Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

MT5 Application: The Ultimate Choice for Multi-Market Trading

Introduction: The Demand for Multi-Asset Trading

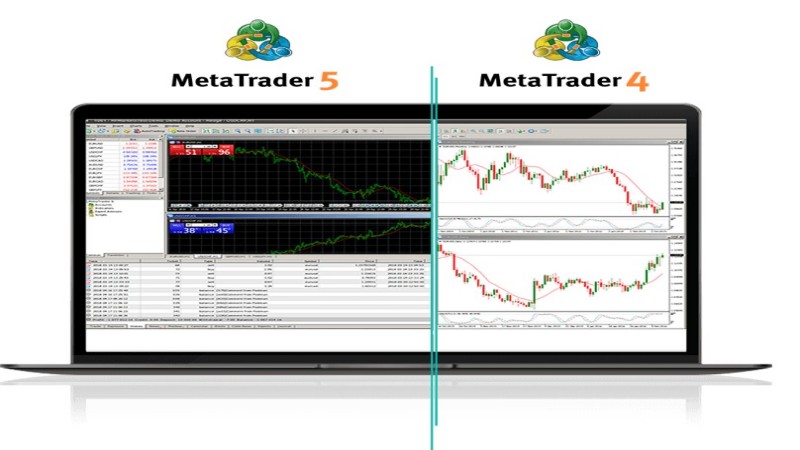

The financial markets are constantly evolving, with forex, commodity CFDs, and cryptocurrencies becoming essential instruments for investors to diversify risk. In the past, many traders relied on MT4 for forex trading. However, for those interested in a broader range of markets, the MT5 application offers expanded functionality and greater flexibility. This does not mean that MT5 is inherently superior to MT4, but rather that it highlights its advantages in multi-market trading, algorithmic strategies, and scalability, providing users with an additional choice based on their specific needs.

What is MT5?

o MT5, short for MetaTrader 5, is the successor to MT4 with several expanded features. It supports a wider range of markets and offers more advanced technical analysis tools.

o The MT5 application is available in both desktop and mobile versions, compatible with Android and iOS, allowing investors to track market trends and execute trades on any device.

Advantages of MT4 and MT5

Both MT4 and MT5 applications are developed by MetaQuotes and share a similar interface. However, they are designed with different functionalities tailored to their target users. MT4 remains one of the dominant platforms in the forex market, whereas MT5 provides enhanced technical support for trading stocks, indices, commodities, and cryptocurrencies.

Core Software Differences

o MT4 is built on the MQL4 language, while MT5 has been upgraded to MQL5.

o The MT5 application offers greater flexibility in algorithmic trading, enabling more sophisticated Expert Advisor (EA) strategies.

Who Should Choose MT5?

o Investors who need to monitor multiple financial instruments.

o Traders who want to leverage advanced algorithmic trading or multi-timeframe technical analysis.

o Users who wish to simultaneously manage investments in stocks, commodities, cryptocurrencies, and other diversified assets.

Core Features of the MT5 Application

Before diving into the technical aspects of the MT5 application, it’s important to understand the core value it offers to users.

Multi-Market Integration

o Supports trading across multiple asset classes, including forex, futures, indices, and cryptocurrencies, enabling investors to track various markets within a single platform.

o Different traders focus on different assets, and the MT5 application allows multi-chart monitoring to eliminate the hassle of switching between multiple platforms.

Enhanced Technical Indicators

o Features over 80 built-in analytical indicators and a broader range of timeframes.

o Investors can overlay multiple indicators, customize scripts, and implement automated strategies for precise order execution.

Powerful EA and Automated Trading

o The MT5 application utilizes the MQL5 language to develop Expert Advisors (EAs), offering faster execution for certain trading strategies compared to MT4.

o Within the MQL5 community, traders can access a vast library of free and paid EAs, enabling quick deployment of automated trading systems.

Multiple Order Execution Modes

o In addition to market orders, limit orders, and stop orders, MT5 also supports hedging and netting modes.

o The MT5 application is designed for flexibility, making it ideal for traders who use complex strategies or need to manage multiple orders simultaneously.

MT5 Application Download and Installation

If you are ready to experience the MT5 application, follow the installation steps for your device. The process is straightforward, but it is recommended to check your system version beforehand to ensure optimal performance.

Windows and macOS Versions

Windows Installation:

o Visit the official website or your broker’s platform to download the appropriate MT5 application installer.

o Follow the on-screen instructions and click “Next” to complete the installation. Once installed, launch the platform and log in with your account credentials.

macOS MT5 Installation:

o Some brokers provide a dedicated macOS installer. Download and drag the application into the “Applications” folder to install.

o If an official macOS version is unavailable, users may consider running MT5 via Wine or other emulators, though compatibility should be verified beforehand.

Android and iOS MT5 Installation

Android MT5 Installation:

o Open Google Play Store, search for “MetaTrader 5,” and install the application.

o Log in to your broker’s server to start using the mobile version of MT5.

iOS MT5 Installation:

o Search for “MetaTrader 5” in the App Store, download, and install the app following the on-screen instructions.

o Ensure your iOS version meets the application requirements for stable performance.

