Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteIs Platinum A Good Investment?

Yes, platinum can be a good investment due to its rarity, strong industrial demand, and growing role in green technologies like hydrogen fuel cells. It offers diversification beyond gold and silver, but investors should consider its price volatility and reliance on South African supply.

Why Should I Invest in Platinum?

Platinum is more than just a precious metal; it plays a crucial role in key industries:

- Industrial Demand: Over 50% of platinum demand comes from the automotive sector, particularly for catalytic converters in diesel engines. It is also used in electronics, medical devices, and green hydrogen technology.

- Limited Supply: Around 70% of the world’s platinum supply comes from South Africa, making the metal vulnerable to supply shocks from labor strikes, electricity shortages, or political instability.

- Diversification: Platinum offers portfolio diversification, especially during periods of market volatility or U.S. dollar weakness.

These factors combined make platinum a strategic hedge against both inflation and geopolitical risks.

Will Platinum Rise in Value?

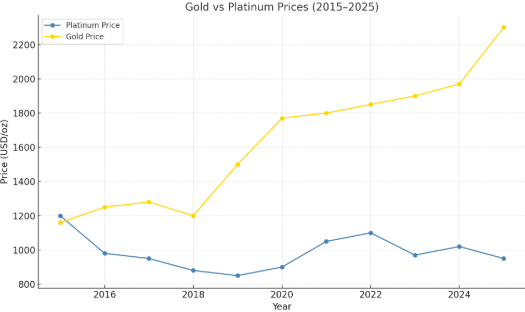

Based on the chart comparing gold and platinum prices from 2015 to 2025, platinum has significantly underperformed gold in recent years. Historically, platinum traded at a premium to gold, but since 2015, gold has consistently outperformed. In recent years, gold surged above $2,300/oz, while platinum hovered below $1,000/oz, highlighting a significant valuation gap. This divergence underscores platinum’s current undervaluation and potential upside if industrial demand accelerates or supply constraints persist.

Platinum prices have been historically volatile, influenced by macroeconomic conditions, industrial demand cycles, and mine supply. While past performance is not indicative of future results, several fundamentals suggest upside potential:

- Undervalued Compared to Gold: Historically, platinum traded at a premium to gold. As of 2025, gold trades significantly higher than platinum, which some analysts view as a long-term mispricing.

- EV and Green Energy Boom: Platinum is increasingly used in hydrogen fuel cell vehicles and electrolyzers, suggesting demand could rise as clean energy adoption grows.

- Supply Constraints: With limited new mining projects and potential disruptions in South Africa, supply could lag behind growing demand.

Platinum Coins as Investment

Investing in platinum coins is a popular way to gain exposure to the metal. Coins such as the American Platinum Eagle or Canadian Platinum Maple Leaf are government-issued, widely recognized, and easier to liquidate than bars.

Advantages:

- High liquidity

- Government-backed purity and authenticity

- Suitable for smaller investment amounts

Disadvantages:

- Higher premiums over spot price

- Vulnerable to physical storage risks

Platinum Bars as Investment

For larger investments, platinum bars offer lower premiums per ounce compared to coins. They are typically available in weights ranging from 1 oz to 1 kg and are favored by institutional investors and high-net-worth individuals.

Advantages:

- Lower cost per gram/ounce

- Easier to store in bulk

Disadvantages:

- Less liquid than coins

- Requires secure storage solutions

Is It Better to Invest in Gold or Platinum?

Gold is often seen as a safer long-term store of value, especially during financial crises. Platinum, on the other hand, may outperform during industrial booms and global recovery cycles.

Gold and platinum serve different investment roles:

| Criteria | Gold | Platinum |

| Role | Safe-haven asset | Industrial + precious metal |

| Price Volatility | Lower | Higher |

| Supply Source | Diversified | Concentrated in South Africa |

| Historical Price | Higher than platinum | Historically higher, now lower |

Why Is Platinum So Cheap to Buy?

Despite its rarity, platinum is currently cheaper than gold due to several factors:

- Diesel Vehicle Decline: Falling demand for diesel cars has impacted platinum’s use in catalytic converters.

- COVID-19 Supply Chain Disruptions: These temporarily reduced industrial demand.

- Market Mispricing: Some traders argue the market has not fully priced in platinum’s role in hydrogen energy and future clean technologies.

However, this price gap could present a value opportunity if industrial demand rebounds or supply tightens further.

Conclusion

Platinum can be a strategic investment for those looking to diversify beyond gold and silver. Its industrial use, constrained supply, and growing role in the green energy transition make it an asset worth considering. However, potential investors should also be aware of the risks tied to price volatility and concentrated supply.

For a tailored investment strategy, consider trading platinum with Ultima Markets. We offer access to global precious metals markets with tight spreads, real-time data, and professional trading tools for informed decision-making.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.