Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is a Short Put Option?

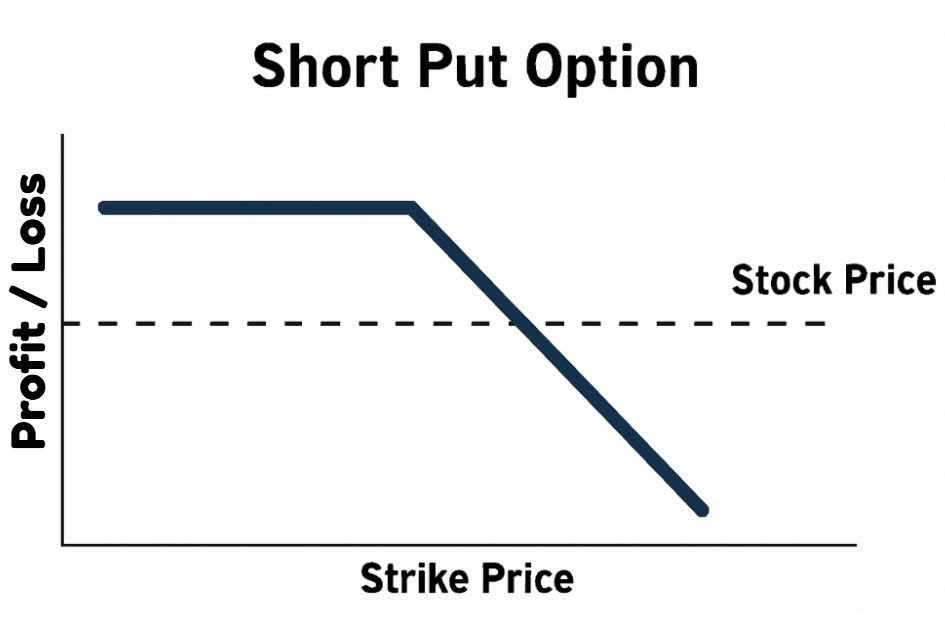

A short put option is an options strategy where a trader sells a put contract and receives a premium in return. The seller takes on the obligation to buy the underlying asset at the strike price if the buyer exercises the option. This strategy profits when the asset stays above the strike price, making it a neutral to bullish income strategy, but carries significant risk if the asset’s price falls sharply.

This strategy is popular among traders who are neutral to moderately bullish on the underlying asset and want to generate income through option premiums. If the option expires out-of-the-money, the seller keeps the entire premium as profit.

Why Use a Short Put Option?

Traders use a short put option to generate income from option premiums, to potentially buy a stock at a lower effective price, and to profit from stable or rising markets. This strategy works best in neutral to bullish conditions and can be a lower-cost alternative to directly buying shares.

Premium Income

Selling a put gives you immediate cash flow through the premium received. Many traders repeat this strategy to build consistent income.

Discounted Stock Entry

If assigned, you buy the underlying at the strike price, but your true cost basis is reduced by the premium collected. This can act like setting a “limit order” with a cash bonus.

Neutral-to-Bullish Market Play

Short puts don’t require a strong rally. As long as the price stays above the strike, the option expires worthless and you keep the profit.

Efficient Use of Capital

Compared with buying shares outright, short puts may require less initial cash (depending on margin rules). A cash-secured put ties up capital but provides risk control.

Flexibility & Adjustments

Traders can roll positions forward, hedge with spreads, or manage assignments, making it a versatile tool within an options portfolio.

How Does a Short Put Work?

A short put works by selling a put option and collecting a premium upfront. The seller profits if the underlying asset stays above the strike price, since the option expires worthless. If the asset falls below the strike, the seller may be obligated to buy it at the strike price, creating potential losses.

Sell to Open (STO)

The trader sells a put contract at a chosen strike and expiration, receiving premium immediately.

Profit Scenario

If the underlying stays at or above the strike, the option expires worthless. The seller keeps the premium as full profit.

Loss Scenario

If the underlying falls below the strike, the option buyer can exercise. The seller must purchase the asset at the strike price, which may be higher than the market value, leading to a loss.

Break-even Point

- Strike price – premium received = breakeven.

- Losses occur below this level.

Risk-Reward Profile

- Maximum profit: The premium received.

- Maximum loss: Significant, if the underlying price collapses.

Market Conditions for a Short Put

A short put option works best in neutral to moderately bullish market conditions, when implied volatility is high and expected to decline. In these environments, premiums are richer, time decay works in the seller’s favor, and the probability of the put expiring worthless increases.

Neutral to Bullish Outlook

The short put is ideal when you don’t expect a major price drop. Even small upward or sideways moves help the position stay profitable.

High Implied Volatility (IV)

Selling puts when IV is elevated allows you to collect higher premiums. If volatility later falls, option prices shrink, letting you close or hold for profit.

Time Decay (Theta)

Every passing day reduces the option’s extrinsic value. This natural decay benefits short put sellers, especially as expiration approaches.

Stable or Supportive Price Levels

Traders often sell puts at strike prices aligned with technical support zones, increasing the odds that the option expires worthless.

Best Underlyings

Highly liquid stocks or indices with tight bid-ask spreads are preferable. They reduce slippage and make rolling or adjusting positions easier.

