Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

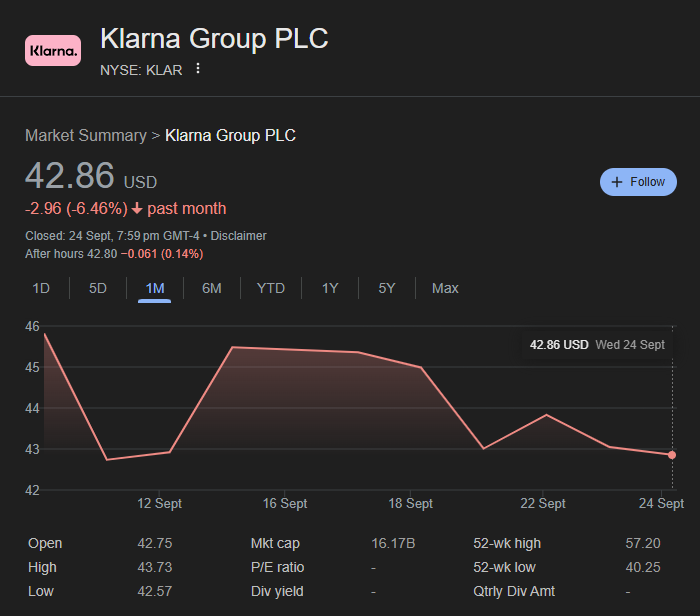

I confirm my intention to proceed and enter this websiteThe long-awaited Klarna IPO date has finally arrived, marking one of the most closely watched fintech listings in recent years. Investors have been eager to see how the Swedish “Buy Now, Pay Later” giant would perform once it hit the U.S. markets, and the results have not disappointed. Here’s a complete breakdown of the IPO timeline, share price, market reaction, and what to watch next.

When is Klarna IPO Date

Klarna officially entered the public markets on September 10, 2025, trading on the New York Stock Exchange under the ticker symbol KLAR. The company priced its offering the day before, on September 9, at $40 per share. That pricing was above the earlier guidance range of $35 to $37, reflecting strong investor demand. The IPO raised approximately $1.37 billion from the sale of around 34.3 million shares, valuing Klarna at about $15 billion at the issue price.

The debut made Klarna the largest U.S. IPO of 2025 at the time, a significant milestone for both the company and the broader fintech sector

Klarna Stock Share Price Performance

Klarna shares started trading at $52 on their opening day, surging more than 30% above the IPO price. At one point during the session, the stock touched an intraday high of nearly $57, before closing at $45.82, a solid 15% gain compared with the offering price.

The strong debut translated into a market valuation of roughly $19.65 billion, signaling that investors see growth potential in Klarna despite rising competition in the BNPL space.

For investors tracking the stock now, the most accurate way to check the Klarna stock share price is to follow the real-time ticker KLAR on platforms.

Klarna Valuation: From Pricing to First-Day Pop

- IPO pricing valuation: ~$15.1B at $40/share

- Debut valuation after opening jump: ~$19.65B

Why the jump? Investor demand for profitable/near-profitable fintechs + improving IPO risk appetite in late 2025. Coverage across major outlets aligns on the pricing, volume and first-day close.

Klarna’s Business and Profitability

Founded in Stockholm, Klarna built its reputation on flexible “Buy Now, Pay Later” solutions. Over the past few years, it expanded into debit cards, consumer banking, and merchant services, making it a broader financial technology company.

One key difference between Klarna and many earlier BNPL firms is its recent swing to profitability. In its SEC filing ahead of the IPO, Klarna reported a net profit of around $21 million for 2024, compared with a net loss in 2023. This turnaround played a major role in boosting investor confidence ahead of the listing.

Klarna Stock Price Prediction

Most analyst commentary after the IPO highlights Klarna’s swing to profitability in 2024, which sets it apart from some BNPL peers. This gives the company a stronger base, but the stock’s future direction will depend on quarterly results, credit performance, and Klarna’s ability to compete globally.

While early trading has been positive, the future of Klarna’s share price depends on several critical factors:

- Credit performance: Klarna must keep defaults and credit losses under control as BNPL loans expand.

- Revenue growth: Merchant fees remain its core income stream, but new products like banking services and advertising could diversify growth.

- Macroeconomic conditions: Higher interest rates and consumer debt stress can weigh on demand for BNPL products.

- Competition and regulation: Klarna faces pressure from PayPal, Affirm, and even traditional credit card companies, along with potential regulatory scrutiny.

Most analysts agree that Klarna’s medium-term outlook hinges on execution. If it sustains profitability and expands internationally, the stock could trade higher in the coming quarters. But investors should be cautious: BNPL is still a young and volatile sector.

How to Buy Klarna Stock

Klarna shares trade as ordinary stock on the NYSE. This means investors can buy shares of KLAR through any broker that provides access to U.S. markets. For those outside the U.S., international brokers with U.S. equity access can facilitate purchases, though additional costs like currency conversion and local tax rules may apply.

Conclusion

The confirmed Klarna IPO date of September 10, 2025 marked a major milestone for both the company and the fintech sector. With a strong debut and renewed investor confidence, Klarna now faces the challenge of sustaining growth, managing credit risk, and competing in an increasingly regulated global landscape.

For traders, Klarna’s listing highlights the opportunities and risks that come with investing in high-growth fintech companies. Instead of relying on hype or speculation, the smart move is to follow company earnings, regulatory updates, and sector trends closely.

At Ultima Markets, we help traders navigate these developments with real-time market insights, education, and access to global financial instruments. Whether it’s a high-profile IPO like Klarna or broader macroeconomic shifts, we believe informed trading leads to smarter decisions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.