Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteLululemon Stock Forecast: Buy or Not?

Lululemon (NASDAQ: LULU) has seen a sharp 50% drop in its stock value in 2025, a sharp contrast to its impressive performance in previous years. This decline is driven by factors such as slowing growth in North America, increased competition, and broader macroeconomic pressures. With so much uncertainty, what does the Lululemon stock forecast indicate for investors?

Let’s dive into Lululemon’s financial outlook and assess its future prospects.

Lululemon at a Glance

Founded in 1998 and headquartered in Vancouver, Lululemon is a global leader in athletic apparel, footwear, and accessories. It operates across three segments: Company-Operated Stores, Direct to Consumer, and Other, solidifying its position as a premium athleisure brand. By 2022, Lululemon operated 574 stores globally, reflecting a robust presence in North America and abroad.

Despite recent challenges, Lululemon remains a strong player, and its financial performance continues to be a key indicator of its growth potential.

What’s Behind the Decline?

After a decade of impressive growth, 2025 has proven challenging for Lululemon, with North American revenue growth slowing to just 4% YoY in constant currency. This is a sharp contrast to its previous double-digit growth. The slowdown has been compounded by increasing competition within the athleisure category, particularly from Nike, Adidas, and newer entrants like Alo Yoga and Vuori.

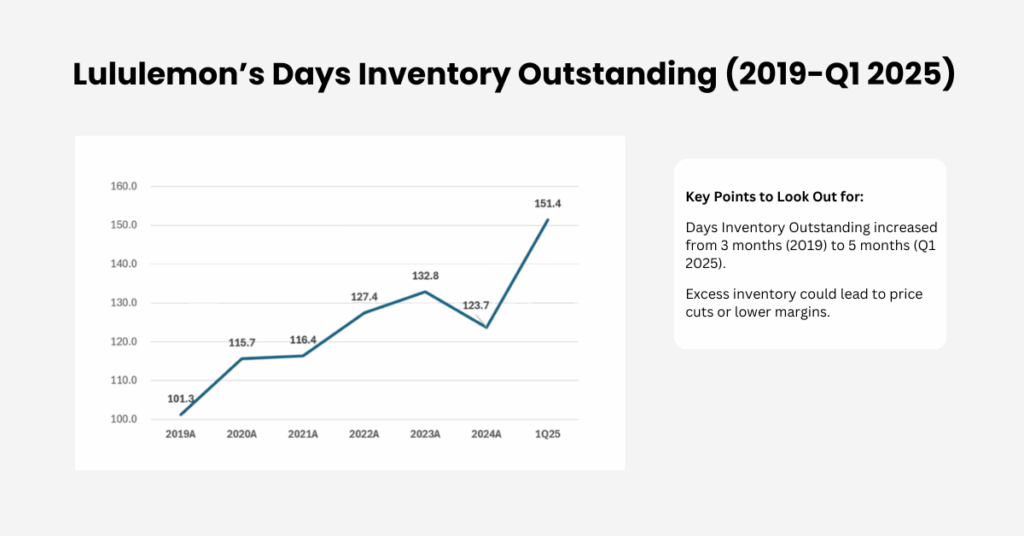

Moreover, inventory concerns have emerged, with the company sitting on $1.7 billion of unsold gear, a 23% increase compared to the previous year. This surplus could lead to price cuts if consumer demand slows, further putting pressure on profit margins. Lululemon’s increased inventory could become a drag on growth if it doesn’t sell quickly.

Despite these struggles, the company remains one of the best performers in the sector, but it will need to innovate and diversify its product offerings to maintain its competitive edge.

How Does the Lululemon Stock Forecast Stack Up?

Lululemon Athletica operates in the highly competitive Consumer Non-Durables sector, specifically within the Apparel/Footwear group. The competition in the athletic apparel market is fierce, with established brands like Nike and Adidas pushing hard to capture market share, especially in the women’s segment that Lululemon dominates. Despite this, the lululemon stock forecast remains optimistic due to the company’s elite profit margins and fiercely loyal customer base.

Rising Demand and Its Impact on Stock Price

The fundamental principle of supply and demand plays a crucial role in determining stock prices. When demand for a company’s products increases, leading to higher sales, this often results in improved earnings per share (EPS). Investors, recognising the company’s growth potential, may bid up the stock price, anticipating future profitability.

International Expansion: A Bright Spot for Lululemon

While North American growth is sluggish, Lululemon is seeing impressive growth in its international markets, particularly in China and Europe. China’s sales surged 21% in the most recent quarter, and the company is expanding its presence across the East Asian market, the world’s largest spender on luxury goods.

