Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

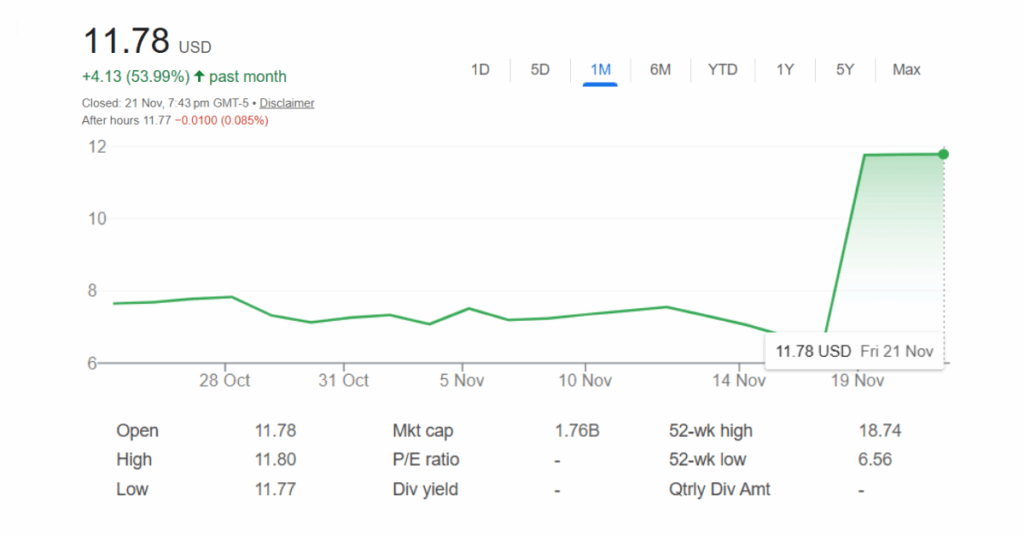

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomSemrush Stock Skyrockets On Adobe Acquisition

Semrush stock has jumped into the spotlight.

On 19 November 2025, Adobe announced an all cash deal to acquire Semrush Holdings Inc for about 1.9 billion dollars, paying 12 dollars per share. The offer represented roughly a 75 percent premium to the previous closing price, and Semrush stock reacted immediately with a steep move higher into the 11 dollar area.

From this point, Semrush stock is no longer trading like a normal growth SaaS name. It is trading as a takeover story, where price and risk are driven mainly by the Adobe acquisition and the chances that it goes through.

Details of the Semrush Stock

Here are the key details in one place:

- Acquirer: Adobe Inc

- Target: Semrush Holdings Inc (ticker SEMR)

- Deal type: All cash acquisition

- Offer price: 12 dollars per share

- Equity value: About 1.9 billion dollars

- Premium: Around 75 to 78 percent above the pre deal close

- Timeline: Expected to close in the first half of 2026

- Conditions: Regulatory approvals and Semrush shareholder approval

Before the news, Semrush stock traded in the high six dollar range. After the announcement, the share price quickly moved closer to the 12 dollar offer, which is typical once a takeover is confirmed.

Why Adobe Is Buying Semrush

To understand why Semrush stock now commands such a premium, it helps to look at the strategic side of the deal.

Semrush is best known as an SEO and online visibility platform. It helps businesses and marketers:

- Research keywords and search demand

- Analyse competitors, backlinks and traffic

- Audit websites and track rankings

- Monitor brand visibility across search engines

In the last year, Semrush has expanded into AI and “visibility in AI answers”. New tools help brands understand how they show up not only in classic search results, but also inside responses from generative AI tools.

Adobe wants to plug that capability into its existing marketing and analytics products. The plan is for Semrush to sit inside Adobe Experience Cloud and connect with tools like Adobe Experience Manager and Adobe Analytics. This would allow enterprise clients to see brand visibility across websites, search engines and AI chat experiences in one place.

Analysts sometimes call this shift Generative Engine Optimisation, where brands optimise how they appear inside AI driven answer engines, not just on a search result page. For Adobe, buying Semrush is a direct way to strengthen its AI marketing stack and own more of this new visibility layer.

What The Deal Means For Semrush Stock Holders

Once a definitive acquisition is announced, the way you look at Semrush stock changes.

Upside Is Mostly Capped Near 12 Dollars

If the transaction closes as planned, Semrush shareholders will receive 12 dollars per share in cash. That price becomes a natural ceiling for the stock.

For Semrush stock to trade meaningfully above 12 dollars, the market would need to expect either:

- A higher competing bid, or

- Adobe raising its own offer

So far there are no signs of other bidders. That is why Semrush stock has moved close to, but not above, the offer price.

The Main Driver Now Is Deal Risk

From here, day to day moves in Semrush stock mostly reflect the perceived risk that the deal is delayed or blocked. The key questions are:

- Will regulators approve the acquisition

- Will Semrush shareholders support the deal

After Adobe’s abandoned Figma deal, investors are more sensitive to regulatory issues around big software and data transactions. The Semrush acquisition is smaller and sits in a more fragmented market, which helps, but antitrust authorities are still cautious.

It is also common in United States deals for law firms to announce reviews of whether the price is fair to shareholders. These actions usually lead to more disclosure rather than cancelled transactions, but they can influence timelines and headlines.

If regulators and shareholders approve the deal on schedule, Semrush stock is likely to trade close to, but slightly below, 12 dollars until completion. If the transaction were delayed or abandoned, the share price could fall back toward levels supported by Semrush as a stand alone company, which were far lower before the acquisition news.

Semrush Stock As A Merger Arbitrage Trade

Because of this setup, many professional investors now treat Semrush stock as a merger arbitrage position:

- Buying below 12 dollars offers a potential spread if the deal closes

- That spread is the reward for taking on regulatory and deal completion risk

The narrower the gap between the market price and 12 dollars, the more confident the market is that the acquisition will go through. If the gap widens, it usually means concern about delays or pushback.

For retail investors, the key question around Semrush stock is now less about product features and more about probability. It is on how likely is it that Adobe completes this 1.9 billion dollar acquisition on the announced terms?

What This Signals For SEO And AI Visibility

Even if you do not own Semrush stock, the deal sends a clear message about the direction of digital marketing.

- SEO and visibility platforms are now viewed as strategic infrastructure, not just optional tools.

- Visibility across search and AI answer engines is converging, and large suites like Adobe Experience Cloud want to cover both.

- More consolidation is likely, as big software players look for data and AI driven platforms that strengthen their marketing stacks.

For marketers and SEO professionals, it suggests a future where classic SEO metrics and AI visibility metrics live inside the same platform, and where understanding how your brand appears in AI answers is as important as ranking on page one of search.

Conclusion

The Semrush stock story has moved into a different phase. Instead of debating quarterly user growth or new feature launches, investors are weighing a single, clear event and the set of risks around it. That kind of setup demands a slightly different mindset. It becomes less about forecasting revenues and more about reading regulatory signals, company communications and the broader mood around large tech deals.

At the same time, this acquisition is a reminder that the value of many software names now sits at the intersection of data, AI and distribution. Platforms that can map how people discover brands in a world of search engines, recommendation feeds and chatbots are likely to attract strategic buyers. For anyone tracking Semrush stock, or the sector more broadly, the real question is how to position in a market where visibility itself has become one of the most valuable assets on the screen.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.