Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteSilver has always carried a dual identity, a precious metal used as a safe-haven investment and an industrial material essential for technology. In 2025, this dual role makes silver a particularly interesting asset. The big question is whether silver is a good investment today and in the years ahead.

Is Silver A Good Investment Today and Future?

Yes, silver is considered a good investment today and for the future. It benefits from strong industrial demand in solar and electric vehicles, while also serving as a hedge during inflation and uncertainty. However, silver is more volatile than gold, so it suits investors who can tolerate price swings and take a long-term view.

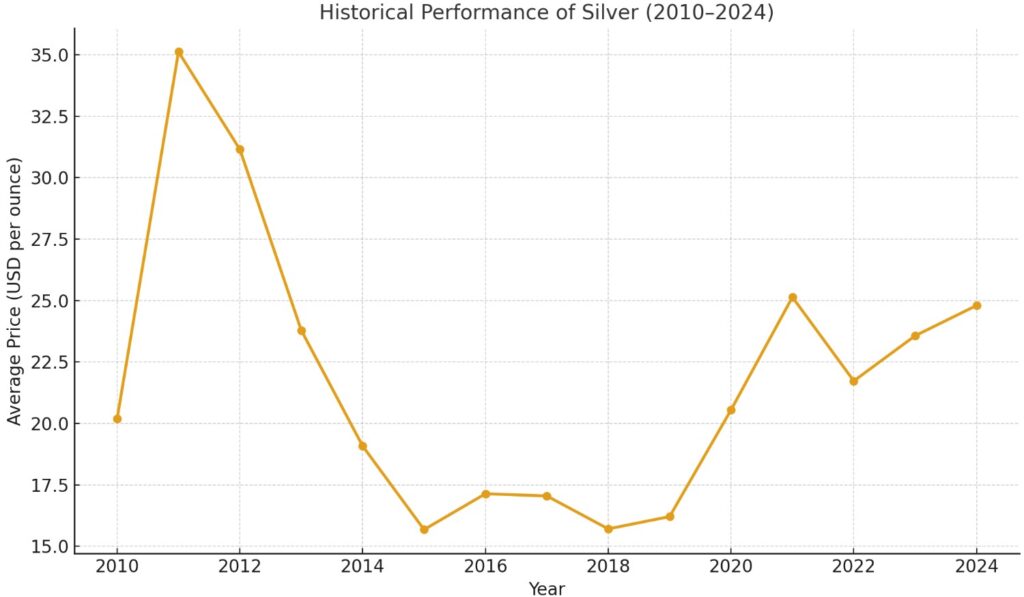

Historical Performance of Silver

Silver’s past shows both resilience and volatility. Prices peaked near US$48 per ounce in 2011, then again in 2020, when they climbed above US$28/oz at the height of the pandemic. These moments highlight silver’s tendency to surge in times of crisis, though they also remind investors of its sharp corrections compared to gold.

