Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomIs the Euro Stronger Than the Dollar?

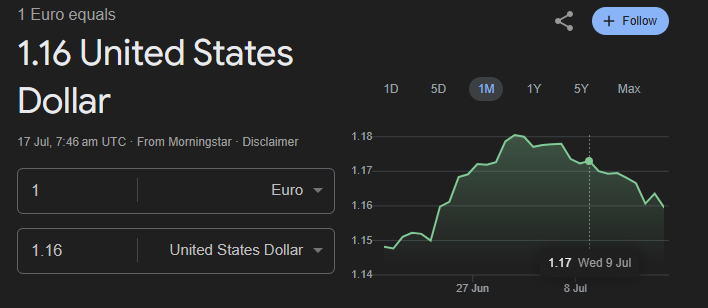

Yes, the Euro is currently stronger than the Dollar in nominal terms, with 1 Euro equaling approximately 1.16 U.S. Dollars as of July 2025. However, in real economic strength based on global demand, reserve status, and purchasing power, the U.S. Dollar remains more dominant.

Euro vs. Dollar: What Does “Stronger” Really Mean?

In forex, a currency’s strength is often measured by its purchasing power, demand in global trade, central bank policy, and investor sentiment. While the euro-dollar exchange rate might show 1 EUR = 1.16 USD, that does not necessarily mean the Euro is stronger in a broader economic sense.

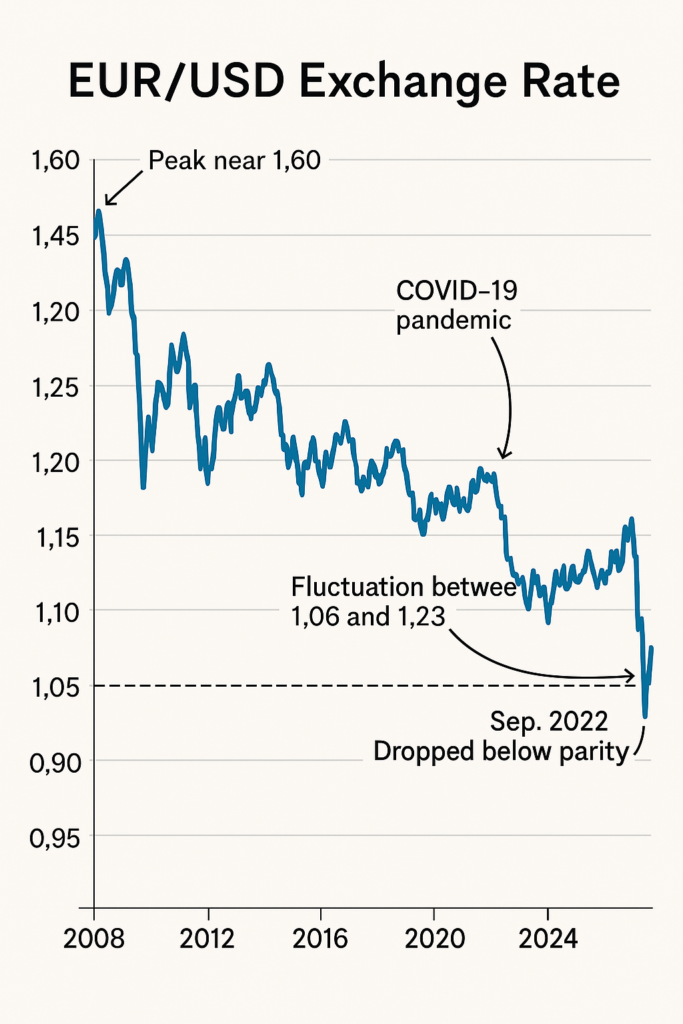

Historically, the EUR/USD pair has seen significant volatility. For instance:

- In 2008, EUR/USD peaked near 1.60.

- During the COVID-19 pandemic in 2020, it fluctuated between 1.06 and 1.23.

- In September 2022, EUR/USD dropped below parity, hitting 0.95 for the first time in 20 years due to aggressive Fed tightening.

Why Is the Euro Sometimes Stronger Than the Dollar?

