Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

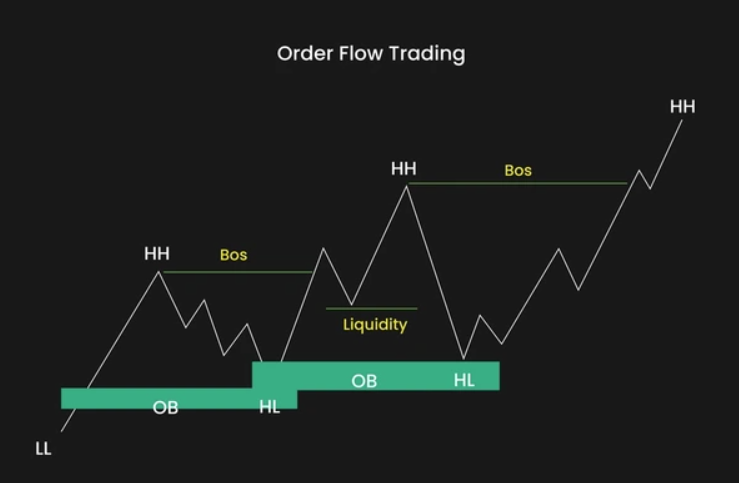

What is Order Flow Trading?

Order flow trading is a method of market analysis and execution that focuses on the real-time behaviour of orders (buy & sell), rather than relying solely on lagging indicators or historical price patterns. Its goal is to detect shifts in supply and demand as they happen, allowing traders to align with the “true flow” of the market.

Unlike traditional technical analysis, which focuses on past price action (candlesticks, support/resistance, moving averages), order flow trading examines the microstructure of the market, how orders are placed, filled, canceled, and how imbalances form. This gives traders a more direct window into institutional activity, liquidity absorption, and short-term momentum.

Because order flow is “live,” non-lagging, and reflects the actual forces pushing price, many professional and advanced retail traders consider it among the highest-resolution signals available.

Why Order Flow Matters in Modern Markets

Visibility into Order Imbalance & Liquidity

Order flow reveals when one side (buy or sell) is aggressively consuming liquidity, or when large limit orders are being placed or withdrawn. These imbalances often precede big moves.

Precision in Entry & Exit

Since order flow shows cluster activity at price levels, one can place tighter stop losses and higher-confidence entries by aligning with real-time pressure.

Better Risk Management

Instead of relying only on static support/resistance zones, you can dynamically adjust based on how orders are behaving. If a setup fails and order flow rotates, you can quickly abort.

Detecting Institutional Behavior

Large traders, algorithms, and institutions often hide in the order flow. Spotting absorption, iceberg orders, or stealth accumulation/ distribution can hint at “smart money” moves.

Types of Orders

Understanding different order types is fundamental to interpreting the flow.

Market Order

An order to buy/sell immediately at the best available price. Market orders consume liquidity, large market orders create detectable spikes in order flow.

Limit Order

An order to buy/sell at a specified price (or better), or not executed. Limit orders form resting liquidity, they are the skeleton against which market orders push.

Stop Order / Stop-Market

An order that becomes a market order once a trigger price is reached. Stop orders often lead to cascades (stop hunts) and can amplify order flow shifts.

Hidden / Iceberg Order

A large order split so that only a small portion is visible in the order book. These mask true liquidity, detecting their footprint requires subtle order flow techniques.

Cancel / Modify Order

Existing orders modified or canceled before execution. Rapid cancellation or repositioning often hints at liquidity testing or market maker behavior.

In order flow analysis, much insight comes from watching the interplay of market orders hitting limit orders, the cancellation of limit orders, and shifts in the order book depth.

Analyzing Order Flow Data

Order flow analysis requires sophisticated tools. Below are the key concepts and instruments:

Depth of Market (DOM) / Order Book

The DOM display shows current resting orders (bid/ask) at various price levels, with volume and order counts. Observing how these change, orders added, withdrawn, or consumed, yields insight into liquidity.

When orders are pulled from one side or large aggressive orders flood one side, you may infer upcoming directional pressure.

Time & Sales (“The Tape”)

This is a sequential list of executed trades: price, volume, timestamp, and whether the aggressor was a buyer or seller (i.e. trade at bid or at ask). “Tape reading” is a foundation of order flow. By parsing the tape (size, speed, clustering), you can detect when momentum is building or waning.

Footprint Charts / Volume Profile / Delta / Cumulative Delta

- Footprint Charts: Show executed buy/sell volume at each price within a bar, often with color coding for imbalances.

- Volume Profile: Aggregates total volume by price level over a session or period, showing where volume clusters (value areas) are formed.

- Delta / Cumulative Delta: Difference between buying volume and selling volume; cumulative over time to show directional bias.

