Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Is Stock Lending A Good Idea Or Not?

Yes, stock lending can be a good idea if you want to earn passive income from your investments, especially if you’re holding stocks long-term and don’t need immediate access to them. It allows you to earn fees by lending your shares to short-sellers or institutional investors.

However, it’s important to weigh the benefits against the risks, such as losing dividends and counterparty risks. If you’re comfortable with the potential downsides and using a reputable broker, stock lending can be a profitable strategy for generating extra income.

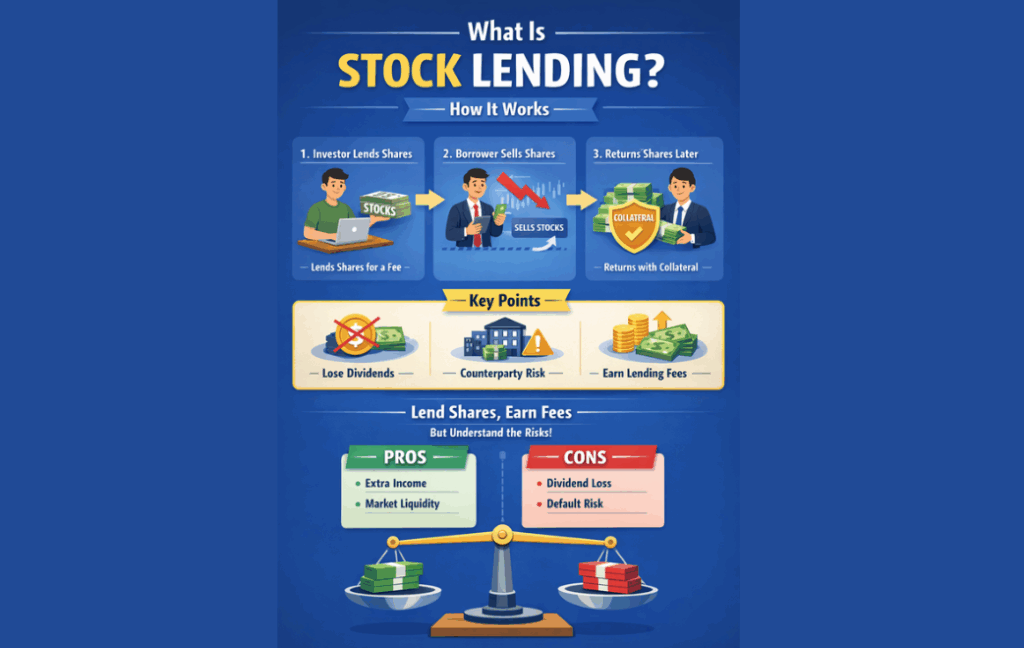

What Is Stock Lending?

Stock lending is the practice where investors lend their shares to other market participants, typically short-sellers, in exchange for a fee. The borrower sells the borrowed stocks in the market and is required to return the shares at a later date, often with collateral as a form of protection for the lender.

This process helps increase market liquidity and enables short-selling, but it also comes with potential risks, such as losing dividends and the risk of the borrower defaulting.

This process plays a critical role in the broader market ecosystem by providing liquidity to the market, especially for short-selling activities. However, understanding the benefits and risks associated with stock lending is crucial before you participate.

Advantages and Risks of Stock Lending

Advantages of Stock Lending

Stock lending offers several benefits for investors looking to generate passive income from their portfolios. By lending out their shares, investors can earn fees and make use of idle assets without selling their holdings. This can be particularly valuable for long-term investors.

However, while it provides opportunities to increase returns, it’s important to understand the specific advantages that come with participating in stock lending:

Earning Extra Income

One of the most attractive aspects of stock lending is the potential to earn passive income. When you lend your stocks, you receive a lending fee, which can provide a steady source of income. Is stock lending a good idea in a low-interest-rate environment?

Absolutely. It can be a great way to earn returns when traditional savings accounts offer minimal interest. This can be particularly appealing in a low-interest-rate environment, where traditional savings accounts may offer minimal returns.

