Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteIn 2025, stock splits once again became the focus of the market. According to research by Bank of America, stocks rose an average of 25% within 12 months after announcing a split, far outperforming the 12% performance of the major market index during the same period. This indicates that stock splits indeed provide significant support for the long-term trend of stock prices.

Against this backdrop, we will delve into the principles, types, impacts, application process of stock splits, and how Ultima Markets can help you seize the opportunity.

What Is a Stock Split?

A stock split, also known as a share split, is an action taken by a company to increase market liquidity by lowering the price per share and multiplying the number of shares.

For example, in a 2-for-1 split, shareholders will have their shares doubled while the price per share is halved, with the total market value of their holdings remaining unchanged. This approach can increase retail investor participation and improve stock liquidity when share prices are high.

If a company’s current stock price is NT$3,000 per share, after implementing a 3-for-1 stock split, the price per share will become NT$1,000, while the number of shares held will triple, keeping the total value of the holdings unchanged.

Common Types of Stock Splits

The common types include:

- Regular Stock Split: Increases outstanding shares, making the stock price appear more affordable

- Reverse Split: Reduces the number of shares to raise the stock price, often used to avoid delisting

Regular and reverse splits demonstrate the diverse strategies companies use in their operations.

Overview of the Stock Split Process

The stock split process generally includes the following steps:

- The company’s board of directors approves the stock split plan.

- The plan is filed with regulatory authorities, and a public announcement is issued.

- The ex-rights date (shareholder record date) is set, and the split is executed.

- From the ex-rights date, the stock trades at the new price.

How to Check Stock Split Announcements?

You can track the latest stock split news for US and global popular stocks through listed companies’ official websites, stock exchange announcements, or by using Ultima Markets’ real-time market information platform.

Why Do Companies Choose to Split Stocks?

Enhancing Liquidity:

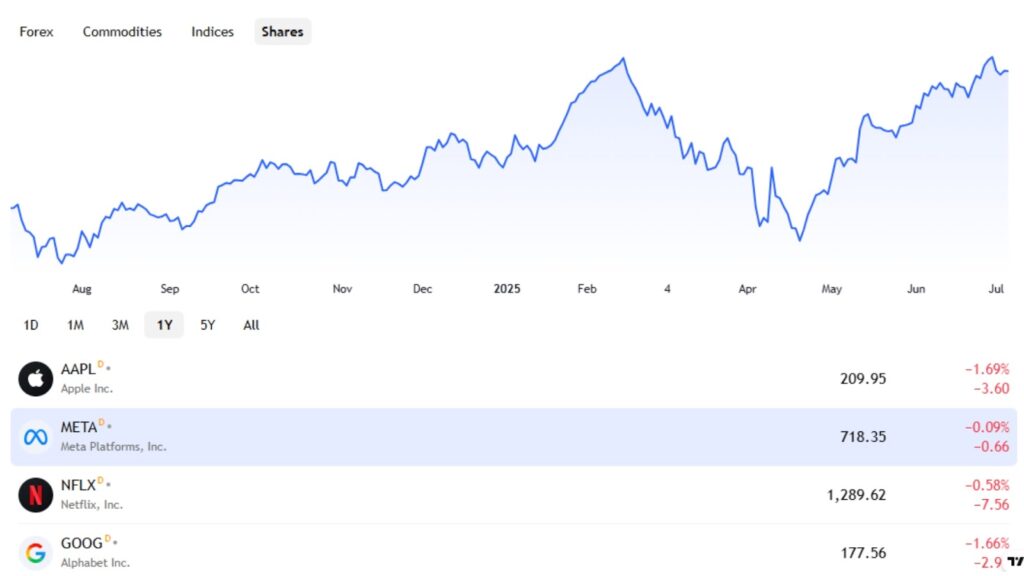

As pointed out by Bank of America, over the past three years, 23 companies were identified as eligible for stock splits. The market generally expects Meta to have the potential for a split, as its stock price surpassed $500 in 2025, similar to the conditions under which past splits occurred. Meta is also one of the focal points for Taiwanese investors.

Attracting Retail Buying Interest:

After the stock price is lowered, it becomes “more affordable,” making stock split strategies particularly effective for small investors.

