Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Is TSLY ETF a Good Investment?

Yes, TSLY ETF is a good investment but only for a very specific type of investor. TSLY delivers high monthly distributions but comes with high risk, capped upside, and potential NAV erosion. It is not a core holding for most portfolios. Instead, it may suit experienced investors who understand option-based ETFs, want short-term income, and can tolerate volatility tied to Tesla’s stock.

For long-term growth or diversified income strategies, alternatives like broad covered-call ETFs (JEPI, QYLD) or Tesla stock itself may be more suitable.

What Is TSLY ETF?

TSLY ETF is the YieldMax TSLA Option Income Strategy ETF, launched in November 2022. It is an actively managed single-stock ETF that seeks to generate monthly income by selling call options on Tesla (TSLA) while holding U.S. Treasuries as collateral. Unlike buying Tesla shares directly, TSLY uses a synthetic covered-call strategy:

- It does not own Tesla stock.

- It sells options on Tesla to collect premiums.

- It offers high distributions but with capped upside and full downside risk.

- Expense ratio is about 1.0%, and payouts are made monthly.

TSLY ETF gives investors Tesla-linked income through options but carries high risk, concentration, and limited growth potential.

Distribution Policy

- Payout frequency: Monthly.

- Most recent ex-date: September 4, 2025 (paid September 5).

- 30-day SEC yield: 2.78% (as of August 31, 2025).

- Headline distribution rate: Much higher (sometimes quoted above 90% annualized), but this is not the same as sustainable yield or total return.

- Tax character: Distributions may include ordinary income, capital gains, and return of capital (ROC). ROC can reduce net asset value (NAV) over time.

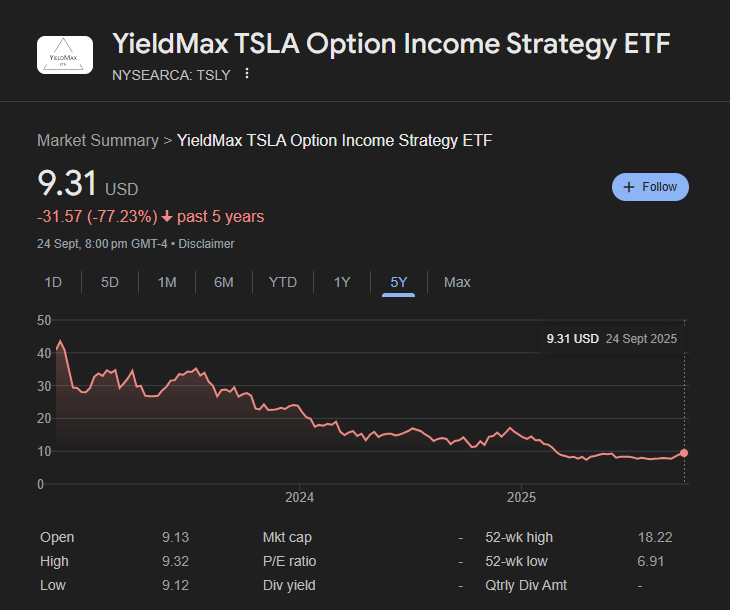

TSLY ETF Performance (2022–2025)

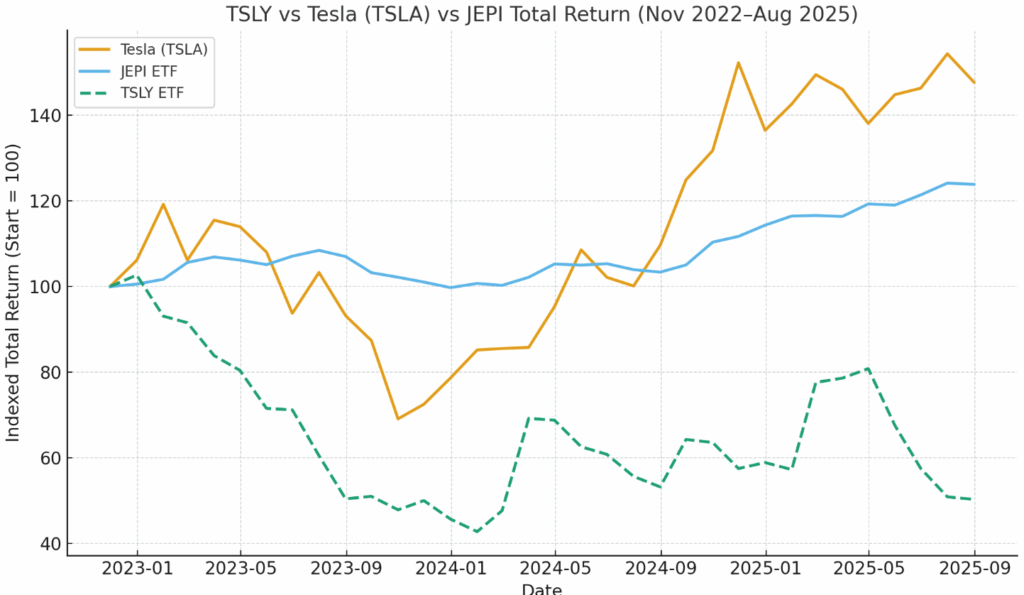

TSLY’s performance shows a stark gap between headline distribution rates and actual investor returns. While the ETF may look like a high-yield machine, since inception it has lost value overall. Investors should view it as a tactical, high-risk income play, not a long-term wealth builder.

