Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomNikola Corporation (OTC: NKLAQ) has been a closely watched name in the electric truck and hydrogen sector. Once hailed as a Tesla challenger, the company’s trajectory changed dramatically in 2025, when it filed for Chapter 11 bankruptcy.

NKLA Stock Forecast

Traditional price targets are no longer applicable. After a bankruptcy filing, most analysts withdraw coverage, and previous forecasts become outdated.

At present:

- Equity value is speculative. Bankruptcy proceedings prioritize creditors, and common shareholders often face a total loss.

- Asset sales are ongoing.

- Lucid Group acquired select Arizona facilities through a bankruptcy auction in April 2025.

- Hyroad Energy purchased 113 hydrogen fuel-cell trucks, spare parts, and related IP in August 2025.

With assets being sold, Nikola’s future business operations remain uncertain. Without a confirmed restructuring plan, no reliable 12-month or long-term stock forecast can be made.

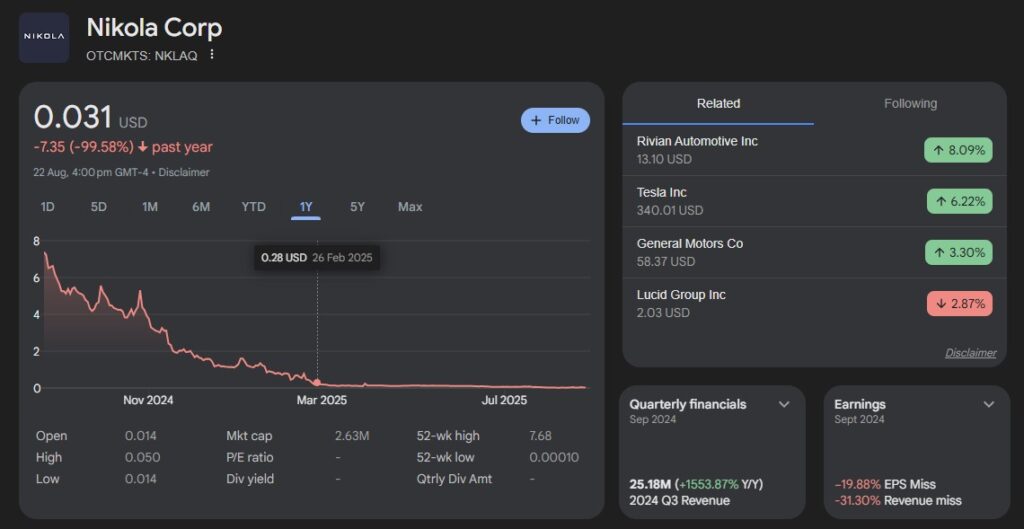

NLKA Stock Overview

- Bankruptcy filing: On February 19, 2025, Nikola and subsidiaries entered Chapter 11 protection.

- Delisting: Nasdaq suspended trading on February 26, 2025. Nikola announced plans to file Form 25 and deregister with the SEC on March 24, 2025.

- New ticker: Shares now trade over-the-counter as NKLAQ.

- Price range: In August 2025, NKLAQ has been trading between $0.02–$0.05 per share.

- Reverse split: Prior to bankruptcy, Nikola completed a 1-for-30 reverse split on June 25, 2024 to maintain listing compliance.

