Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Looking for a credible Shiba Inu Price Prediction 2025–2030? We combine live market data with on-chain metrics from Shibarium and transparent burn analysis to build bear, base, and bull scenarios you can actually benchmark.

Shiba Inu Price Prediction 2025-2030

Shiba Inu Price Prediction 2025–2030: Our base case puts SHIB at $0.000010–$0.000018 in 2025 and $0.000014–$0.000025 by 2030, assuming steady Shibarium usage and modest token burns. Upside with durable utility could reach $0.000030–$0.000050, while a weak-liquidity bear path risks $0.000004–$0.000009. Educational, not financial advice.

2025 Outlook

Base Case — $0.000010–$0.000018

Mixed but ongoing Shibarium usage, modest burns relative to float, and a choppy alt-coin tape keep SHIB range-bound with tactical spikes.

Daily Shibarium transactions oscillate without multi-month trend higher. Weekly burns remain in the tens of millions of tokens (directionally positive, not yet transformative).

Visible fee-linked burn sinks (automatic) instead of sporadic manual burns. Third-party apps (payments/games) driving sustained DAUs. Multi-week surge in daily txs plus contracts deployed and steadier, larger weekly burns.

Bull Case — $0.000020–$0.000030

Clear apps and fee sinks emerge on Shibarium, usage stabilizes at higher run-rates, and crypto liquidity turns risk-on. (Monitor explorer stats for DAUs/txs and verified contracts; look for programmatic burn mechanisms.)

Bear Case — $0.000007–$0.000010

Usage stalls, weekly burns fade, and meme-liquidity rotates to newer narratives; seasonality headlines (e.g., “Uptober/833%”) fail to convert into real demand.

2026 Outlook

Base — $0.000011–$0.000020

Gradual appreciation consistent with conservative long-run anchors like Kraken’s prediction tool (example 2030 anchor ~$0.000016 under slow growth). Shibarium usage steady but not compounding; burns grow, yet still small vs supply.

Bull — $0.000022–$0.000033

Requires compounding utility plus programmatic burns and deeper exchange liquidity.

Bear — $0.000006–$0.000010

Prolonged risk-off or network activity contraction.

Tx trend slope (higher highs over quarters), weekly burn totals, and order-book depth on major exchanges.

2027–2028 Outlook

Base — $0.000012–$0.000022

Sideways-to-slight-up path if adoption holds and burns improve slowly.

Bull — $0.000025–$0.000040

Multiple sticky use-cases (apps/games/payments) and ongoing fee-linked burn design reduce effective supply over time.

Bear — $0.000005–$0.000010

Utility stagnation and meme-capital rotation cap sustained advances.

Contracts deployed & verified trend, address growth, and gas-to-burn linkage if implemented.

2029–2030 Outlook

Base — $0.000014–$0.000025

Kraken’s tool example implies ~$0.000016 by 2030 under slow growth, which sits inside our base band.

Bull — $0.000030–$0.000050

Clear, durable utility + sizable, repeatable fee-linked burn; exchange depth supports higher market cap without severe slippage.

Bear — $0.000004–$0.000009

Shrinking usage, thin liquidity, or regulatory frictions.

Multi-quarter tx uptrend, contracts & DAUs retention, weekly/monthly burn as % of circulating supply, and exchange reserves/liquidity (to avoid reflexive selloffs).

What is Shiba Inu Coin?

Shiba Inu (SHIB) is an Ethereum-based meme coin launched in 2020 that grew from an online community into a broader ecosystem. It began as a playful, Dogecoin-inspired token but now includes Shibarium (its Layer-2 network), related tokens like BONE and LEASH, community-driven burns to reduce supply, and experiments in payments, NFTs, and games. In short: SHIB is a high-volatility, community-led crypto that lives on Ethereum and aims to add utility through its L2 and apps.

SHIB Right Now: Price, Market Cap, and Momentum

Shiba Inu (SHIB) is trading near $0.000013 on the 1-year view shown, with performance over the period down roughly 28%. The chart highlights a sharp December spike followed by a steady grind lower and range-bound trading through spring and summer.

Momentum has been choppy, brief rallies have faded at prior swing highs, while pullbacks have held above the year’s capitulation lows. For near-term direction, watch whether price can reclaim recent resistance while volume and liquidity improve without that, SHIB likely remains in a sideways, headline-driven range.

