Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is a Stock Split and Why Do Companies Implement Them?

A stock split is a corporate strategy. The company divides its existing shares into multiple new shares. This reduces the price per share, but the total value of the stock remains the same.

For example, in a 2-for-1 split, each shareholder receives two shares for every one share they previously owned. The price of the stock is halved. The company’s overall market capitalization (the total value of all shares) remains unchanged.

Companies generally choose to split their stock for a few key reasons:

- Improved Accessibility: As a company’s stock price increases, it may become less affordable for retail investors. A stock split lowers the price per share, making the stock more accessible to a broader group of investors.

- Increased Liquidity: With more shares in circulation, trading volume often increases, which improves market liquidity and allows for easier entry and exit from positions.

- Symbolic Confidence: A stock split can signal to the market that the company is performing well and expects continued growth. While it does not affect the company’s value, it can boost investor sentiment and visibility.

Palo Alto Networks Stock Split

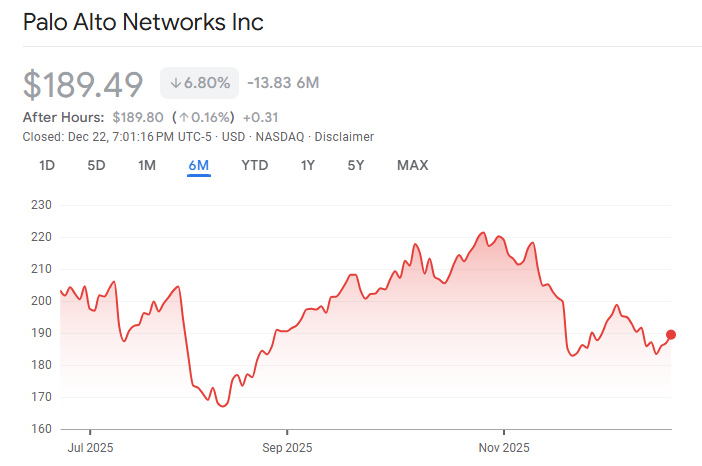

Palo Alto Networks has carried out two stock splits in recent years, a 3-for-1 split in September 2022 and a 2-for-1 split in December 2024. These splits have played a key role in maintaining stock accessibility for a broader group of investors, all while keeping the company’s market value stable.

In this article, we’ll explore Palo Alto Networks’ stock split history, its rationale, and how it impacts traders. Plus, we’ll look at what could happen in 2026, as well as the latest performance metrics for the company.

Palo Alto Networks Stock Split History

3-for-1 Stock Split in September 2022

Palo Alto Networks executed a 3-for-1 stock split in September 2022 after experiencing significant share price appreciation. The purpose of the split was to make the stock more accessible to retail investors and ensure better liquidity in the market. The company wanted to maintain a lower nominal share price, which is often more attractive to smaller investors. Despite the stock split, the company’s market capitalization remained unchanged, as only the number of shares and the price per share were adjusted.

2-for-1 Stock Split in December 2024

Following another rise in Palo Alto Networks’ share price, the company opted for a 2-for-1 stock split in December 2024. This move aimed to support continued accessibility and improve trading liquidity as the stock price climbed again. Like the previous split, the total value of the company remained unaffected, and the adjustment primarily impacted the number of shares in circulation and the price per share.

Why Did Palo Alto Networks Conduct Stock Splits?

Both stock splits like 2022 and 2024 were driven by Palo Alto Networks’ desire to maintain accessibility for investors and ensure a manageable share price for day-to-day trading. Here’s why stock splits are common in the tech industry:

- Affordability for Investors: When a company’s share price rises significantly, it can become expensive for retail investors. By splitting the stock, the company makes its shares more affordable, allowing a larger pool of investors to buy in.

- Liquidity: Increasing the number of shares in circulation typically leads to higher trading volume. This enhanced liquidity benefits traders by allowing them to enter and exit positions more easily.

- Operational Momentum: During both the 2022 and 2024 splits, Palo Alto Networks had strong operational performance, with revenue growth and expanding demand for its cybersecurity services. The stock splits came at a time of continued subscription-based revenue growth, ensuring that the company remained in a strong financial position.

It’s important to note that while stock splits do not directly affect the company’s valuation, they can help maintain a trading-friendly environment and boost market participation.

Latest Performance: Palo Alto Networks FY2025 Results

Palo Alto Networks continues to perform well, as evidenced by its fiscal year 2025 (FY2025) results. The company reported:

- Q4 2025 revenue: Approximately $2.5 billion, a 16% year-on-year increase.

- FY2025 total revenue: Around $9.2 billion, a 15% year-on-year growth.

- Next-Generation Security (NGS) ARR: Around $5.6 billion, showing a 32% increase.

- Remaining Performance Obligation (RPO): About $15.8 billion, growing 24%.

These results highlight strong demand for Palo Alto Networks’ network security, cloud security, and security operations platforms. There has also been notable growth in recurring revenue streams, particularly in subscription services.

Palo Alto Networks: Key Strategic Priorities for 2026

Palo Alto Networks has identified several key priorities for the 2026 fiscal year, which reflect the company’s continued focus on growth and innovation:

- Double-Digit Revenue Growth: The company expects to continue its strong revenue growth trajectory, supported by momentum in subscription services and a growing base of recurring revenue.

- Platform Strategy: Palo Alto Networks will continue promoting its platform-based approach to cybersecurity, focusing on its three core areas: network security, cloud security, and security operations. This strategy aims to streamline security management and provide comprehensive solutions for customers.

- Next-Generation Security and AI Integration: Palo Alto Networks is committed to expanding its Next-Generation Security (NGS) portfolio, with increased adoption of Secure Access Service Edge (SASE) offerings and advanced AI-driven solutions for cloud security.

- Cloud Security and AI: The company’s efforts to enhance cloud firewall technology, identity protection, and automation will continue to evolve as it meets growing demand for cloud security, particularly among companies integrating AI technologies.

Conclusion

Palo Alto Networks’ stock splits in 2022 and 2024 improved share accessibility, enabling more investors to participate. While there are no confirmed plans for a stock split in 2026, the company’s strong performance and growth in cybersecurity services make it a stock to watch for traders.

For those looking to capitalize on movements like Palo Alto Networks’ stock, Ultima Markets offers a robust trading platform. With real-time market data, advanced charting tools, and access to a wide range of securities, Ultima Markets equips traders to navigate short-term volatility and long-term strategies.

By staying updated on Palo Alto Networks’ performance and market trends, traders can position themselves for success. Ultima Markets provides the tools and insights to enhance your trading experience and help you optimize strategies in today’s dynamic market.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.