Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteIs Palladium a Good Investment Prospect?

Palladium, a precious metal often overshadowed by its more famous counterparts like gold and silver, has been quietly making waves in the investment world. But is palladium a good investment?

For those willing to venture beyond the traditional metals, palladium offers unique opportunities and also risks that could shape your portfolio. In this article, we’ll explore what makes palladium valuable, its recent performance, and whether it should be part of your investment strategy.

What is Palladium?

Palladium is a silvery-white metal belonging to the platinum group of metals, alongside platinum and rhodium. Known for its malleability and corrosion resistance, palladium is primarily used in the automotive industry for catalytic converters, which help reduce harmful emissions from vehicles.

It’s also found in electronics, jewelry, and dental components. Though less well-known than gold, palladium plays a crucial role in various industries, and its scarcity and demand give it significant value in the markets.

Why is Palladium So Valuable?

The value of palladium is driven by both its industrial applications and its limited availability. Let’s break down some of the key factors that contribute to its worth and why palladium could be a good investment:

The value of palladium is driven by both its industrial applications and its limited availability. Let’s break down some of the key factors that contribute to its worth:

1. Demand from the Automotive Sector

Palladium’s main demand comes from its use in catalytic converters for gasoline-powered vehicles. As the world tightens emission regulations, the automotive industry relies heavily on palladium to meet these standards. Despite the growing rise of electric vehicles (EVs), which don’t use catalytic converters, traditional vehicles and hybrids continue to drive the demand for palladium.

2. Scarcity and Supply Constraints

Approximately 30 times rarer than gold, Palladium is a rare metal. This scarcity adds to its value. The primary sources of palladium are Russia and South Africa, where production is often hindered by political instability, infrastructure challenges, and environmental regulations. These supply constraints play a significant role in driving up palladium’s price, especially when geopolitical tensions or sanctions affect these key producers.

3. Investment Demand

With precious metals like gold and silver reaching record highs, investors are increasingly turning to palladium for diversification. In times of economic uncertainty and geopolitical tensions, palladium serves as a safe-haven investment, attracting more attention from investors seeking stability beyond traditional assets like stocks or bonds.

Recent Price Trends: How is Palladium Performing?

Palladium’s price has had a roller-coaster ride in recent years, with significant fluctuations driven by supply-demand imbalances, economic policies, and investor sentiment. But is palladium a good investment based on its price performance?

Palladium’s Recent Performance

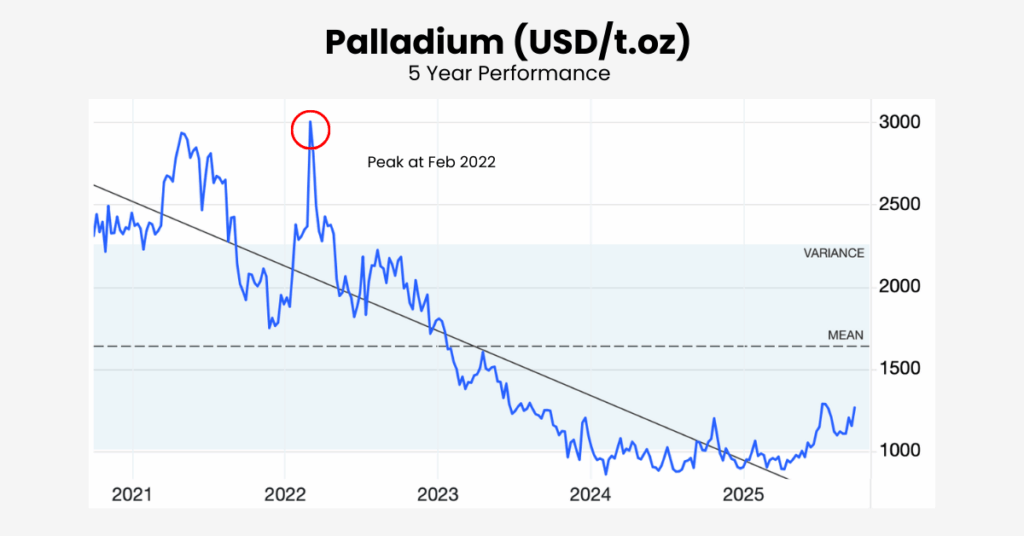

At the beginning of 2025, palladium was trading in the $900 range. By mid-year, it surged to a high of $1,288 by July, as market optimism and supply constraints led to upward momentum. This rebound followed a sharp decline from its February 2022 peak of nearly $3,000 per ounce, a testament to the volatility that can define palladium’s price.

These price movements show that palladium is a good investment for those willing to take on moderate risk.