Since Inception

- Launch date: November 22, 2022

- Since inception total return: approximately –29.9% (as of August 31, 2025, Schwab report).

- This means that despite eye-catching distributions, investors who held from the start are sitting on a loss in overall value.

2023 Performance

- Tesla stock was highly volatile in 2023, surging at times then retreating.

- TSLY underperformed Tesla in rallies because the sold calls capped upside.

- During declines, distributions softened the blow but couldn’t prevent NAV erosion.

2024 Performance

- February 26, 2024: TSLY underwent a 1-for-2 reverse split to manage a falling share price.

- Throughout 2024, Tesla remained choppy. TSLY produced high payouts, but NAV continued trending lower due to capped upside and recurring drawdowns.

- Total return remained negative for the calendar year, even with distributions.

2025 YTD (up to August 31, 2025)

- Tesla has had mixed performance in 2025 amid shifting EV demand, competition, and macro pressures.

- TSLY continued paying large monthly distributions, but its YTD total return is negative, reflecting the structural challenge of its strategy.

- 30-day SEC yield is only 2.78% (as of Aug 31, 2025), showing the disconnect between marketed yield and what’s actually earned.

Why Performance Lags Tesla

- Capped upside when Tesla rallies, TSLY can’t fully participate.

- Full downside exposure when Tesla drops, the ETF still absorbs losses.

- Option premium volatility distributions depend on implied volatility, which fluctuates with Tesla’s options market.

- NAV erosion frequent use of return of capital (ROC) means the fund can appear to pay high “income” while reducing shareholder equity.

This chart compares the total return of TSLY ETF, Tesla stock (TSLA), and JEPI from November 2022 to August 2025. While Tesla shows strong but volatile growth and JEPI delivers steady gains, TSLY underperforms due to capped upside and NAV erosion despite its high monthly distributions.

Pros and Cons of TSLY ETF

Investors often weigh the appeal of TSLY’s high monthly payouts against the risks of its options-based, single-stock strategy. Like any ETF, it comes with both advantages and disadvantages, but TSLY’s trade-offs are sharper than most because its returns are tied directly to Tesla’s stock movements and option market conditions. Understanding these pros and cons is essential before deciding whether TSLY fits your portfolio.

Advantages

- High monthly income potential: Attractive for income seekers.

- Leverages Tesla volatility: Option premiums rise when implied volatility is high.

- Alternative Tesla exposure: Different payoff profile than simply holding TSLA shares.

- Liquidity: Actively traded with strong retail interest.

Drawbacks

- Capped upside: Misses out when Tesla surges.

- Full downside exposure: NAV falls when Tesla declines.

- Return of capital risk: Some distributions may not be sustainable.

- High concentration: Single-stock ETF tied to Tesla, unlike diversified income ETFs.

- High costs: Expense ratio (~1%) is above market-average for ETFs.

- Complex tax treatment: Option income and ROC require careful accounting.

Who Should Consider TSLY?

TSLY ETF is best for income-focused, risk-tolerant investors who understand covered-call strategies, while it is unsuitable for conservative or long-term growth investors seeking full Tesla upside or broad diversification.

TSLY ETF may be suitable for investors who:

- Want high monthly income from option premiums.

- Can tolerate high risk and volatility tied to Tesla’s stock.

- Understand covered-call strategies and how capped upside works.

- Already have a diversified portfolio and view TSLY as a tactical income play, not a core holding.

TSLY is not ideal for:

- Conservative, long-term investors seeking steady growth.

- Investors who want full exposure to Tesla’s upside.

- Those looking for diversified income ETFs with lower risk.

Conclusion

The TSLY ETF offers a unique way to generate high monthly income from Tesla’s volatility, but it comes with clear trade-offs: capped upside, full downside risk, and the potential for NAV erosion over time. For the right investor, someone who prioritises short-term cash flow, understands options strategies, and accepts higher risk. TSLY can play a role as a tactical income tool. For most long-term investors, however, alternatives like Tesla stock, diversified covered-call ETFs, or dividend-focused funds may be more suitable.

At Ultima Markets, we believe every investor should approach strategies like TSLY with caution, context, and a clear understanding of both risk and reward. That’s why our platform provides access to trusted market insights, educational resources, and tools to help you make informed trading decisions. Whether you’re exploring ETFs, stocks, or broader opportunities, our goal is to help you trade with confidence and with purpose.

FAQs

The YieldMax TSLA Option Income Strategy ETF (TSLY) generates income primarily through a covered call options strategy on Tesla’s stock (TSLA)

Yes, TSLY does pay a monthly dividend, but it is subject to the performance of Tesla stock and the fund’s distribution policy. The dividend amount can vary based on the underlying holdings and capital gains.

Whether TSLY is a buy, sell, or hold depends on your investment strategy and outlook for Tesla’s stock. Due to its leveraged nature, it is more suitable for short-term traders rather than long-term investors. If you are bullish on Tesla’s stock, it could be a buy in the short term, but if you believe Tesla’s growth will slow, it might be a sell or hold for risk-averse investors.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.