Psychological Pricing Effect:

Psychologically, a lower price per share is easier to accept.

Management Confidence Signal

The act of splitting conveys the management team’s positive outlook on the future.

How to View Stock Price Movements After a Split?

After a split, stock prices may experience short-term fluctuations, but the long-term trend still depends on the company’s fundamentals and market confidence.

Short Term:

After the announcement of a split, a brief price increase is common, providing trading opportunities.

Nvidia’s 10-for-1 split implemented in June 2024 is one of the most representative tech stock split cases in recent years, reducing its stock price from 1200 to around 120, yet it continued to trade firmly afterward.

Long Term:

According to statistics from Bank of America, historically, company stocks have risen an average of over 25% within 12 months after a split, significantly outperforming the major market index during the same period.

Investor Notes

- a split does not indicate an improvement in fundamentals, so do not “bet” solely based on it

- if a split is announced during a market crash (such as the sharp declines in the S&P and Nasdaq in early April 2025), stock prices may still be affected by broader economic trends

Stock Split vs Rights Issue

Comparing stock split vs rights issue, the differences are as follows:

| Method | Change in Shares | Share Price | Shareholder Equity | Applicable Scenario |

| Stock Split | Increase | Decrease | Not diluted | Reflects an excessively high share price, enhances liquidity |

| Rights Issue | Increase | Price adjustment depends on dividend distribution method | Diluted | Company fundraising, dividend distribution, or capital restructuring |

Why Choose To Trade Stock Splits Through CFDs?

Compared with directly buying US stocks, Contracts for Difference (CFDs) allow you to participate in price movements without owning the actual shares, and leverage can be used for operations. This is suitable for tracking popular tech stocks such as Apple, Nvidia, and Tesla that have undergone or are about to undergo stock splits. Ultima Markets offers a fully Chinese interface, a low-latency trading environment, and real-time quotes, enabling you to participate more flexibly in the US stock split boom.

How To Trade Popular Stocks After Splits On Ultima Markets?

You can participate in global popular stock split trends without holding actual shares:

How To Apply For Stock Split:

- Go to the UM official website and register an account.

- Open a demo account to practice, or directly open a trading account.

Trading Process Steps Explanation:

- After logging into the platform, search for stocks expected to split (such as Fastenal, ORLY).

- Set leverage, direction (buy/sell) and take-profit/stop-loss parameters.

- Schedule the closing time, monitor price fluctuations and market depth.

UM Platform Advantages:

- Offers over a hundred popular stock CFDs, including tech stocks such as Apple, Tesla, and NVIDIA

- Supports real-time quotes and automatic position adjustment after splits, so you do not need to worry about technical operations

- Use MT4 / MT5 or the dedicated App to enjoy a low-latency and high-liquidity trading experience

- Provides a demo account trial + deposit bonus activities to reduce initial risks

- Real-time market analysis and news tools enhance information access

Frequently Asked Questions FAQ

Q1: Will The Total Market Value Change After A Stock Split?

A: No. A split only adjusts the number of shares and lowers the price per share, while the total market value remains unchanged.

Q2: Will A Split Affect Dividend Distribution?

A: The dividend per share decreases, but as the number of shares increases, the total distribution to shareholders basically remains unchanged.

Q3: How Can Investors In Taiwan Participate In US Stock Splits?

A: By using CFD platforms such as Ultima Markets, you can participate through Contracts for Difference trading.

Q4: Is It Suitable To Enter The Market After A Split?

A: It depends on the company’s fundamentals and market evaluation, but prices usually stabilize gradually after short-term volatility.

Q5: Is A Reverse Split Always Bad News?

A: Not necessarily. It is common for companies with excessively low share prices or delisting risks; their fundamentals need further observation.

Conclusion

Stock splits have once again become a major focus in 2025. Whether technical splits or reverse operations, they reflect corporate strategies and market momentum.

Investors can use Ultima Markets, combining a demo account and CFD tools, to participate flexibly in split opportunities. Whether you are a beginner or an experienced trader, Ultima Markets provides a comprehensive platform and educational resources. Register an account now to seize the next high-growth split stock!

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.