Maximising Idle Assets

For long-term investors, stock lending offers a way to generate returns on stocks that they plan to hold for a while. If you’re not actively trading your shares, lending them out can help you make use of otherwise idle assets without sacrificing ownership.

Supporting Market Liquidity

Stock lending supports market liquidity, which is essential for the smooth functioning of financial markets.

By lending your stocks, you’re facilitating the ability of short-sellers and institutional investors to execute trades, which in turn contributes to price discovery and market efficiency.

Risks of Stock Lending

While stock lending offers potential benefits, it also comes with certain risks that investors need to carefully consider before participating. The main concerns are related to the loss of control over the shares, possible financial implications from market movements, and the reliability of borrowers. Here are the key risks associated with stock lending:

Potential for Lost Dividends

While your stocks are lent out, you forfeit the right to any dividends paid during the loan period. Although you receive the lending fee, it may not always offset the value of the dividends you miss out on, particularly if the stock is a high-yield dividend payer.

Counterparty Risk

When lending your stocks, you are relying on the borrower to return the shares. While most brokerage firms ensure borrowers are highly rated and provide collateral, there is always a risk that the borrower may default. Is stock lending a good idea in this case? If you’re risk-averse, the counterparty risk might outweigh the potential benefits.

Lack of Control Over Your Shares

Once you lend your stocks, you no longer have control over them for the duration of the loan. This means you won’t be able to sell your stocks, which could be problematic if market conditions change and you want to liquidate your position quickly.

How Does Stock Lending Work?

Stock lending typically occurs through a brokerage platform. The process involves several steps:

- You offer your shares to the broker, who then matches them with a borrower.

- The borrower provides collateral, usually in the form of cash or securities, which serves as protection for the lender in case the borrower defaults.

- The lender receives a fee for the loaned shares, which is generally a percentage of the value of the stock loaned.

- The borrower returns the shares once the loan term ends, or when the lender requests them back.

Is Stock Lending Right for You?

Stock lending can be a good way to generate passive income from your investments, but it’s not without its risks. Here are some key factors to consider before getting involved:

- Investment Strategy: If you’re a long-term investor who holds stocks for capital appreciation, stock lending may be a good way to generate additional income. However, if you need regular access to your shares, it might not be the best option.

- Risk Tolerance: If you’re risk-averse, the counterparty and potential dividend loss risks may outweigh the benefits of stock lending.

- Market Conditions: Stock lending works best in a healthy and liquid market. During periods of market volatility, there might be higher risks involved.

Latest Trends in Stock Lending

As of early 2026, stock lending has seen a rise in popularity due to growing interest from institutional investors and hedge funds. The recent market fluctuations have made the lending market more dynamic, with fees for lending high-demand stocks reaching new heights.

According to recent data from the Securities Lending Market Report (2026), the average lending fee for popular stocks has increased by 20% compared to the previous year, driven by short-seller activity.

Additionally, regulatory changes in several markets have made the stock lending process more transparent, improving security and reducing risks for lenders. In some countries, including the U.S., financial regulators are now mandating more detailed disclosures for stock lending transactions to protect investors.

Should You Consider Stock Lending?

Stock lending can be a good idea for generating passive income, especially for long-term investors holding stocks that they don’t need immediate access to. However, it’s essential to weigh the benefits, such as earning extra income, against the risks, including the loss of dividends and counterparty risk.

If you’re comfortable with these risks and work with a reputable broker, stock lending can be a profitable strategy. Always ensure you fully understand the terms and conditions before getting involved to make the most out of your investment.

FAQs

Yes, stock lending can be a good idea for earning passive income by lending your shares to others. However, it comes with risks like losing dividends and potential borrower defaults. It’s suitable for long-term investors who don’t need immediate access to their stocks.

The main risks include losing dividends during the loan period, counterparty risk if the borrower defaults, and losing control over your shares for the duration of the loan.

You can earn a fee based on the value of the stock lent, typically ranging from 0.25% to 2% annually. Popular stocks or high-demand shares may generate higher fees.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.