Lululemon plans to open 40 to 45 new stores globally in 2025, with a significant focus on international locations like China and Europe. This international expansion provides Lululemon with a substantial runway for future growth, despite challenges in North America.

Valuation: Trading at a Discount

Currently, Lululemon is trading at a price-to-earnings (P/E) ratio of under 13, its lowest in a decade. This suggests the stock may be undervalued, especially when considering the company’s long-term growth potential.

Analysts have set a price target of $261.75, implying a potential upside of 32.42% from its current price of $197.66. The latest analyst earnings estimate for the upcoming fiscal year further supports this valuation, as projections for Lululemon’s fiscal year 2025 earnings indicate potential for continued growth.

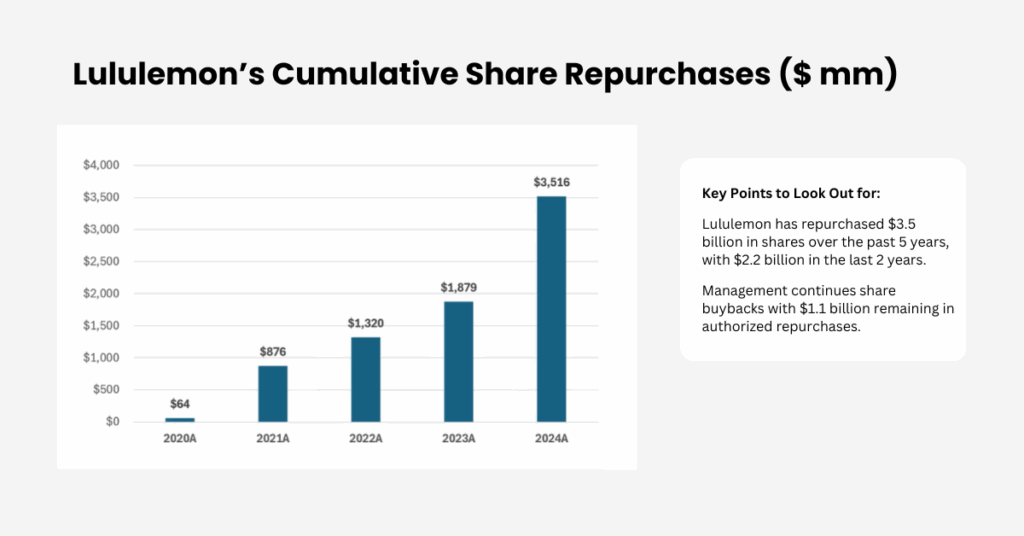

In addition to its discounted valuation, Lululemon has been aggressively repurchasing its stock, buying back $1.77 billion worth of shares over the past year, a move that is expected to significantly boost earnings per share (EPS).

As EPS grows, often driven by increased sales and demand, the stock price tends to rise as well. Investors view higher EPS as an indicator of a company’s profitability and growth prospects, leading to increased demand for the stock. This relationship underscores the importance of sales growth in driving stock price appreciation.

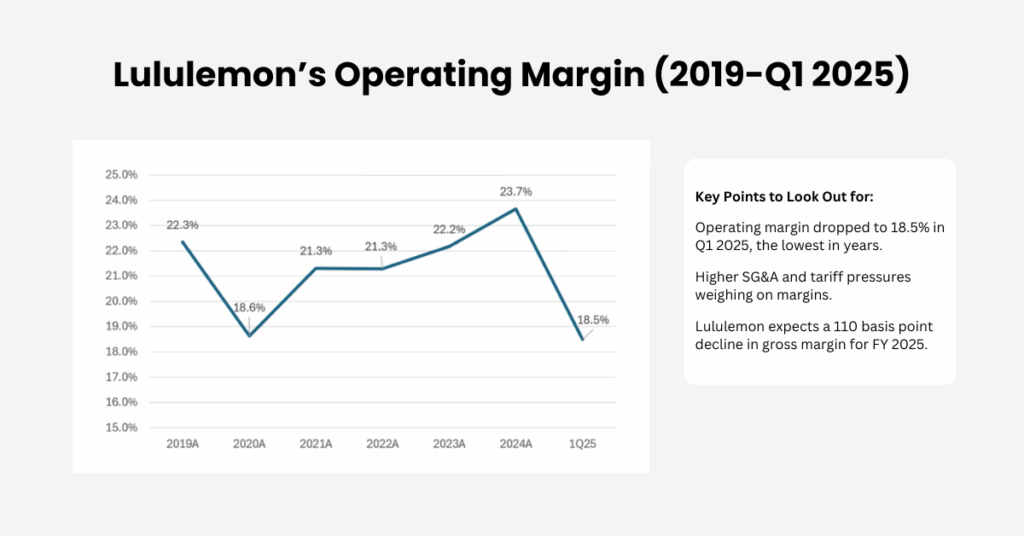

Despite operating margins dropping to 18.5% due to rising costs such as tariffs and SG&A expenses, the stock still presents significant upside potential.

