Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Rivian Stock Price Prediction 2030

Rivian stock price prediction for 2030 ranges between $25 and $80 per share, depending on production growth, profitability, and EV market expansion.

- The bull case assumes Rivian scales its R2 platform, expands globally, and achieves sustainable profit margins, potentially pushing the stock above $70–$80.

- The bear case suggests continued losses or delays in product rollout could limit the stock to around $25–$30 by 2030.

Bull Case Rivian

- Annual deliveries surpass 300,000 units.

- Full profitability achieved by 2027, strong margins thereafter.

- R2 ramps successfully, expanding ARR/recurring revenue.

- Amazon and other fleet deals accelerate.

Estimated price range: $80–$120.

Base Case Forecast

- Deliveries scale to ~200,000/year by 2030.

- Gradual margin improvement, steady revenue growth.

- Moderate expansion of commercial contracts beyond Amazon.

Rivian stock price prediction 2030: $45–$60.

Bear Case Rivian

- Delivery growth slows due to execution or competitive pressures.

- Margins remain thin; continued losses require equity offerings.

- Regulatory headwinds erode credit revenue stream.

Upside range: $10–$20, with downside risk if dilution increases.

What is Rivian?

Rivian is an American EV company founded in 2009 and headquartered in Irvine, California. It produces the R1T pickup, R1S SUV, and Amazon-branded delivery vans (EDV). It has recently entered a $5.8 billion joint venture with Volkswagen aimed at developing scalable platforms like the upcoming R2 mass-market vehicle

Rivian Stock Price Performance 2024-2025

In 2024, Rivian Automotive delivered a total of 51,579 vehicles, while production stood at 49,476 units, reflecting strong year-over-year growth as the company ramped up operations. In the final quarter of 2024, Rivian reported 14,183 deliveries and 12,727 vehicles produced, a continuation of its upward trend despite production challenges. However, Q1 2025 saw a temporary slowdown, with deliveries declining to 8,640 units, primarily due to plant retooling efforts and the transition to 2026 models. Cumulative production by the end of Q1 reached 14,611 units.

On the financial side, Rivian achieved a milestone by posting its first-ever positive gross profit of $170 million in Q4 2024, signaling improving cost efficiency and scale. The company generated approximately $1.7 billion in Q4 revenue, contributing to a full-year 2024 revenue total of around $4.97 billion. Additionally, its net loss narrowed to $4.7 billion, a meaningful improvement from the $5.7 billion loss recorded in 2023, indicating progress toward long-term financial stability.

Looking ahead, Rivian’s 2025 guidance suggests a delivery range of 46,000 to 51,000 vehicles, slightly below 2024’s volume due to regulatory and demand-related adjustments. Despite the softer outlook, management anticipates achieving modest full-year gross profitability in 2025, driven by operational efficiencies, better cost control, and improving margins.

| Metric | Q4 2024 | Full-Year 2024 | Q1 2025 | 2025 Outlook |

| Vehicles Delivered | 14,183 | 51,579 | 8,640 | 46,000 – 51,000 (guidance) |

| Vehicles Produced | 12,727 | 49,476 | 14,611 (cumulative by Q1) | – |

| Revenue | ~$1.7 billion | ~$4.97 billion | – | – |

| Gross Profit | $170 million (positive) | – | – | Modest full-year gross profit expected |

| Net Loss | – | $4.7 billion | – | Further improvement expected |

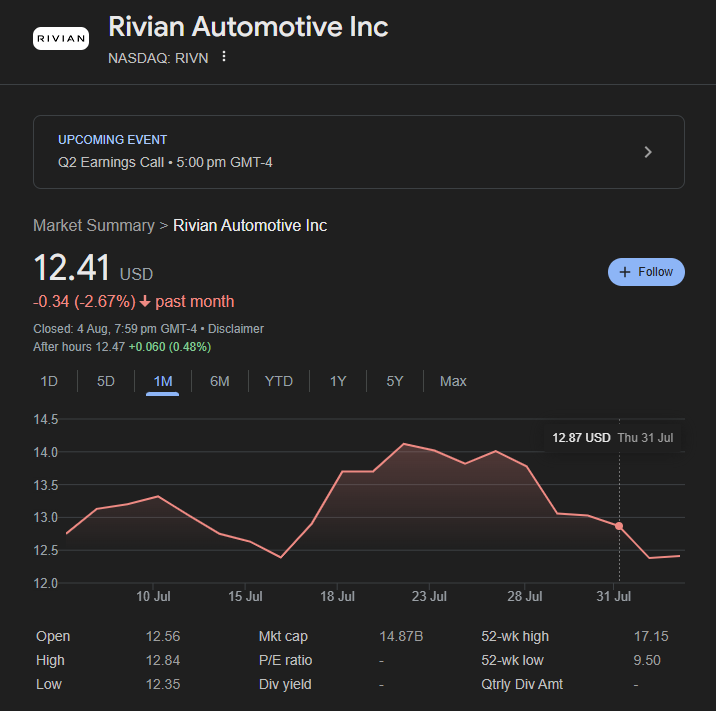

Current Stock Price & Analyst Forecast (Mid‑2025)

