Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

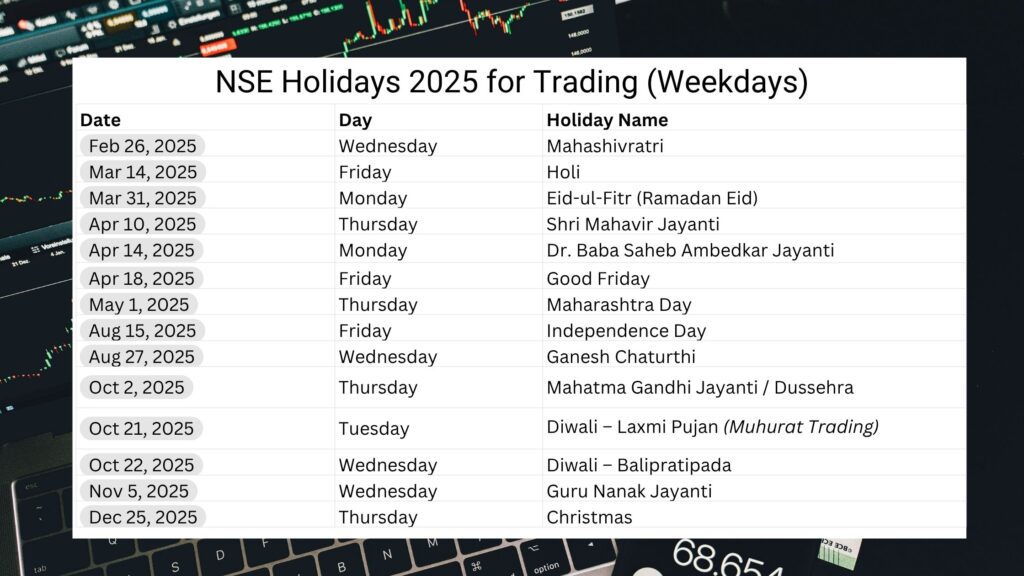

I confirm my intention to proceed and enter this websiteKnowing the NSE Holidays 2025 in advance is essential for traders and investors to plan trades, manage positions, and avoid unexpected disruptions. The National Stock Exchange (NSE) has released the official 2025 holiday calendar for Equity, Equity Derivatives, SLB, and Commodity segments.

NSE Holidays 2025 for Trading (Weekdays)

Below is the official list of NSE trading holidays 2025 for Equity, Equity Derivatives, and SLB segments:

| Date | Day | Holiday Name |

| Feb 26, 2025 | Wednesday | Mahashivratri |

| Mar 14, 2025 | Friday | Holi |

| Mar 31, 2025 | Monday | Eid-ul-Fitr (Ramadan Eid) |

| Apr 10, 2025 | Thursday | Shri Mahavir Jayanti |

| Apr 14, 2025 | Monday | Dr. Baba Saheb Ambedkar Jayanti |

| Apr 18, 2025 | Friday | Good Friday |

| May 1, 2025 | Thursday | Maharashtra Day |

| Aug 15, 2025 | Friday | Independence Day |

| Aug 27, 2025 | Wednesday | Ganesh Chaturthi |

| Oct 2, 2025 | Thursday | Mahatma Gandhi Jayanti / Dussehra |

| Oct 21, 2025 | Tuesday | Diwali – Laxmi Pujan (Muhurat Trading) |

| Oct 22, 2025 | Wednesday | Diwali – Balipratipada |

| Nov 5, 2025 | Wednesday | Guru Nanak Jayanti |

| Dec 25, 2025 | Thursday | Christmas |

Note: Muhurat Trading will be held on Diwali – Laxmi Pujan (Oct 21, 2025). Exact session timings will be announced by NSE closer to the date.

NSE Holidays 2025 Falling on Weekends

When NSE holidays fall on a Saturday or Sunday, there is no additional market closure. In 2025, these holidays land on weekends:

- Jan 26, 2025 (Sunday) – Republic Day

- Apr 6, 2025 (Sunday) – Ram Navami

- Jun 7, 2025 (Saturday) – Bakri Eid / Eid-ul-Adha

- Jul 6, 2025 (Sunday) – Muharram

NSE Timings 2025

Understanding NSE market timings helps traders plan entries, exits, and order placements effectively.