For example

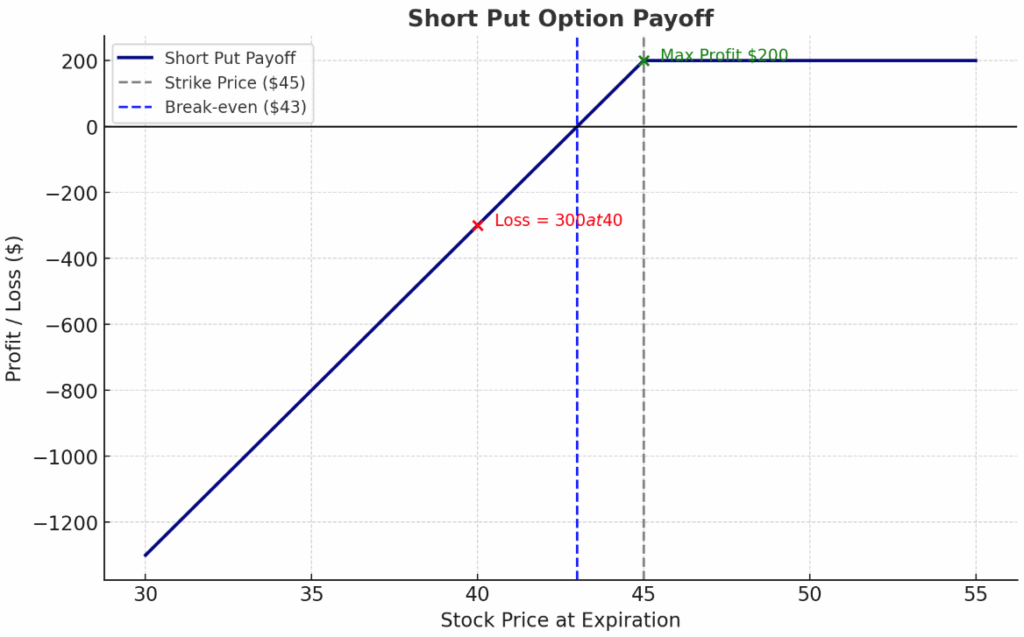

Suppose a stock trades at $50. You sell a $45 put for $2.

- Premium collected: $200 (since each option controls 100 shares).

- Break-even: $43 ($45 – $2).

- If the stock finishes above $45, you keep the $200.

- If the stock finishes at $40, you must buy at $45, but your net cost is $43, meaning a $300 loss.

Risks of a Short Put

The main risk of a short put option is potentially large losses if the underlying asset falls sharply below the strike price. While profits are limited to the premium collected, downside risk can be substantial, especially in naked puts without collateral.

Unlimited Downside Risk

If the stock or index collapses toward zero, the seller must buy at the strike price, creating large losses. Example, Selling a $50 put could mean buying stock at $50 even if it crashes to $10.

Assignment Risk

If the option finishes in-the-money, the trader may be assigned and forced to buy shares. Early assignment is possible, especially before dividends in American-style options.

Margin and Capital Risk

Naked puts require significant margin. If the trade moves against you, brokers may issue margin calls, forcing liquidation at a loss.

Volatility Risk

Sudden spikes in implied volatility can inflate option values, making it expensive to buy back the short put. This risk is common during earnings, news shocks, or market crashes.

Liquidity Risk

Options with wide bid-ask spreads can result in slippage, increasing costs when entering or exiting.

Psychological Risk

The strategy often provides frequent small gains but rare large losses. This asymmetry can lull traders into overconfidence, followed by steep drawdowns.

Variations of Short Put Strategies

The main variations of a short put strategy include the cash-secured put, the naked put, and the bull put spread. Each offers different risk and capital requirements, allowing traders to adjust the strategy to their market outlook and risk tolerance.

Cash-Secured Put

You sell a put option and set aside enough cash to buy the stock if assigned. Limited to owning the stock at strike minus premium. Conservative traders seeking income or discounted stock entry.

Naked Put (Uncovered Put)

You sell a put without holding cash collateral. High, since losses can be very large if the stock falls sharply. Advanced traders with margin availability and strong conviction.

Bull Put Spread

Sell a put at a higher strike and buy another put at a lower strike. Capped at the strike difference minus premium collected. Traders wanting defined risk while still generating premium income.

Rolling a Short Put

Closing the current position and reopening at a different strike or expiration. Extends duration, collects more premium, or lowers risk exposure. Active traders managing assignment or volatility swings.

Combining with Other Strategies

Iron Condor / Short Strangle: Adding a short call to capture premium on both sides. Synthetic Short Put, constructed by combining long stock with a short call.

Conclusion

The short put option is a versatile strategy that allows traders to earn premium income and potentially enter stocks at a lower effective cost. While the reward is capped at the premium received, risks can be substantial if the underlying asset falls sharply. That’s why disciplined position sizing, cash-secured setups, and proper risk management are essential.

For traders, the short put can be an effective tool in neutral to bullish markets, especially when implied volatility is high and expected to decline. Understanding when and how to use this strategy and the variations such as cash-secured puts or bull put spreads is key to long-term success.

At Ultima Markets, we believe in empowering traders with the right knowledge to navigate complex instruments like options. As a multi-regulated broker supporting global traders, our focus is on education, transparency, and tools that help you trade smarter.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.