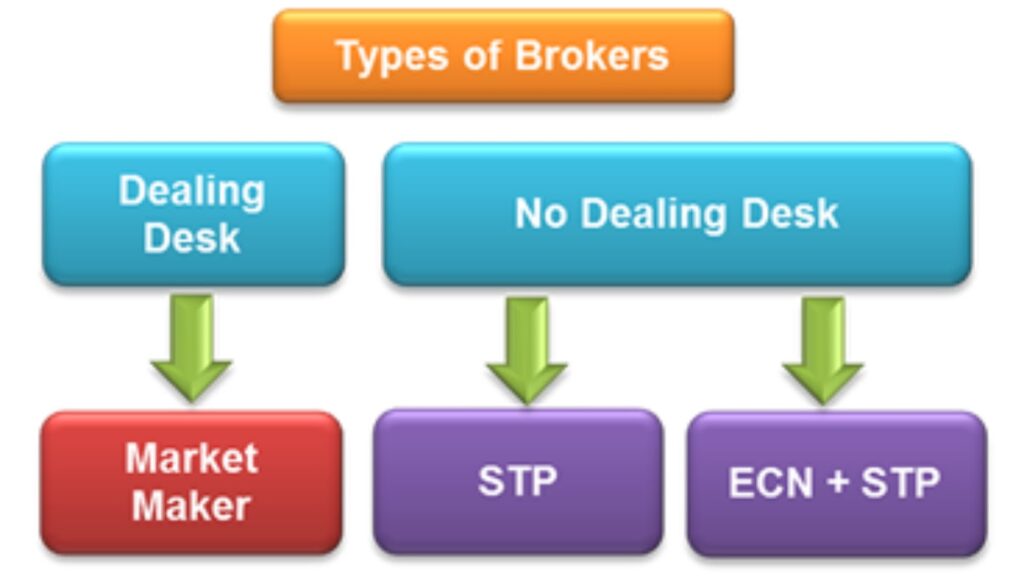

Many confuse STP and ECN (Electronic Communication Network). While both fall under the No Dealing Desk (NDD) model, key differences exist:

- STP: Brokers route orders to liquidity providers, typically offering fixed or slightly higher spreads. Suitable for small-medium investors with lower trading volume thresholds.

- ECN: Brokers place orders directly into the market order book, matching traders with other participants (e.g., banks, hedge funds). Spreads are minimal or zero, but commissions apply. Ideal for high-volume, frequent traders.

STP vs ECN vs MM: Three Models Key Differences

| Dimension | STP Model | ECN Model | Market Maker (MM) Model |

| Order Counterparty | Liquidity Providers (LP) | Multi-institutional Bidding (Banks/Hedge Funds) | Broker Itself |

| Spread Type | Floating Spreads | Ultra-tight Floating Spreads + Commission | Fixed Spreads (Often Include Hidden Markups) |

| Slippage Risk | Market Volatility-Induced (Controllable) | Market Volatility-Induced (Significant in High Frequency) | Platform Intervention Amplifies Slippage |

| Suitable For | Beginners to Professionals (Balanced Cost & Speed) | High-Capital High-Frequency Traders | Not Recommended |

For example, Ultima Markets offers two types of accounts:

- STP Account: Average spreads 1.2~1.5 pips, zero commission. Suitable for beginners and steady traders.

- ECN Account: Spreads from 0.0 pips, USD 5 commission per lot. Ideal for professional day trading and high-frequency strategies.

Understanding these distinctions enables choosing the most suitable account type.

STP Model Advantages and Risk Management

Advantages

- Transparency and Fairness: Real market pricing with no hidden fees, ensuring aligned interests between clients and brokers to avoid conflicts from trading against clients.

- Low Cost: Most STP brokers profit only from spreads with no hidden commissions.

- Fast Execution: Orders automatically match optimal liquidity sources. Particularly during major economic events (e.g., US Federal Reserve rate decisions, Non-Farm Payroll releases), order processing speed is critical.

Disadvantages and Risks

- Liquidity Dependency: Insufficient liquidity during extreme market conditions may cause slippage.

- High Risk Control Demands: Improper leverage use amplifies losses.

Risk Management Strategies

- Set rational stop-loss/take-profit levels to avoid emotional trading.

- Utilize demo accounts to test strategies and build trading confidence progressively.

- Start with small lot sizes and scale up gradually to reduce per-trade risk.

Why Choose Ultima Markets as Your STP Broker?

In the 2024 FX broker rankings, Ultima Markets was awarded “2024 Best Asia Pacific Forex Trading Platform,” “2024 Best Asia CFD Broker,” and “2024 Fastest-Growing Asia CFD Broker.” Ultima Markets’ advantages include:

Multiple Regulatory Safeguards

Regulated by authorities in Australia, Cyprus, and Mauritius, strictly adhering to international financial compliance standards. This ensures rigorous fund protection and a compliant environment regardless of trading location, reducing risks of fraud or fund misappropriation.

Fund Security

All client funds are held in segregated custody with WBC (WESTPAC Bank), Australia, never commingled with company operational funds. This guarantees investor peace of mind, ensuring user funds remain protected even if the company faces financial challenges.

Offers Up to 1:2000 Leverage for Flexible Trading

Ultima Markets provides leverage ratios up to 1:2000, enabling investors to access larger market positions with smaller capital. For agile short-term or day traders, this significantly enhances capital efficiency and profit potential.

Exclusive Compensation Fund

As a Financial Commission member, Ultima Markets users receive additional compensation protection, eligible clients may claim up to EUR 20,000. This fund maintains a stable source independent from company funds, making Ultima Markets among the few brokers globally offering this protection tier.

These advantages have helped Ultima Markets accumulate substantial loyal users across Asian markets, particularly among investors prioritizing trading costs and security.

How to Start Your STP Trading Journey with Ultima Markets?

If you understand STP meaning basics, now is the ideal time to begin. UM offers a streamlined account creation process:

- Visit Ultima Markets official website → Click Here to Go

- Click to Register → Enter details (e.g., name, email, phone)

- Select account type → STP or ECN

- Submit verification documents → usually required ID/passport and address proof

- Complete funding → Supports wire transfer, credit cards, e-wallets, crypto wallets

Notably, UM provides demo accounts with $100,000 virtual funds for practicing STP trading, testing strategies, and mastering platform operations risk-free.

Frequently Asked Questions Q&A

Q1: Is STP Model Suitable for Beginners?

Yes, STP’s transparent execution and market-sourced quotes help beginners understand genuine market volatility without misleading fake quotes.

Q2: Are STP Account Trading Costs High?

Compared to ECN accounts, STP accounts typically incorporate wider spreads but are commission-free. This offers cost advantages for low-frequency or small-volume traders.

Q3: Does Ultima Markets STP Account Have Minimum Deposit?

The current minimum deposit is only USD 50, ideal for beginners starting with small capital.

Q4: STP vs ECN: Which Benefits Short-Term Trading?

ECN accounts’ tighter spreads and faster execution speed favor intraday short-term/high-frequency traders. STP accounts better conserve costs for medium-long term or low-frequency traders.

Conclusion

Understanding STP meaning, its operational flow, and advantages is essential for every investor seeking steady growth in the FX market. Market transparency, execution speed, and cost optimization are pivotal factors determining trading success. Choosing a regulated, highly-rated, and fund-secure STP broker like Ultima Markets empowers your FX journey to advance steadier and farther.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.