What is Nikola

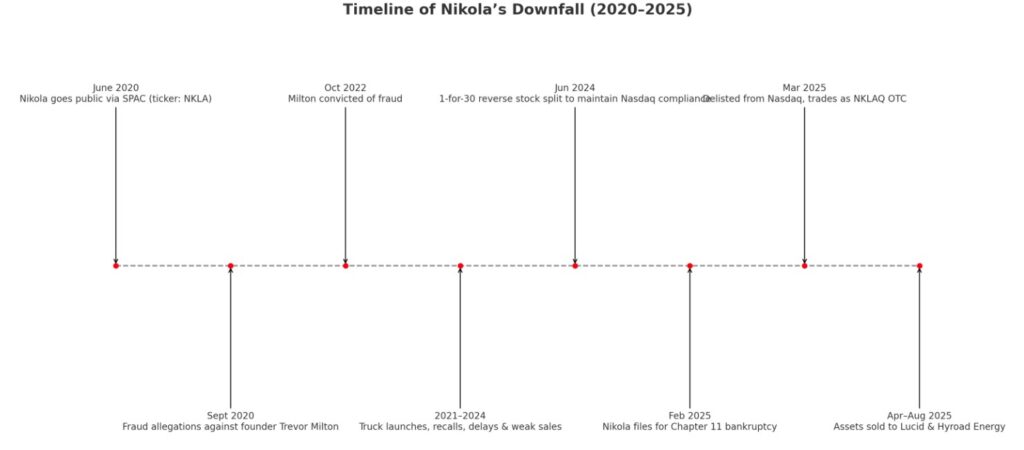

Nikola Corporation, founded in 2014, designs battery-electric (BEV) and hydrogen fuel-cell (FCEV) trucks. It went public via a SPAC merger with VectoIQ in June 2020 and traded under the ticker NKLA on Nasdaq.

The company aimed to disrupt heavy-duty trucking with zero-emission vehicles and hydrogen fueling infrastructure. However, delays, recalls, and financial struggles ultimately led to its Chapter 11 bankruptcy filing in February 2025.

Nikola’s trajectory toward bankruptcy was shaped by a combination of financial, operational, and credibility challenges:

- Ongoing Losses and Cash Burn – Nikola consistently reported steep quarterly losses since going public in 2020, with limited revenue from truck deliveries. The company struggled to generate enough sales to offset high production and R&D costs.

- Production and Delivery Issues – While Nikola launched battery-electric and hydrogen fuel-cell trucks, it faced recalls, supply chain constraints, and slower-than-expected customer adoption. These delays weakened confidence and strained finances.

- Fraud Allegations and Settlements – In 2020, the SEC and DOJ investigated Nikola’s founder, Trevor Milton, over misleading statements about the company’s technology. Milton was later convicted of fraud in 2022, which severely damaged Nikola’s reputation and investor trust.

- Liquidity Crisis – By early 2025, Nikola’s cash reserves had dwindled, and access to new funding became limited. Without sufficient capital to continue operations and meet debt obligations, the company filed for Chapter 11 bankruptcy on February 19, 2025.

In short, persistent financial losses, weak demand, reputational damage from fraud cases, and a critical cash shortfall pushed Nikola into bankruptcy, ending its trajectory as a standalone EV truckmaker.

Is Nikola Stock a Good Buy?

Nikola stock is not considered a good buy at this time. Since the company filed for Chapter 11 bankruptcy in February 2025, its shares have been delisted from Nasdaq and now trade as NKLAQ on the OTC market at just a few cents per share. In bankruptcy proceedings, creditors have priority over shareholders, and it is common for existing equity to be cancelled or rendered worthless.

While some traders may speculate on the stock for short-term gains, the risk of a total loss is extremely high, making Nikola unsuitable for long-term investors or those seeking stable growth.

Does Nikola Have a Future?

Nikola’s brand and technology assets are being sold to other companies. While the Nikola name may persist under new ownership, the original company’s future as an independent entity is doubtful. For current shareholders, the outcome hinges on how the bankruptcy court allocates value and history suggests shareholders are last in line.

Is Nikola a Long-Term Buy?

No. Given bankruptcy status, asset sales, and trading at pennies, Nikola is not a long-term investment. Until the Chapter 11 process concludes, equity recovery remains highly unlikely.

Why is Nikola stock now NKLAQ?

The “Q” indicates that the company is in bankruptcy proceedings and trades on the OTC market.

Conclusion

Nikola’s story serves as a powerful reminder of the risks tied to speculative stocks. Once positioned as a hydrogen truck pioneer, the company is now in Chapter 11, with its assets being sold off and its future uncertain. For traders, this highlights the importance of combining excitement about innovation with a clear focus on fundamentals, risk management, and credible analysis.

At Ultima Markets, we help traders navigate these challenges with expert market insights, education, and tools designed to support smarter decisions in volatile conditions. Whether it’s spotting early warning signs or exploring opportunities in more stable assets, Ultima Markets empowers you to trade with purpose and stay prepared for market shifts.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.