Analyst Sentiment on the Lululemon Stock Forecast

Despite its challenges, analysts remain largely bullish on Lululemon’s future. The consensus rating is “Buy”, with 35% recommending a strong buy. Some analysts have concerns about short-term growth due to increased competition and inventory risks, but the stock is still viewed as having significant upside potential.

While several Wall Street analysts have lowered their price targets, citing margin compression and slower traffic growth in North America, the lululemon stock forecast still holds a moderately bullish outlook. Analysts are optimistic about its international expansion, particularly in China and Europe.

However, the stock’s potential to hit $500 in 2025 is subject to multiple factors. To reach this level, Lululemon’s P/E ratio would need to expand, a scenario that’s possible given the stock’s current low valuation and improving macroeconomic conditions, such as lower interest rates.

Investment Opportunities and Risks

For investors considering Lululemon Athletica Inc., the current market environment presents both compelling opportunities and notable risks. On the opportunity side, Lululemon’s strong brand reputation, global growth potential, and conservative financial management provide a solid foundation for future gains. The company’s stock, trading near a five-year low, offers an attractive entry point, especially with a price target of $261.75 suggesting significant upside from current levels.

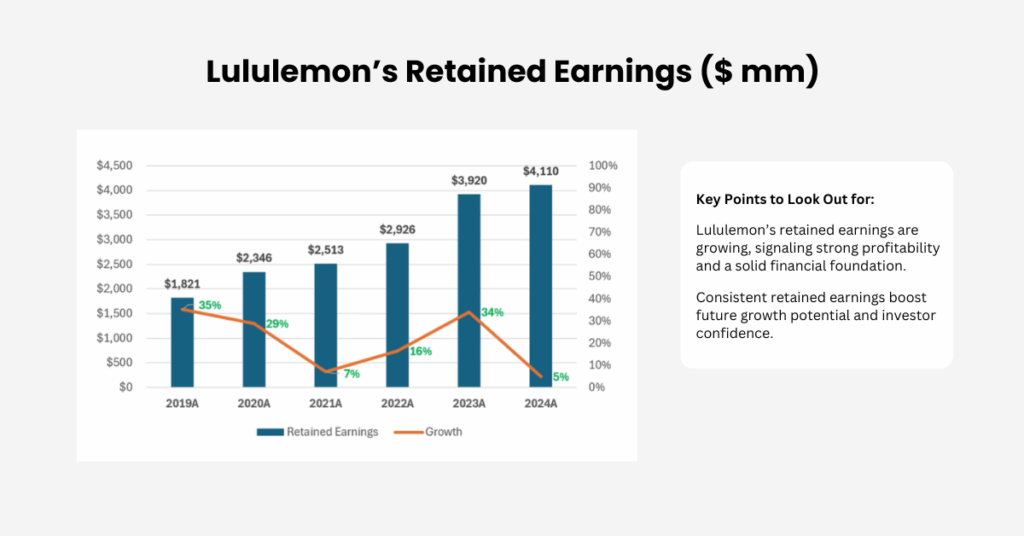

Lululemon’s growing retained earnings highlight the company’s ability to generate profits and reinvest them, strengthening its long-term growth prospects.

However, it’s important to recognise the risks. Lululemon faces intense competition in the athleisure market, which could lead to margin compression and impact its market position. As mentioned previously, the company’s inventory surplus and higher tariffs could affect its margins and ability to remain competitive. Despite these challenges, the prevailing market sentiment appears overly pessimistic, potentially making LULU stock a buy for those willing to look beyond short-term volatility.

Investors should carefully consider the company’s financial performance, analyst ratings, and historical averages, as well as broader market trends, before making any investment decisions. As always, balancing the potential for growth with the inherent risks is key to making informed decisions in today’s dynamic market.

Conclusion: Is Lululemon Stock a Buy?

At its current price, Lululemon represents an interesting opportunity for value investors. Despite short-term growth concerns, the stock is trading at a discount and offers considerable upside potential, especially as it continues to expand in global markets. The company’s strong financial position, combined with aggressive buybacks and market share gains in international markets, makes it a compelling option for those looking to invest in a growth stock at an attractive price.

For those willing to take on some risk, this could be a once-in-a-lifetime opportunity to buy into a market leader at a historically low valuation. However, investors should keep an eye on future earnings reports and macroeconomic trends to assess whether this opportunity will materialise into long-term gains.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.