Equity & Equity Derivatives Timings:

- Pre-Open Session: 9:00 AM – 9:15 AM (Order entry until 9:08 AM, then order matching until 9:15 AM)

- Normal Trading Hours: 9:15 AM – 3:30 PM

- Closing Session: 3:30 PM – 4:00 PM

- Block Deal Session: Morning: 8:45 AM – 9:00 AM, Afternoon: 2:05 PM – 2:20 PM

Upcoming NSE Commodity and Settlement Holiday Variations

Settlement Holidays (Non-Trading Days for Clearing Only)

Some dates affect only the settlement process, not actual trading. In 2025, settlement holidays include:

- Feb 19 – Chhatrapati Shivaji Maharaj Jayanti

- Apr 1 – Annual Bank Closing

- May 12 – Buddha Purnima

- Sep 5 – Id-e-Milad

Commodity Segment Holidays

In the NSE Commodity Derivatives segment, some holidays have morning session closures but evening sessions remain open. Full-day closures occur on:

- Good Friday

- Independence Day

- Gandhi Jayanti

- Diwali Laxmi Pujan

- Christmas

Muhurat Trading 2025

Muhurat Trading 2025 will be conducted on October 21, 2025 (Diwali – Laxmi Pujan). This special trading session is considered auspicious in Indian markets, attracting high participation and symbolic portfolio activity. Timings will be confirmed by NSE in October.

Why NSE Holidays 2025 Matter for Traders

For active market participants, knowing the NSE Holidays 2025 in advance is more than just marking days off on a calendar, it’s part of risk control, trade timing, and liquidity management. Here’s why:

Avoiding Liquidity Traps

On trading days right before or after an NSE holiday, liquidity often drops as institutional participants adjust their books. Thin volumes can lead to higher bid-ask spreads, slippage, and more volatile intraday moves. By being aware of the holiday schedule, traders can decide whether to reduce exposure or use volatility to their advantage.

Managing Overnight and Weekend Risk

Holidays extend the holding period of open positions. For example, a Friday holiday or a long weekend means positions remain exposed to global market developments, currency moves, or commodity price changes without the ability to react instantly. Strategic position sizing and hedging become crucial in such scenarios.

Adjusting Settlement and Clearing Schedules

Settlement-only holidays can delay the clearing of trades without halting market activity. For traders using margin or rolling over futures contracts, this can impact cash flows and collateral requirements. Understanding NSE settlement holiday variations prevents operational bottlenecks.

Planning Around Commodity Market Variations

In the commodity derivatives segment, some holidays result in morning closures but open evening sessions, which can be critical for traders reacting to international commodity price movements. Knowing these exceptions helps maintain participation in key price-setting hours.

Leveraging Muhurat Trading Opportunities

Muhurat Trading, scheduled for October 21, 2025, is symbolic but can generate concentrated order flows and short-term momentum. Traders who prepare watchlists and execution plans in advance can capture opportunities during this one-hour special session.

Coordinating with Global Market Events

Indian market holidays do not always align with major global exchanges like NYSE, LSE, or SGX. International market moves during NSE holidays can create price gaps when trading resumes, impacting both intraday and swing traders. Awareness allows for better pre-holiday hedging or option positioning.

Conclusion

The NSE Holidays 2025 calendar is more than just a list of market closures, it’s a trading tool. By tracking holiday dates, understanding weekend overlaps, planning around settlement holidays, and preparing for events like Muhurat Trading, traders can minimize risk and optimize execution.

At Ultima Markets, we provide traders with timely market insights, economic calendars, and analysis to help you navigate every trading session with confidence. Whether you’re trading equities, derivatives, or commodities, having an updated NSE holiday calendar ensures you never miss an opportunity or get caught off-guard by a market closure.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.