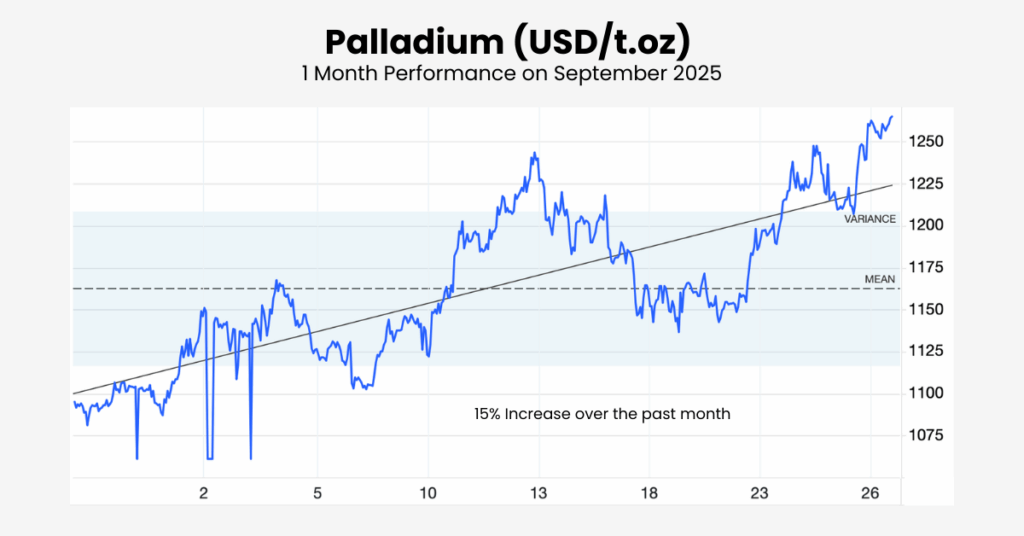

Recently, as of late September 2025, palladium has reached around $1,256 per ounce, marking an 8-week high and showing a 15% increase over the past month. This surge can be attributed to several factors, including the end of EV tax credits in the U.S. and geopolitical instability affecting supply chains.

Supply and Demand Dynamics

The World Platinum Investment Council (WPIC) reported that palladium’s supply increased slightly in 2024, but demand from the automotive sector saw a decline. The softening demand in automotive catalytic converters, especially with the rise of EVs, is expected to continue reducing overall demand for palladium in the future. However, investment demand remains strong, providing some support for prices.

Despite these challenges, palladium is expected to continue facing supply deficits in the short term. The WPIC forecasts a supply deficit of 120,000 ounces in 2025, down from the larger shortfalls seen in prior years. This is expected to keep upward pressure on prices in the near term.

How to Invest in Palladium

If you’re considering adding palladium to your portfolio, there are a few different ways to gain exposure. But first, it’s important to understand how each option aligns with the question: is palladium a good investment for you?

1. Palladium ETFs

Exchange-traded funds (ETFs) that track palladium’s price are one of the easiest ways to invest in the metal without physically owning it. These funds are highly liquid, accessible, and offer a way to capitalize on palladium’s price movements without the hassle of storing the metal.

2. Physical Palladium

Investors can also buy palladium in physical forms, such as bars or coins. While physical palladium requires storage and insurance, it provides direct ownership of the metal. Some examples include the 1-ounce Canadian Maple Leaf Palladium Coin or the 1-ounce American Eagle Palladium Coin.

3. Palladium Stocks

Investing in mining companies that produce palladium is another option. Stocks of companies like Sibanye Stillwater or Impala Platinum offer exposure to palladium’s price movements. However, mining stocks come with added risks tied to mining operations, management, and geopolitical issues.

4. Futures Contracts

More experienced investors might opt for palladium futures contracts, which allow you to speculate on the price movement of palladium. While these contracts provide leverage, they also carry higher risks due to the volatility of the palladium market.

Risks of Investing in Palladium

Like any investment, palladium carries certain risks:

1. Price Volatility

Palladium has a reputation for extreme price volatility. Unlike gold, which often behaves as a safe-haven asset, palladium’s price swings are more closely tied to industrial demand and supply disruptions. This can lead to significant fluctuations that may be unsettling for conservative investors.

2. Automotive Demand Uncertainty

The automotive industry’s shift toward electric vehicles (EVs) poses a risk to palladium’s long-term demand. As EV adoption grows, the need for palladium in catalytic converters could diminish, leading to a decrease in its price. However, hybrid vehicles still require palladium, so demand is expected to persist in the medium term.

3. Substitution Risk

Palladium’s use in catalytic converters is vulnerable to competition from platinum, which can sometimes be used as a substitute. If automotive manufacturers increasingly switch to platinum, palladium’s price could suffer.

Is Palladium a Good Investment?

Palladium offers a compelling case for investors seeking to diversify their portfolios with a unique precious metal. Its limited supply, industrial demand, and potential for price appreciation make it an attractive option. However, palladium’s volatility, reliance on the automotive sector, and risks associated with EV adoption mean that it’s not without its challenges.

If you’re looking to diversify and are willing to accept the risks that come with price fluctuations and shifting demand, palladium could be a valuable addition to your investment strategy. As with any investment, it’s crucial to weigh the pros and cons and consider your overall risk tolerance before diving in.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.