- The current share price in late July 2025 is around $13.70

- The consensus 12‑month analyst price target is in the $14.1–$14.7 range, with upside expectations of ~5–15%

- Rating consensus: “Hold” with limited bullish sentiment; only ~20–30% rate it a Buy

What Drives Rivian Stock Price?

Understanding what drives Rivian stock price is essential for traders and long-term investors alike. Rivian (NASDAQ: RIVN) is still in its growth phase, so its stock is highly sensitive to operational performance, investor sentiment, and broader EV industry trends. Here’s a breakdown of the key factors:

Vehicle Deliveries and Production Ramp-Up

The most direct driver of Rivian’s stock price is its ability to consistently increase vehicle deliveries. In 2024, Rivian delivered over 51,000 vehicles, but growth expectations in 2025 have been tempered due to market conditions. If Rivian meets or beats delivery targets, investor confidence improves, typically leading to upward price momentum. Missed targets, on the other hand, can trigger sharp sell-offs.

Profitability and Gross Margins

Rivian posted its first-ever positive gross profit of $170 million in Q4 2024, a milestone that supports a bullish narrative. Going forward, the company’s ability to reduce costs and scale production efficiently will be crucial. Margin expansion signals to investors that Rivian is on track toward long-term sustainability, a major stock catalyst.

Amazon Partnership and Commercial Contracts

Rivian has a long-term contract to supply 100,000 electric delivery vans to Amazon, one of its largest stakeholders. The pace of Amazon van production and Rivian’s ability to secure new fleet deals directly impact its revenue pipeline and growth multiple. These contracts offer recurring revenue potential, which helps stabilize the stock.

Cash Reserves vs. Dilution Risk

As of 2025, Rivian holds substantial cash reserves (~$7.9B), but still operates at a loss. If cash burn continues, Rivian may need to issue new equity or debt, which could dilute shareholder value. Traders closely watch balance sheet updates and capital raise announcements, as they often cause large price swings.

New Product Launches and Platform Scalability

The upcoming R2 platform, aimed at more affordable mass-market EVs, is expected to launch in 2026. Positive updates on R2 production, pricing, and demand could lift investor expectations. Conversely, delays or weak reception could drag the stock lower.

Broader EV Market and Regulatory Environment

Rivian stock also moves with broader electric vehicle sentiment. Factors like: Government EV subsidies, Raw material (lithium) prices, Tesla pricing wars, Tariff changes (e.g., U.S.–China trade tension) and all contribute to sector volatility, which often spills into Rivian’s valuation.

Institutional Ratings and Analyst Forecasts

Rivian’s stock responds heavily to analyst upgrades/downgrades. For example, a shift from “Hold” to “Buy” from a major institution like Morgan Stanley can quickly trigger a rally. As of mid-2025, most analysts rate RIVN as a “Hold”, with a consensus target of $14.40.

How High is Rivian Stock Expected to Go?

While analysts’ 12‑month targets center near $14–15, longer‑term optimism is contingent on:

- Scaling R2 cost efficiently.

- Achieving EV delivery volume milestones.

- Executing software, credit, and commercial van expansion.

- Managing macro risks like subsidy rollbacks or tariffs.

Without major progress on these fronts, stock is likely to stay in $10–20 range in mid‑term.

Conclusion

Rivian remains one of the most closely watched EV stocks due to its strategic Amazon partnership, growing delivery numbers, and upcoming R2 product launch. While the company has made progress with gross profitability, long-term success depends on its ability to scale efficiently and avoid further cash burn.

The Rivian stock price prediction for 2030 varies widely from $25 on the bear side to $80+ in a bullish scenario driven by production milestones, margins, and sector-wide EV adoption.

At Ultima Markets, we continue to monitor Rivian’s performance in real time, offering clients access to the latest technical levels, institutional sentiment, and macro-driven market insights. Whether you’re trading short-term volatility or investing long-term, having the right market intelligence is key.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.