Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

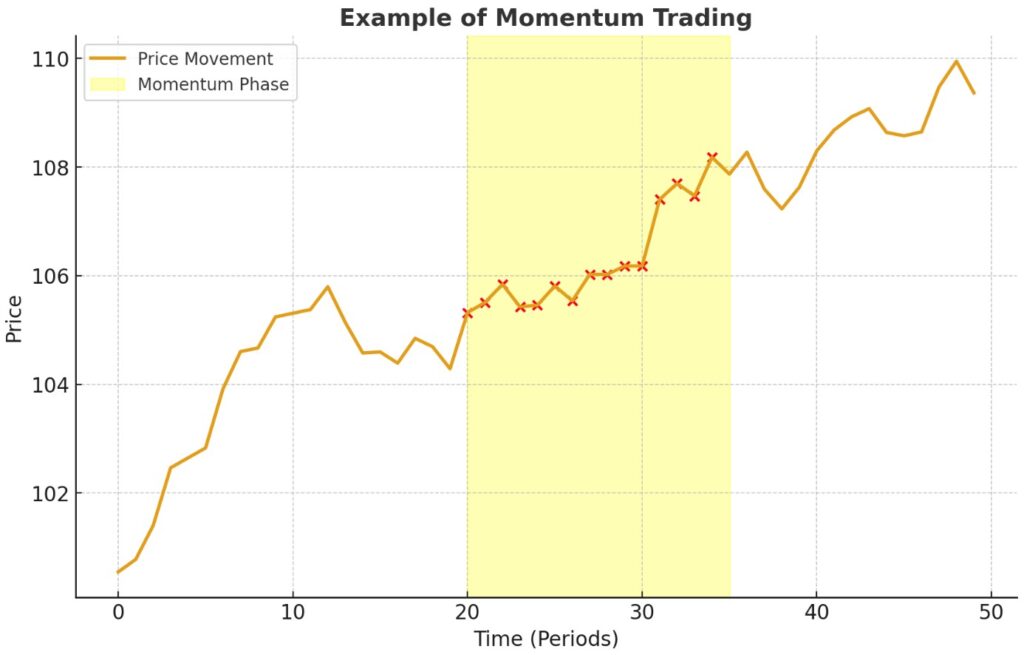

What Is Momentum Trading?

Momentum trading is a strategy where traders buy assets showing strong upward momentum and sell those with downward momentum. The principle is simple: assets that are moving strongly in one direction are more likely to continue that trend in the short term than suddenly reverse.

This approach is widely used in forex trading, equities, and commodities because it allows traders to capitalise on market psychology. When prices accelerate, many participants jump on the move, reinforcing momentum.

Example: If GBP/USD breaks through a multi-week resistance level on high volume, momentum traders may buy, anticipating that more traders will follow and push prices higher.

How Momentum Trading Works

Momentum trading works by combining price movement, volume, and market psychology.

- Identify strong price action: Traders look for assets making decisive moves (e.g., new highs/lows).

- Confirm with volume: Higher trading volume strengthens the case for sustainable momentum.

- Enter trades in direction of strength: Long trades in bullish momentum, short trades in bearish momentum.

- Exit when momentum slows: Traders watch for reversal signals like declining volume or divergence on indicators.

Momentum is not permanent. It typically peaks when buying/selling pressure becomes exhausted or when new information shifts sentiment.

How to Identify Momentum in the Markets

Spotting momentum is one of the most important skills for traders. Unlike simple trend-following, momentum trading is about recognising the speed and strength of a price move. Here are the main ways to identify it:

Price Action Signals

Price itself is the clearest momentum indicator.

- Strong Candles: Large-bodied bullish or bearish candles, especially after a consolidation, often signal the start of momentum.

- Breakouts: A price breaking above resistance or below support with conviction suggests traders are piling in.

- Gaps (in stocks/indices): Market gaps caused by news or earnings often reflect sudden momentum.

Example: If EUR/USD breaks above a six-month high with three consecutive bullish candles, that’s momentum confirmation.

Trading Volume

Momentum without volume is often a false signal.

- High Volume + Strong Move = Valid Momentum.

- Low Volume + Price Move = Risk of Reversal.

Volume shows how many traders are backing the move. In forex, look at tick volume from your broker (not perfect, but highly correlated with actual volume).

Momentum Indicators

Professional traders use technical indicators to quantify momentum.

Relative Strength Index (RSI):

- Above 70: overbought but also shows strong bullish momentum.

- Below 30: oversold but shows strong bearish momentum.

- RSI diverging from price = momentum is fading.

MACD (Moving Average Convergence Divergence):

- Bullish momentum: MACD line crosses above the signal line.

- Bearish momentum: MACD line crosses below.

- Increasing distance between MACD and signal line = strengthening momentum.

Rate of Change (ROC): Measures the percentage change in price over a given period. High ROC = stronger momentum.

Moving Averages as Confirmation

Although they lag, moving averages help filter false signals.

- Short-term MAs (10 or 20 periods) respond faster to price changes.

- Long-term MAs (50, 100, 200 periods) confirm broader trend direction.

