Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Starlink IPO: Where Things Stand in 2025

Few potential stock market debuts have generated as much excitement as a possible Starlink IPO. As the satellite internet arm of SpaceX continues to expand, investors are watching closely for any sign that it might finally list on public markets.

As of August 25, 2025, there has still been no official announcement. Even with the wave of “Super-IPO” speculation earlier this month, Elon Musk has not indicated that Starlink is preparing to go public in the immediate future.

The Super-IPO Speculation

In July, investor James Altucher suggested that Starlink could announce what he called a “Super-IPO” on August 13, 2025. He pointed to Musk’s past comments about waiting for predictable cash flow, speculation that another public company could relieve financial pressure on Tesla, and Bloomberg’s reporting that a Starlink spinoff had been considered in 2024.

The prediction quickly made headlines and fueled investor excitement. However, when the day arrived, no news was announced. The outcome underscored two points: demand for a Starlink listing is extremely high, but Musk is unlikely to act based on market speculation.

Musk’s Position on Starlink IPO

Any discussion about a Starlink IPO has to begin with SpaceX. Starlink is not an independent company; it operates as a division within SpaceX. That structure means the timing, strategy, and even the possibility of an IPO all depend on decisions made by SpaceX and its CEO, Elon Musk.

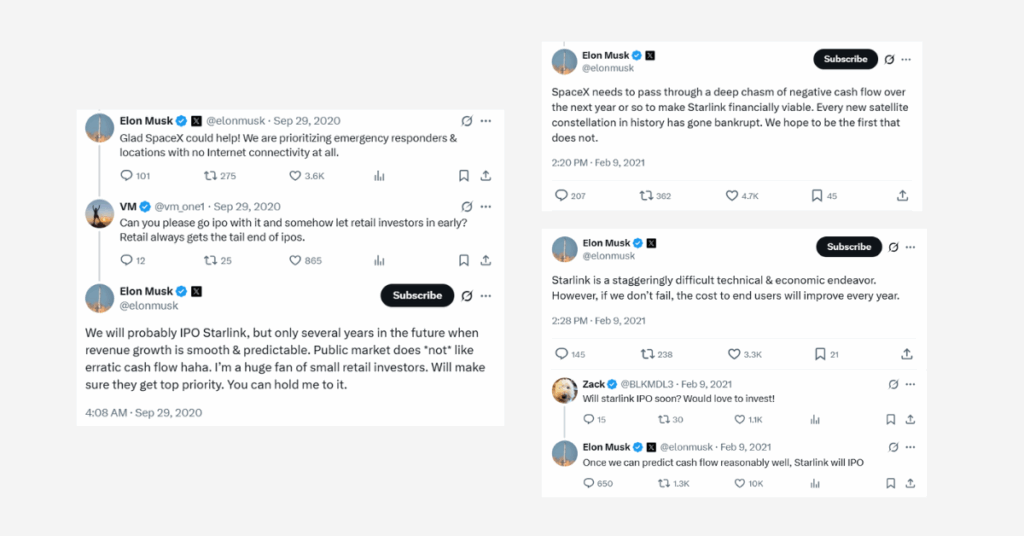

Musk has been consistent about one thing: SpaceX itself will not IPO in the near future. However, he has left the door open for Starlink to go public once certain conditions are met.

As early as 2022, he told employees not to expect a listing before 2025. Since then, he has repeated that the business must demonstrate profitability and predictable performance before going public.

In 2023, CEO Elon Musk said Starlink had no difficulty raising money privately, so there was no urgent need to tap public markets. Even in 2025, he described a potential IPO as “possible,” but offered no timeline.

The takeaway is clear. Starlink is becoming increasingly important to SpaceX’s revenue, but Musk is in no rush to spin it off.

Could Starlink IPO Before SpaceX?

One interesting possibility is that Starlink could become public before SpaceX. Analysts have pointed out that SpaceX could partially spin off Starlink as its own entity, selling a percentage of shares through a traditional IPO. Another option would be a tracking stock, which would allow investors to gain exposure to Starlink’s financial results without owning the rest of SpaceX.

There has also been speculation about a SPAC (special purpose acquisition company) as a potential path. While technically possible, industry analysts note that SPACs have performed poorly in recent years, making a traditional IPO the more likely route. This would allow SpaceX to raise capital in a way that carries greater credibility with investors while still maintaining majority control of Starlink.

Strategically, such a move could maximise valuation, attract new investors, and unlock fresh capital. For SpaceX, the proceeds could strengthen its rocket division and fund further innovation. For investors, it would offer a choice between the capital-intensive, unpredictable rocket business and the more stable, subscription-based internet service.

Starlink’s Importance to SpaceX

Industry reports suggest that Starlink is now the single largest source of revenue for SpaceX. Much of this comes from recurring internet subscriptions, which provide a far steadier income stream than space launches.

The profitability picture has started to improve significantly. According to Quilty Space, Starlink is projected to generate around $2 billion in free cash flow in 2025, with revenues expected to reach $11.8–12.3 billion. Analysts estimate that Starlink became EBITDA-positive in 2024 and is now firmly on track toward sustained profitability. One filing even reported a net profit of $72 million in 2024, though margins remain under pressure from the high costs of building and maintaining satellites.

That said, Bloomberg has reported that the high cost of manufacturing and launching satellites continues to limit margins, meaning profitability is still fragile. Even with those costs, its explosive growth makes Starlink the most valuable piece of the SpaceX ecosystem and a natural candidate for a future public listing.

Key Questions About the Starlink IPO

Is Starlink Publicly Traded?

No. Starlink is still private and remains under the ownership of SpaceX. At present, there is no Starlink stock available on public exchanges.

Starlink shares are not available for purchase or trading until the company goes public.

What Could Starlink Be Worth?

Valuation estimates vary widely. Some analysts suggest it could be worth between $30 billion and $100 billion, with forecasts placing 2025 revenue at over $12 billion. In November 2023, billionaire investor Ron Baron predicted a Starlink IPO might not occur until 2027, but when it does, he expects a valuation between $250 billion and $300 billion. The timing and scale of Starlink’s IPO could significantly impact investor interest and market dynamics.

For now, Starlink acts as a major revenue engine for SpaceX, financing rocket development and other long-term projects. That role reduces Musk’s incentive to move quickly toward an IPO.

Risks and Challenges

Despite the promise, there are obstacles ahead. Maintaining a constellation of satellites is enormously expensive, and the process of launching satellites at the scale required for Starlink’s expansion adds significant logistical and financial challenges. Competition from Amazon’s Project Kuiper and OneWeb is intensifying.

In addition, regulatory approvals are needed in every country where Starlink operates, which could slow its global rollout. Above all, the decision on when to list rests with Musk, who has shown little urgency so far.

Conclusion

The Starlink IPO remains one of the most anticipated potential listings in global markets. While speculation about a “Super-IPO” in August 2025 proved to be premature, the company’s growth and strategic importance make it a strong candidate for a future public debut.

With billions in recurring revenue, contracts across industries, and a growing global presence, Starlink is already reshaping how the world connects. When it eventually goes public, it could be one of the defining IPOs of the decade.

FAQs

Will Starlink have an IPO?

Yes, but not immediately. Musk has said it is unlikely before 2025, with profitability and predictable cash flow as requirements.

Is Starlink stock available now?

No. Starlink is still private and has no ticker symbol.

Could Starlink IPO before SpaceX?

Yes. Analysts believe it could happen via a spinoff or tracking stock, while SpaceX retains control.

What might Starlink be worth?

Estimates range from $30 billion to as much as $300 billion, depending on growth and timing.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.