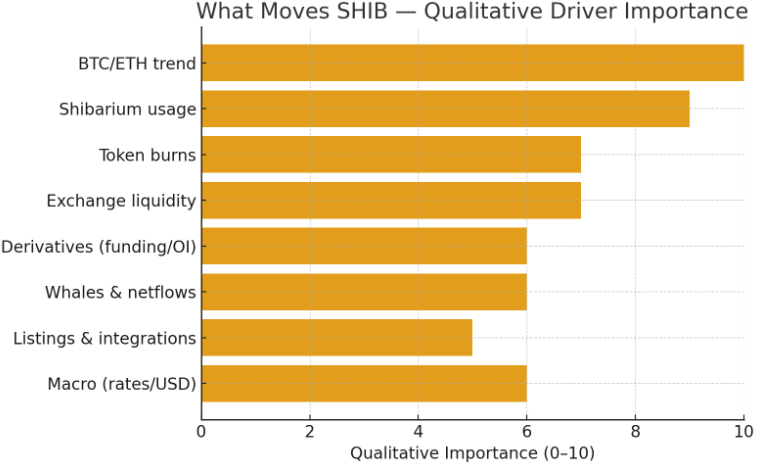

What Moves the SHIB Price Up and Down

Shiba Inu reacts to crypto beta (BTC/ETH trends), on-chain utility on Shibarium, token-burn scale, liquidity and order-book depth, derivatives positioning (funding/open interest), whale flows and exchange netflows, headline catalysts such as listings or integrations, and the macro backdrop (rates, USD strength, risk sentiment).

Market Beta (BTC and ETH Direction)

When Bitcoin and Ethereum trend, most altcoins follow.

- Bullish impact: BTC/ETH uptrend, improving risk appetite, rising alt breadth.

- Bearish impact: Sharp BTC drawdowns or ETH selloffs drain liquidity and pressure SHIB.

Shibarium Usage (On-Chain Utility)

Real demand on Shiba Inu’s L2 matters more than headlines.

- Bullish: Multi-week rise in daily transactions, active wallets, and new verified contracts.

- Bearish: One-off spikes that fade; declining activity or stalled app launches.

Token Burn Mechanics (Supply Side)

Burns can reduce effective supply but only if they scale.

- Bullish: Programmatic, fee-linked burns that occur consistently.

- Bearish: Sporadic, small burns that are immaterial versus circulating supply.

Liquidity & Order-Book Depth

Where and how SHIB trades affects volatility.

- Bullish: Deeper books on major exchanges, tighter spreads, healthy market-maker presence.

- Bearish: Thin books and wide spreads that amplify slippage during selloffs.

Derivatives Positioning

Perpetuals often drive short-term swings.

- Bullish: Negative/neutral funding rates with price rising (short squeeze), increasing open interest behind breakouts.

- Bearish: Overheated positive funding and crowded longs into resistance; cascading liquidations.

Whale Activity & Exchange Netflows

Large wallets and venue flows are early tells.

- Bullish: Outflows from exchanges, accumulation on-chain, long holding periods.

- Bearish: Big CEX inflows before or during rallies, distribution from top wallets.

Listings, Integrations, and Roadmap Delivery

Access plus utility fuels participation.

- Bullish: New exchange listings, payment/game integrations, shipped roadmap milestones.

- Bearish: Delistings, delays, contract/security issues, or negative community news.

Macro Backdrop (Rates, USD, Risk Sentiment)

Global liquidity sets the stage for crypto cycles.

- Bullish: Easier financial conditions, risk-on equities/tech, stable or weaker USD.

- Bearish: Hawkish surprises, risk-off episodes, stronger USD.

Conclusion

Shiba Inu Price Prediction 2025–2030 comes down to sustained Shibarium utility, meaningful and repeatable burns, and the broader liquidity cycle shaped by Bitcoin, Ethereum and macro conditions. The smartest approach is to watch the data, not the hype: track daily Shibarium activity, monitor burn cadence as a share of circulating supply, and read funding, open interest and exchange netflows to judge whether a move has fuel or is likely to fade.

At Ultima Markets, we focus on giving you clean market context, timely education and practical risk frameworks so you can make decisions with discipline and avoid anchoring to round numbers or headlines. Stay informed, respect volatility, and let evidence guide your plan. This is educational content and not financial advice.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.