Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteNVDA Nvidia Stock Price Prediction 2030

Nvidia (NASDAQ: NVDA) has become the defining stock of the artificial intelligence era. What began as a company building graphics cards for gamers is now the foundation of modern computing. Its GPUs power the platforms of today’s biggest tech giants, from ChatGPT and Google’s Gemini to Tesla’s self-driving systems, and the largest data centers in the world.

In July 2025, Nvidia made history as the first publicly traded company to surpass a $4 trillion market capitalisation, briefly overtaking Apple and Microsoft.

With such momentum, investors naturally ask: where will Nvidia stock be by 2030?

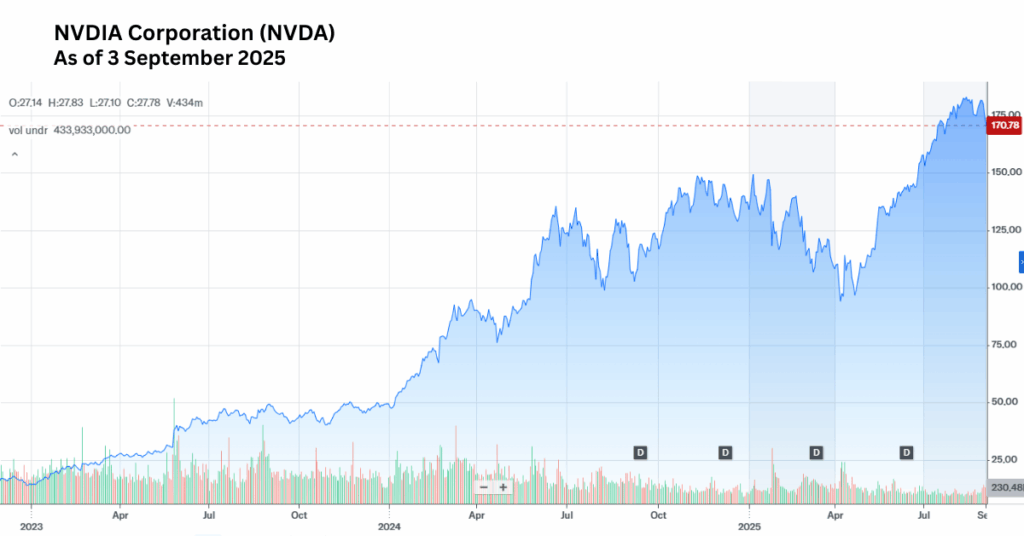

Current Position and Financial Strength

As of September 2025, Nvidia is valued at over $4.2 trillion. Its most recent quarterly earnings continued to impress: revenue came in at $46.7 billion versus $46.06 billion expected, while EPS of $1.05 edged past forecasts. Margins remain exceptional, with gross margins near 70% and net profit margins above 50%.

Despite trading at premium multiples—around 56 times trailing earnings and 30 times forward earnings—Nvidia’s valuation is more restrained than in 2023–2024, when P/E ratios pushed above 60. The company also maintains low debt and generates strong free cash flow, reinforcing its financial position.

Wall Street analysts have responded by raising targets. Bernstein, Bank of America, Citi, JPMorgan, KeyBanc, Morgan Stanley, and Oppenheimer all boosted their estimates in recent months, now clustered around $210–$235.

A Record of Wealth Creation

Nvidia’s long-term performance underscores its role as one of the market’s most powerful wealth generators. Since its IPO in 1999, the stock has delivered total returns of over 482,000%. Even in the last decade, shares rose by more than 31,000%, turning a $100 investment into more than $32,000.

Financially, Nvidia has moved in lockstep with its stock. Between 2014 and 2024, revenue climbed from $4.1 billion to nearly $61 billion, while net income expanded from $588 million to almost $30 billion. In the last five years, as AI demand accelerated, the stock advanced by 1,468%.

Why Nvidia Stock Price Prediction 2030 Remains Bullish

The AI market was valued at $196.6 billion in 2023 and is projected to grow at a compound annual growth rate of 36.6% through 2030. Jensen Huang, Nvidia’s CEO, has forecast $3–$4 trillion in AI infrastructure spending by the end of the decade.

Critically, demand is no longer just about training AI models—it is shifting to inference, or running those models in the real world. Each AI response, whether from ChatGPT or a Google search, consumes “tokens,” and more advanced reasoning models require far more tokens per query. Analysts estimate token use per task is increasing by 5–10 times, and some models demand up to 100× more compute than earlier generations. This makes inference an even larger growth engine than training.

Real-world numbers support this. In Q1 2025, Microsoft processed more than 100 trillion tokens, a fivefold increase YoY, while Google’s token usage rose fiftyfold. Nvidia’s own software, such as the open-source Dynamo library, has boosted token throughput by over 30× per GPU. These figures underscore why Nvidia’s guidance still points to $54 billion in next-quarter revenue—nearly double what it earned in all of fiscal 2023.

Another driver is sovereign AI. Governments in the Middle East, Europe, and Asia are investing billions to build national AI infrastructure. Analysts estimate sovereign AI demand could account for double-digit billions in Nvidia’s revenue as early as 2025.