The Euro is sometimes stronger than the Dollar in nominal terms due to interconnected macroeconomic factors that drive demand for the Euro relative to the U.S. Dollar:

Trade Surpluses in the Eurozone

Many Eurozone countries like Germany and the Netherlands consistently export more than they import. This creates a net demand for Euros because foreign buyers must convert their currencies into Euros to pay for European goods. The steady capital inflow into the Eurozone supports the value of the Euro on global forex markets.

ECB Policy Stance

When the European Central Bank (ECB) tightens monetary policy—such as by raising interest rates or tapering asset purchases, it attracts foreign investors seeking higher returns on Euro-denominated assets. This increases capital inflows into the Eurozone, boosting demand for the Euro and strengthening its exchange rate relative to the Dollar.

Weakness in the U.S. Dollar

At times when the U.S. Federal Reserve maintains low interest rates, or when the U.S. runs high fiscal deficits, the Dollar may weaken. Additionally, during periods of global “risk-on” sentiment when investors shift capital into higher-yield or emerging market assets, the demand for the USD declines. This relative weakness in the Dollar automatically increases the EUR/USD rate, making the Euro appear stronger.

Periods of Dollar weakness due to low interest rates, high U.S. deficits, or risk-on sentiment (where investors prefer emerging market assets) can cause the Euro to appear stronger.

When Is the Dollar Stronger Than the Euro?

In many instances, the Dollar gains strength against the Euro due to global market dynamics:

Safe-Haven Flows

The Dollar is the world’s primary reserve currency. In times of crisis such as the 2008 financial crash or the 2022 energy crisis, investors flock to the USD.

Federal Reserve Rate Hikes

Aggressive rate hikes by the U.S. Federal Reserve typically boost Dollar yields, attracting capital inflows and strengthening the currency. For example, the Fed’s 2022–2023 tightening cycle drove EUR/USD below parity.

Eurozone Economic Challenges

Slower GDP growth, political fragmentation, and energy dependence (particularly on Russia) can weigh on the Euro’s strength.

Current Euro-Dollar Exchange Rate (2025 Update)

As of July 2025, the EUR/USD exchange rate hovers around 1.16, with the Euro maintaining a clear nominal lead. However, this reflects short-term factors including ECB policy adjustments and cooling U.S. inflation.

Traders are closely watching:

- ECB’s next move amid sluggish growth

- Fed’s signal on holding rates steady

- Eurozone inflation falling below 2.5%

- U.S. labor market resilience

Is the Euro Stronger Than the Dollar in Real Terms?

While the Euro may trade at a higher nominal value, real strength includes:

- Inflation-adjusted returns

- Global demand for assets

- Reserve currency status

By these measures, the U.S. Dollar still maintains structural advantages. According to IMF data (2024), over 58% of global FX reserves are held in USD, compared to 21% in Euros.

Euro vs. Dollar: Long-Term Outlook

Looking ahead, analysts expect the EUR/USD to remain rangebound between 1.10–1.20, barring any major macroeconomic shocks. The following factors will be crucial in determining the long-term direction:

- Divergence in monetary policy: If the ECB continues tightening while the Fed holds rates steady or begins cutting, the Euro could gain strength. Conversely, a more aggressive Fed could reverse that.

- Fiscal stability in EU member states: Markets closely monitor debt levels and fiscal discipline in countries like Italy and France. Any instability could pressure the Euro.

- U.S. debt sustainability: Rising U.S. deficits and political gridlock over debt ceilings may erode confidence in the Dollar over time, potentially favoring the Euro in the long run.

Conclusion

So, is the Euro stronger than the Dollar? On paper, yes 1 Euro currently buys about 1.16 Dollars. But from a trader’s perspective, strength is relative and contextual. The Dollar’s role as the global reserve currency, combined with the Fed’s influence and U.S. economic scale, keeps it dominant in the financial system.

That said, the Euro remains a formidable counterpart, particularly when backed by ECB tightening and Eurozone trade strength.

Looking to trade EUR/USD with low spreads and institutional-grade execution? Ultima Markets offers a safe trading environment with advanced tools for forex traders.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.