- Golden Cross: When a short-term MA crosses above a long-term MA, momentum may shift bullish.

- Death Cross: Opposite for bearish momentum.

Always use MAs with other indicators because they don’t capture sudden shifts.

Market Context and Catalysts

Momentum is often triggered by external events.

- Economic Data: Non-Farm Payrolls (NFP), CPI, and interest rate decisions often create sharp moves.

- Earnings Reports: For stocks, a strong beat can spark sustained buying momentum.

- Geopolitical News: Surprises (sanctions, policy changes, elections) often accelerate momentum.

Momentum Trading Strategies You Can Apply

Breakout Trading

Entering trades when price breaks above resistance or below support with strong volume. Works best during high-volatility sessions such as London or New York forex hours.

Trend Following

Using moving averages and price channels to ride established trends. Example: Buying EUR/USD when the 20-day MA is above the 50-day MA with RSI still below 70.

News-Based Momentum

Economic announcements, earnings reports, or geopolitical events often create rapid momentum. Example: U.S. Non-Farm Payrolls (NFP) report can spark major USD moves.

Intraday Momentum

Day traders exploit short-lived moves during liquid hours. Requires strict stop-losses due to volatility.

Momentum trading is high-reward but high-risk. Markets can reverse quickly, especially after overextended rallies. Always set stop-losses and risk only a small percentage of capital per trade.

Momentum Trading vs Swing Trading

Both momentum and swing traders aim to capture shorter-term market opportunities, but their methods differ:

Momentum Trading

- Focus: Speed and volatility

- Holding period: Minutes to days

- Tools: RSI, MACD, volume, breakouts

- Suited for: Active traders who monitor markets closely

Swing Trading

- Focus: Capturing swings within an overall trend

- Holding period: Days to weeks

- Tools: Trendlines, moving averages, Fibonacci levels

- Suited for: Traders who prefer less screen time

Momentum trading demands faster reactions and discipline, while swing trading allows more flexibility but requires patience.

Best Practices for Momentum Traders

Momentum trading can deliver big opportunities, but without discipline it can also lead to heavy losses. Here are the key practices successful traders follow:

Set Strict Entry and Exit Rules

Momentum trades move quickly, which means hesitation or chasing late entries often leads to losses.

- Define entry triggers: e.g., a breakout above resistance confirmed by volume and RSI.

- Plan exits in advance: Set both profit targets and stop-loss levels before entering.

- Stick to your plan: Emotional trading is the fastest way to get caught in false breakouts.

Example: Enter EUR/USD on a breakout at 1.2000 with a stop-loss at 1.1970 and a target of 1.2060. If the move stalls, exit, don’t hope.

Prioritise Risk Management

Momentum trading is high-risk because reversals can be sharp.

- Always use stop-loss orders. Never leave a momentum trade unprotected.

- Risk small per trade: Many professionals risk only 1–2% of their capital.

- Position sizing matters: A smaller position with clear stops is safer than an oversized bet on a “sure thing.”

Rule of thumb: Protecting your capital is more important than chasing profits.

Focus on Liquid Markets

Momentum thrives in markets with high liquidity, where price moves are backed by volume.

- In forex trading, pairs like EUR/USD, GBP/USD, and USD/JPY usually provide cleaner momentum signals.

- In equities, large-cap stocks often deliver stronger, more sustainable moves than thinly traded small caps.

Thin markets = higher slippage + fake breakouts. Stick to where institutions are active.

Avoid Overtrading

Not every spike is true momentum. Overtrading leads to unnecessary losses and emotional fatigue.

- Filter signals: Wait for at least two confirmations (e.g., MACD crossover + strong volume).

- Quality over quantity: One high-probability setup can be more profitable than ten weak trades.

- Take breaks: Constant screen time increases the temptation to “force trades.”

Patience often separates consistent traders from impulsive ones.

Keep Learning and Adapting

Markets evolve, and momentum conditions shift over time.

- Backtest your strategy: Use historical data to see if your rules hold up in different conditions.

- Review trades weekly: Analyse both winners and losers.

- Stay updated: Economic releases, earnings calendars, and global news can change momentum dynamics.

Experienced traders know that consistency comes from continuous learning, not a single “holy grail” strategy.

Conclusion

Momentum trading remains one of the most popular strategies for both retail and institutional traders. When combined with strict risk management and sound analysis, it offers opportunities to profit from short-term market moves.

At Ultima Markets, we equip traders with advanced charting tools, education through UM Academy, and access to liquid forex trading markets so you can apply strategies like momentum trading more effectively.

FAQs

Momentum trading can be challenging for beginners due to its fast-paced nature and reliance on market timing. Beginners should thoroughly understand technical analysis and risk management before attempting momentum trading.

Momentum trading and scalping are similar in that both involve quick trades, but momentum trading focuses on riding large price moves, while scalping involves making many small trades for tiny profits.

Momentum trading can be risky because it relies on rapid price movements, which can be unpredictable. Traders may face significant losses if the momentum shifts suddenly or the market conditions change unexpectedly.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.