Considerations for Different Platform Users

Choosing the MT5 application does not mean abandoning MT4, but rather making a decision based on the range of assets you trade and the complexity of your strategies. The following key considerations can help determine whether upgrading to or using MT5 is the right choice for you:

Diversified Asset Allocation

o If you trade not only forex but also stocks, ETFs, or commodity futures, the MT5 application offers a more comprehensive analysis interface.

Automation and EA Development Needs

o If you have experience in developing algorithmic trading strategies, the flexibility of the MQL5 language may lead to more efficient EA development.

Long-Term or Multi-Timeframe Analysis

o The MT5 application provides a wider range of timeframes, such as 2-minute and 12-hour intervals. If your strategy relies on multi-timeframe analysis, you can fine-tune your entry and exit points with greater precision.

Common Features and Functions of the MT5 Application

The MT5 application is designed to accommodate both professional traders and beginners by integrating user-friendly interfaces and advanced trading tools. Below are some commonly used features to help you get started quickly.

One-Click Trading

o Orders can be placed directly via right-clicking on charts or using shortcut keys, reducing setup time and improving efficiency.

Depth of Market (DOM)

o This feature provides an overview of buy and sell orders at different price levels, which is particularly crucial for short-term or high-volume traders.

MT5 Trading Strategies and EA Integration

o The MQL5 language offers greater flexibility for strategy development, and the MT5 application allows direct backtesting of Expert Advisors (EAs) on the platform.

Multiple Chart Timeframes

o From 1-minute and 5-minute charts to daily, weekly, and even custom minute intervals, MT5 enables in-depth analysis tailored to your trading strategy.

How to Use the Application on Ultima Markets?

To help beginners get started quickly, you can explore the platform’s advantages further on Ultima Markets.

With a trading account on Ultima Markets, investors can experience leveraged trading across multiple financial instruments and seamlessly install Expert Advisors (EAs) for automated trading. For users who wish to test multi-strategy approaches with the MT4 application before committing to live trading, it is recommended to start with a demo account to mitigate potential risks.

Common FAQs

Below are some frequently asked questions from investors to help you use the MT5 application more efficiently.

Q: Can I log in to the MT5 application using my MT4 account?

o A: Generally, no. Since MT4 and MT5 operate on different backend systems, you will need to request a corresponding MT5 account from your broker.

Q: How can I prevent major errors when using MT5 automated trading (EAs)?

o A: It is recommended to first backtest and test your EA in a demo account before deploying it in a live environment. Additionally, regularly review order execution details. The MT5 application provides backend logs to help you monitor every trade execution accurately.

Q: Does MT5 require specific computer configurations?

o A: Generally, any standard Windows or macOS computer can run the MT5 application smoothly. However, if you use multiple technical indicators or engage in high-frequency trading, it is advisable to have a faster CPU and a stable internet connection.

Q: Where can I learn EA programming?

o A: In addition to the official MT5 manual and forums, you can refer to the Wikipedia page on MetaTrader 5 for more insights. The MQL5 community is also a valuable resource where developers share EA scripts and tutorials, making it easier to understand algorithmic trading on the MT5 application.

Trading Mindset & Risk Management

Even with a feature-rich trading platform like the MT5 application, proper risk management is essential. Trading inherently involves uncertainty, and the following key principles can help you better prepare when using MT5:

Diversify Your Investments

o The MT5 application allows you to track multiple asset classes simultaneously, including forex, stocks, and commodities. However, it is still advisable to diversify based on your capital size and risk tolerance.

Set Stop-Loss & Take-Profit Levels

o Define stop-loss and take-profit points before entering a trade to prevent emotions from affecting your decision-making.

Maintain Strategy Discipline

o Whether using automated trading strategies or manual entries and exits, maintaining discipline in executing your original plan helps reduce the impact of market fluctuations.

Review Trading Records Regularly

o The MT5 application provides detailed trade logs, allowing you to analyze your strategy’s strengths and weaknesses and identify areas for continuous improvement.

Conclusion

Both MT4 and MT5 applications are well-established and widely trusted trading platforms. The main difference lies in MT5’s broader asset class support, along with more flexibility in indicator development and automated trading strategies. If you primarily focus on forex trading and are already comfortable with MT4’s functionalities, there may be no urgent need to switch platforms. However, if you are looking to expand into multiple financial instruments, enhance analytical capabilities, or develop more sophisticated EA strategies, MT5 is definitely worth considering.

With its advanced MQL5 programming language and expanded functionality modules, MT5 allows for seamless multi-market integration within a single interface. Additionally, with its mobile version, WebTrader support, and various login options, traders gain the flexibility to monitor markets anytime, anywhere. Of course, before engaging in live trading, it is essential to fully understand the platform’s features and trading rules while establishing a robust risk management strategy.

In summary, the MT5 application plays a pivotal role in today’s investment landscape by offering one-stop market integration, a highly flexible automated trading framework, and user-friendly charting tools. Through Ultima Markets’ platform, traders can easily adapt to MT5 and seamlessly switch between different markets, gaining access to global trading opportunities.

For traders already experienced with MT4, upgrading to MT5 is not mandatory. However, if you plan to diversify into more trading instruments or delve deeper into EA strategy development, MT5 may offer greater scalability and efficiency. Ultimately, the choice of platform depends on your trading goals and habits. Before transitioning to live trading, it is recommended to test the platform extensively with a demo account, ensuring a firm grasp of platform operations and automated strategy stability.