- Imbalance Indicators: Identifies where executed volume is heavily skewed to one side in a price bar.

Together, these let traders spot absorption, exhaustion, breakout confirmation, and trade entry zones.

Order Flow Patterns & Signatures

Some specific patterns or behaviors that order flow traders watch for:

- Absorption: When one side pushes aggressively (e.g. sellers), but the opposite side (buyers) absorbs without price moving. Indicates presence of strong counterparty interest.

- Exhaustion: When momentum fades; subsequent orders are weaker or volume decreases, signaling potential reversal.

- Breakout with Confirmation: A price breaks a level, and order flow (volume, delta) supports continuation.

- Rejections / Reversal Zones: At liquidity extremes or clustered volume zones, sudden reversal when pressure is rejected.

- Order Book “Spoofing” / Fake Liquidity Tests: Traders may place large visible orders to probe and then cancel, tricking weaker participants.

Best Practices for Order Flow Trading

To succeed with order flow, it’s not enough to see the data, you must interpret it in context and act judiciously. Here are best practices:

Use Confluence & Context

Always align order flow with higher time frame structure (trend, support/resistance zones). Don’t trade every imbalance, look for confirming volume, momentum, or confluence with technical levels Filter “fake” liquidity by seeing whether aggressive orders are sustained or fading

Volatility & Noise Filtering

Avoid low-liquidity instruments or times (e.g. right during market open gaps). Set minimum volume thresholds so small incidental orders don’t generate false signals. Use smoothing (e.g. over multiple bars) or clustering techniques to reduce noise.

Risk / Money Management

Always predefine stop-loss and target zones based on order flow structure. Avoid overleveraging, order flow can reverse quickly. Use position sizing rules such that a single loss doesn’t cripple your account.

Build with Demo / Replay Tools

Practice in simulated mode or replay mode to learn how order flow behaves. Use historical order flow replay. Develop a “playbook” of recurring patterns (absorption, exhaustion, etc.).

Trade What You See, Not What You Think

Don’t force bias, let order flow confirm or deny your directional bias. Be mindful of slippage and latency, order flow signals need to be actionable and timely. Combine with other tools (volume profile, VWAP, market structure) rather than relying solely on order flow.

Keep a Log & Review

Document each trade: what order flow signature triggered, outcome, lessons. Review losing trades to spot recurring misinterpretations. Over time, refine your rules and thresholds.

Common Mistakes in Order Flow Trading

Even experienced traders can fall into traps. Here are mistakes to avoid:

Reacting to Every Spike or Imbalance

Not all volume surges are meaningful. Many are “noise” or algorithmic passes. Rely on context, not just raw delta.

Overweighting Delta Alone

Delta (buy minus sell) is useful, but by itself isn’t enough. It must align with volume, structure, trend, and order book dynamics.

Ignoring Larger Market Structure

Trading microflows without regard to trending direction, support zones, or macro market conditions often leads to losses.

No Risk Controls or Poor Sizing

Aggressive trades without defined risk or position sizing can lead to catastrophic drawdowns.

Using Inadequate Tools or Latency

Poor data feeds, lagging platforms, or slow execution can turn valid signals into losing trades.

Not Filtering Low-Liquidity / Off-Peak Periods

Order flow signals tend to be more reliable when markets are active and volume is healthy.

How to Begin with Order Flow Trading (Step-by-Step)

- Look for features like footprint charts, DOM/market depth, time & sales, delta tools (e.g. NinjaTrader Order Flow+, Jigsaw).

- Select Liquid Instruments: Futures (e.g. indices, commodities), major FX pairs, or highly liquid stocks are good.

- Start in Demo or Replay: Practice without risk. Replay historical order flow and label patterns.

- Define Setup Criteria: E.g. “if absorption is seen at support with rising delta, enter long with stop below the absorption cluster.”

- Start Small, Track Every Trade: keep a trade journal with screenshots, setups, and outcomes.

- Review & Refine Strategy: Adjust thresholds, volume filters, and pattern definitions.

- Gradually Move to Live with Strict Risk Control: Trade with minimal size initially; limit exposure and slippage.

Conclusion

Order flow trading gives traders a deeper insight into what truly moves the market, liquidity and order execution. In the forex market, where centralised order books do not exist, traders can still apply order flow principles using volume-based tools, tick data, and aggregated liquidity indicators provided by brokers and ECNs.

By studying how price reacts to key liquidity zones, identifying absorption near support or resistance, and watching momentum through cumulative delta or volume clusters, forex traders can anticipate turning points or breakouts with greater precision.

While no strategy guarantees success, order flow trading offers a data-driven framework for understanding the tug-of-war between buyers and sellers in real time. Combined with strong risk management, clear contextual analysis, and a disciplined mindset, it can become a powerful tool to elevate your forex trading performance and refine your decision-making edge.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.