Current Market Conditions

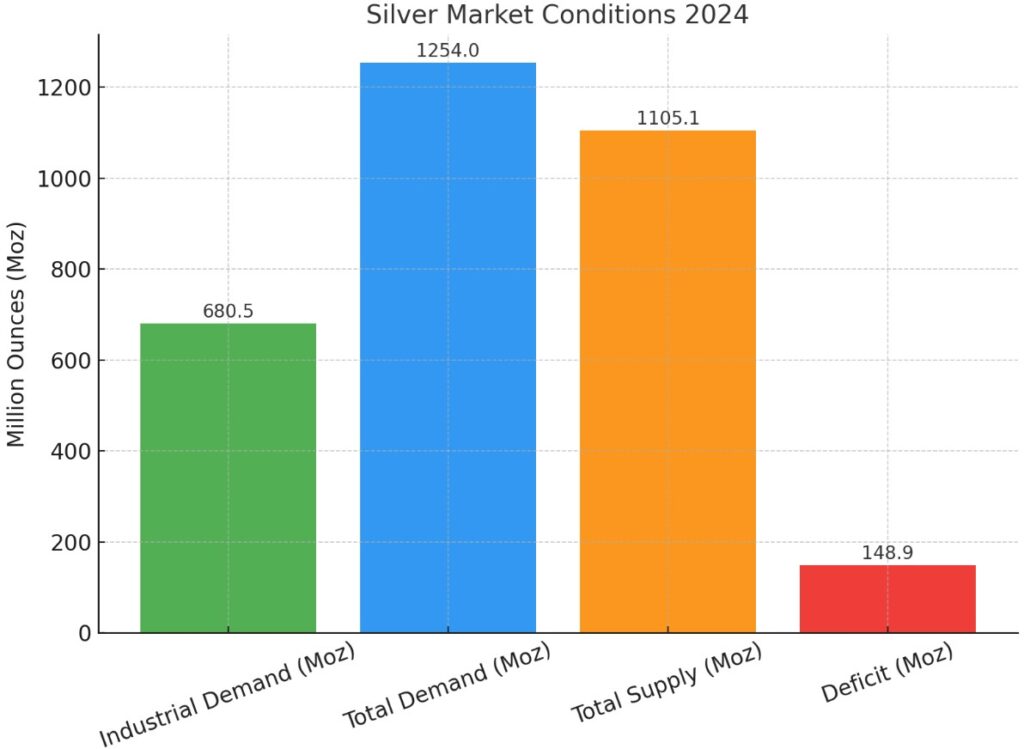

The silver market is tight. Industrial demand reached 680.5 million ounces in 2024, the highest on record, while supply shortages created a deficit of nearly 149 million ounces. At the same time, investor appetite has remained strong as inflation, rate uncertainty, and global volatility push traders toward hard assets.

Factors that Shape Silver Prices

Economic Growth

- Upward Pressure: Expanding economies boost industrial demand for silver in electronics, solar panels, and vehicles.

- Downward Pressure: Economic slowdowns reduce manufacturing output and industrial consumption, softening prices.

Monetary Policy and Inflation

- Upward Pressure: Low interest rates and rising inflation push investors toward silver as a store of value.

- Downward Pressure: Higher interest rates make bonds and cash more attractive, reducing silver demand.

Gold Correlation

- Upward Pressure: Silver often follows gold during safe-haven buying, benefiting from investor flows.

- Downward Pressure: If gold weakens, silver usually falls even harder due to its higher volatility.

Industrial and Green Technology Demand

- Upward Pressure: Growth in solar energy, electric vehicles, and 5G technologies increases silver consumption.

- Downward Pressure: Thrifting and substitution in solar panels or electronics reduce per-unit silver use.

Supply and Mining Output

- Upward Pressure: Mine disruptions, geopolitical tensions, or reduced output can create shortages.

- Downward Pressure: Strong production growth or new discoveries can expand supply and weigh on prices.

US Dollar Strength

- Upward Pressure: A weaker dollar makes silver cheaper for non-US buyers, lifting demand.

- Downward Pressure: A stronger dollar makes silver more expensive internationally, reducing demand.

Investor Sentiment and Speculation

- Upward Pressure: Safe-haven demand during crises or bullish sentiment in commodities markets can lift silver.

- Downward Pressure: Shifts toward equities, crypto, or risk assets can reduce silver’s investment appeal.

Silver vs Gold, Which is Better Investment?

Gold is typically the safer, more stable option for preserving wealth, while silver offers higher upside but also greater swings. Many investors hold both gold as the anchor and silver as the growth satellite in a diversified portfolio.

Gold

- Less volatile, more stable long-term store of value.

- Stronger track record as an inflation hedge and crisis safe haven.

- Generates steady demand from central banks and jewelry.

- Better suited for risk-averse, long-term investors.

Silver

- More affordable entry point than gold.

- Dual role: investment asset + heavy industrial demand (solar, EVs, electronics).

- More volatile, which can create both higher risks and higher returns.

- Attractive for investors looking for growth potential and exposure to the green economy.

Is Silver a Good Investment for the Future?

Yes, silver is considered a promising long-term investment because it combines safe-haven qualities with rising industrial demand. The clean energy transition is a major driver: solar panels require around 10 tons of silver per gigawatt of capacity, and electric vehicles use 25–50 grams each. These structural trends support stronger demand, even as technology gradually reduces silver use per unit.

At the same time, silver markets have faced four consecutive annual deficits, showing that supply is struggling to keep pace with consumption. For long-term investors, this imbalance could provide upward price pressure. However, silver is more volatile than gold, meaning future gains will likely come with short-term price swings.

Is Silver a Good Investment for the Long Term?

Silver can be a valuable long-term investment because it balances the traits of a precious metal with those of an industrial commodity. Over time, silver has shown an ability to preserve purchasing power while also benefiting from structural demand in renewable energy, electric vehicles, and electronics.

For long-term investors, silver provides three main advantages: diversification within a portfolio, partial protection against inflation, and exposure to green-technology growth. However, unlike gold, silver tends to be more volatile and less consistent as an inflation hedge. This means investors may need patience to ride out price swings.

Conclusion

So, is silver a good investment today and for the future? The answer is yes, but with balance. Silver offers growth potential from industrial demand in solar, EVs, and technology, while also acting as a partial hedge against inflation. At the same time, its volatility means it suits investors who are prepared for price swings and take a longer-term view.

At Ultima Markets, we provide traders with the tools, education, and secure trading environment needed to explore opportunities in silver and other commodities. Whether you are looking for short-term trades or long-term diversification, our platform helps you trade with purpose and stay ahead of market trends.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.