Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Next Stock Market Crash Prediction 2025

The next stock market crash prediction for 2025 points to higher volatility driven by restrictive interest rates, record global debt, elevated valuations, and tariff uncertainty. While experts disagree on whether a full crash will occur, most agree that market conditions this year make equities more vulnerable to sharp corrections.

Factors Fueling Stock Market Crash 2025 Predictions

Restrictive Policy Rates

The U.S. Federal Reserve holds rates at 4.25–4.50 percent as of August 2025, a level officials still describe as above neutral. This restrictive stance supports disinflation but leaves growth exposed if policy stays tight too long.

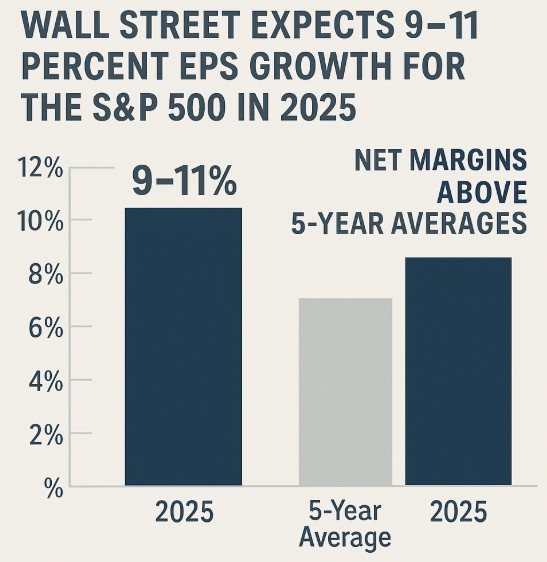

Earnings and Margins

Wall Street expects 9–11 percent EPS growth for the S&P 500 in 2025, with net margins above 5-year averages. While this supports the bull case, sector divergence remains high, and companies exposed to tariffs or slower global demand could underperform.

Rich Valuations

The S&P 500 trades at ~22x forward earnings, above both 5- and 10-year averages. Elevated multiples mean even small earnings disappointments could spark outsized volatility.

Record Global Debt

Global debt surpassed $324 trillion in 2025, with governments and corporations facing heavy refinancing needs this year. Any spike in yields or weaker growth could magnify repayment risks.

Policy and Tariff Uncertainty

Unresolved tariff disputes and policy shifts have become a major driver of volatility in 2025, particularly for export-oriented industries in the U.S. and Europe.

What Experts Are Saying About Stock Market Crash 2025

Expert views on the stock market crash prediction 2025 remain divided, reflecting both optimism and caution in today’s market landscape.

- Bearish outlooks: Some analysts argue that valuations near 22x forward earnings, combined with restrictive interest rates and record global debt, leave little margin for error. They warn that any earnings disappointments, unexpected inflation uptick, or policy missteps could trigger a sharp sell-off.

- Cautious optimism: Other strategists acknowledge the risks but highlight that U.S. corporate earnings have surprised to the upside, with margins still above 5-year averages. They see corrections as likely but expect them to be orderly rather than systemic crashes.

- Risk-on perspectives: A number of global investment banks remain overweight on U.S. equities, noting strong cash flows, resilient consumer spending, and an improving outlook for technology and AI-driven companies. These experts believe volatility will create trading opportunities rather than mark the start of a prolonged bear market.

- Macro watchers: Economists emphasize tariff disputes, debt maturities, and central bank policy as wild cards. Shifts in these areas could tilt the balance between a healthy correction and a deeper downturn.

Key Takeaway for Traders

While the definition of a “crash” differs, most experts agree on one point: 2025 will be a year of heightened volatility. Traders who monitor indicators like earnings revisions, credit spreads, and volatility indices will be better prepared to act quickly, whether markets correct sharply or simply chop sideways.

Portfolio Playbook Ahead of a Potential Market Crash

Diversification Still Matters

Spreading risk across equities, bonds, commodities, and cash remains one of the most effective defenses against downturns.

Gold and Treasuries as Selective Hedges

Gold demand has remained strong in 2025, historically softening equity drawdowns. Treasuries may offer protection in risk-off episodes, though their behavior depends on inflation and yields.

Cash as Dry Powder

Holding a cash buffer lets investors seize discounted opportunities during sharp corrections.

Focus on Quality and Liquidity

Companies with low leverage, strong free cash flow, and resilient demand tend to hold up better in market downturns.

Risk Management Discipline

Stop-loss orders, smaller position sizes, and volatility monitoring can protect against sharp swings.

Beyond Predictions: Key Indicators to Watch in 2025

Predictions alone don’t move markets, signals and data do. For traders, keeping an eye on key indicators is often more valuable than relying on forecasts. Here are the most relevant in 2025:

Yield Curve Dynamics

The U.S. yield curve has been inverted for much of the past two years, historically a recession warning. A steepening curve (long-term yields rising faster than short-term) could indicate stress about growth or debt refinancing. Monitoring the curve helps traders gauge when credit markets expect a slowdown.

Volatility Index (VIX)

The VIX, known as Wall Street’s “fear gauge,” measures expected market volatility. Low readings suggest complacency, while spikes above 20–25 often signal heightened uncertainty. In 2025, traders use VIX movements to anticipate sudden swings in equities and adjust position sizes.

Credit Spreads

The gap between yields on corporate bonds and U.S. Treasuries shows how much risk investors demand to hold company debt. Widening spreads mean investors see rising default risks or weaker growth ahead, often a red flag before equity sell-offs.

Earnings Guidance Trends

Quarterly results are only part of the picture. Forward guidance from companies offers the clearest signal of confidence (or lack of it) in future demand. Downward revisions across sectors can drag markets lower even when current earnings look strong.

Liquidity Conditions

Central banks are still running balance sheet operations, and global liquidity is uneven. Tight liquidity often magnifies market swings. Traders who track central bank statements, repo operations, and global money flows can anticipate volatility before it hits equities.

Conclusion

The next stock market crash prediction for 2025 isn’t about pinpointing a date, it’s about recognizing risk factors and preparing with discipline. Restrictive monetary policy, high valuations, record debt, and tariff uncertainty all point to a more volatile environment. For traders, that means opportunity as well as risk.

At Ultima Markets, we believe education and preparation are the best defenses against uncertainty. Through our trading resources, market insights, and risk management tools, we help traders build strategies that can weather corrections and capitalize on volatility. Whether 2025 brings a correction or a prolonged rally, staying informed and disciplined keeps you in control of your trading journey.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.