Finally, Nvidia’s customer base is unusually concentrated among the world’s largest technology companies. Alphabet, Amazon, Meta, and Microsoft together contribute about 40% of revenue, this case strengthens the growth case for Nvidia stock price prediction 2030 even further.

The Risks Ahead

With great opportunities come significant risks. Nvidia’s valuation remains steep, meaning the stock could correct sharply on any earnings miss. Competition from AMD, Intel, Google (TPU), Amazon (Trainium), and Chinese players like Huawei is intensifying. Export restrictions also limit Nvidia’s ability to sell into China, historically one of its biggest markets. The company recently warned of an $8 billion quarterly revenue impact tied to these restrictions.

There is also the risk of investor over-exuberance. With Nvidia now a favorite for both institutions and retail traders, volatility is inevitable. Still, institutional conviction is strong: BlackRock increased its Nvidia holdings by nearly 8 million shares in Q2 2025, while Vanguard added close to 40 million shares.

Nvidia Stock Price Prediction for 2025–2030

Wall Street and 24/7 Wall St.

- Base case for 2030: $241 per share.

- High case: $506.80

- Low case: $217.20

These estimates assume $7.24 EPS and P/E multiples between 30 and 70.

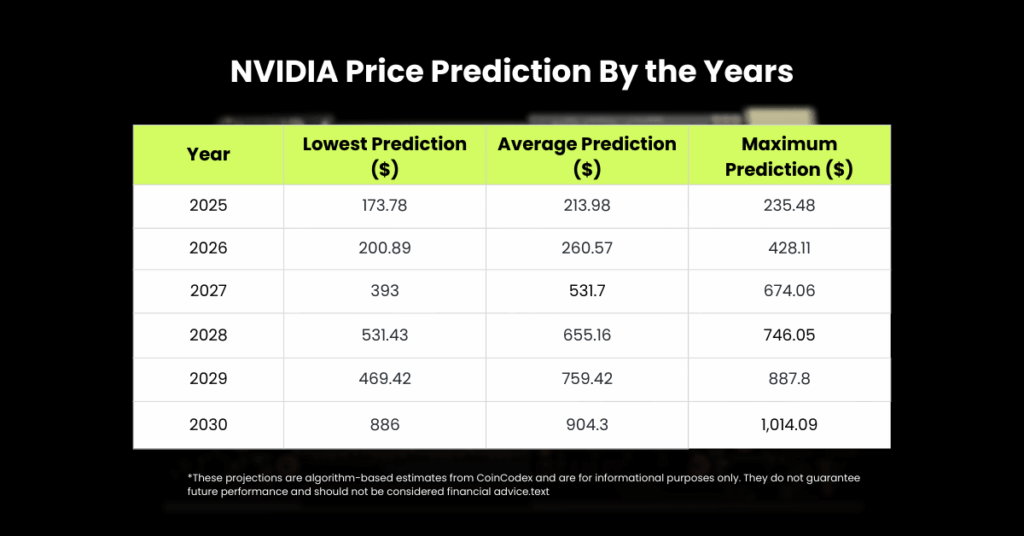

Algorithmic Models (CoinCodex)

Year-by-year projections suggest Nvidia stock could average $213.98 in 2025, $260.57 in 2026, $531.70 in 2027, $655.16 in 2028, $759.42 in 2029, and $904.30 in 2030. The high end crosses $1,000.

The $10 Trillion Market Cap Path

From today’s $4.2 trillion valuation, Nvidia would need to rise about 127% to hit $10 trillion. Wall Street forecasts 23.6% annual revenue growth for the next five years, potentially lifting revenue to $466 billion by 2030. Ben Reitzes of Melius Research is more bullish, projecting $600 billion in annual revenue and suggesting the stock could “double from here, if not more.”

Nvidia Stock Price Prediction 2030

By 2030, Nvidia’s stock could fall into a wide range depending on adoption, competition, and valuation multiples:

- A conservative case puts shares at $1,500–$2,000 if growth slows but margins hold.

- A base case sees $2,500–$3,000 with steady AI demand and continued dominance.

- A bull case envisions $3,500–$4,000 or more if inference and sovereign AI drive a new wave of exponential demand.

Compared with Wall Street’s $241–$506 range and algorithmic models around $900–$1,000, these trader-driven scenarios highlight just how uncertain long-term valuations remain.

Key Takeaway

Nvidia has already created extraordinary wealth for long-term shareholders, and the story may not be finished. By 2030, forecasts range from cautious valuations under $500 to speculative cases above $3,000 per share; and even the possibility of Nvidia becoming the world’s first $10 trillion company.

The truth likely lies somewhere between. Nvidia is not a risk-free investment, but it remains the central player in the AI revolution. For investors with a long horizon, the combination of unmatched technology, surging demand, and global adoption makes Nvidia a stock that cannot be ignored.

*Please note that the Nvidia stock price prediction 2030 is speculative and not financial advice. Always conduct your own research or consult a licensed advisor before investing.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.