Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteIs Oracle A Good Stock To Buy?

Yes, Oracle is considered a good stock to buy for investors focused on AI and cloud growth. In Q1 FY2026, Oracle posted $14.9B revenue (+12% YoY), with cloud sales up 28% and a $455B backlog. Its raised OCI forecast (~77% growth to $18B) highlights strong long-term demand.

Why Oracle Stock Is Surging?

Oracle (NYSE: ORCL) has once again become the centre of market attention. Following its Q1 fiscal 2026 results on September 9, 2025, the stock surged sharply in after-hours trading. While Oracle slightly missed Wall Street’s top- and bottom-line expectations, traders and analysts focused on the explosive growth in its cloud business and a record backlog of $455 billion.

Key Reasons:

Massive Backlog Growth

One of the biggest drivers behind Oracle’s stock surge was its remaining performance obligations (RPO), which represent future booked revenue. Oracle reported $455 billion in RPO, a staggering 359% increase year over year. This backlog gives investors strong visibility into long-term demand, especially in cloud services and AI infrastructure.

Raised Cloud Outlook

Oracle raised its forecast for Oracle Cloud Infrastructure (OCI), projecting ~77% growth this fiscal year, equivalent to about $18 billion in revenue. Management also outlined a longer-term ambition of scaling OCI toward $144 billion within the next 4–5 years, reflecting confidence in its expanding data centre footprint and AI demand.

Multi-Billion-Dollar Contracts

The company signed four multi-billion-dollar contracts in the quarter, highlighting strong enterprise adoption of its cloud solutions. Oracle also strengthened partnerships with AI leaders like OpenAI, Meta, and NVIDIA, positioning itself as a critical player in the global AI race.

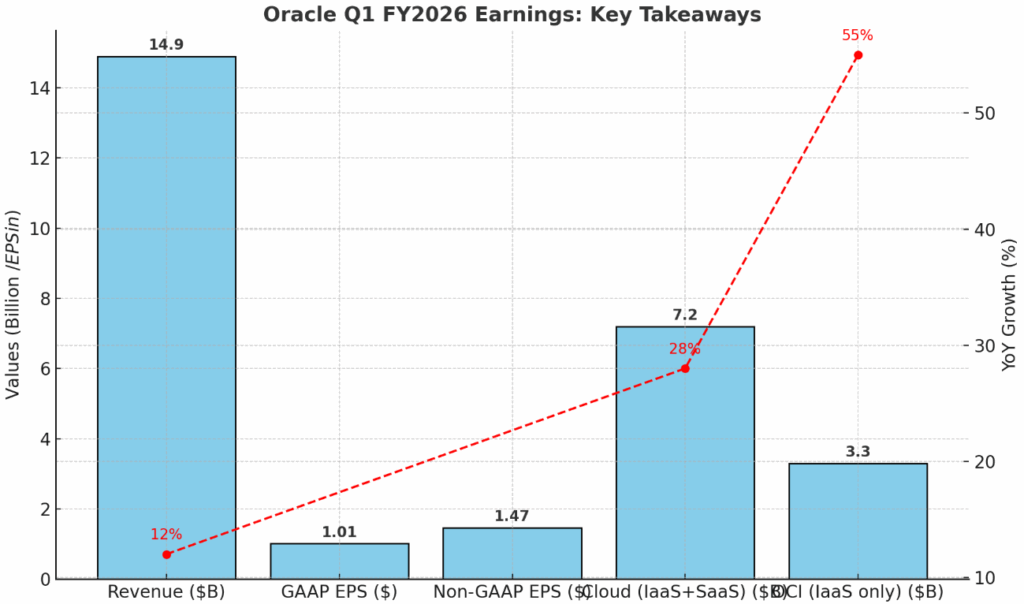

Oracle Stock Earnings: Key Takeaways

Oracle’s Q1 FY2026 results were mixed on the surface but impressive under the hood.

- Revenue: $14.9 billion, up 12% YoY, but slightly below analyst forecasts (~$15 billion).

- GAAP EPS: $1.01

- Non-GAAP EPS: $1.47 (vs. $1.48 consensus)

- Cloud (IaaS + SaaS): $7.2 billion, up 28% YoY

- OCI (IaaS only): $3.3 billion, up 55% YoY

While Oracle missed by a fraction on both revenue and EPS, traders looked past these shortfalls, focusing instead on the extraordinary backlog growth and raised guidance.

Oracle Stock Price Forecast

Oracle stock is forecast to rise on strong cloud and AI demand. For FY2026, Oracle expects Oracle Cloud Infrastructure (OCI) revenue to grow ~77% to about $18B, with a longer-term ambition of scaling OCI toward $144B over 4–5 years, giving traders strong growth visibility.

Analysts have not yet fully adjusted their price targets, but several themes are clear:

- Short-term outlook: The raised OCI forecast to ~$18B makes cloud the dominant growth engine.

- Medium-term trajectory: Management’s $144B target for OCI over the next 4–5 years signals aggressive market share ambitions.

- Competitive landscape: Oracle is becoming a stronger rival to AWS and Microsoft Azure, particularly in multi-cloud deployments.

- Stock reaction: Shares surged 20–27% in extended trading, marking one of the company’s strongest post-earnings moves in years.

Should I Buy Oracle Stock Now?

For traders looking at Oracle as an AI-infrastructure growth play, the stock offers compelling upside. Short-term volatility may persist around earnings beats or misses, but the backlog strength makes Oracle one of the more attractive large-cap tech names for long-term growth exposure.

Bullish Case

- AI-Driven Demand: Oracle’s backlog shows clear evidence of corporations locking in AI and cloud capacity.

- Partnership Momentum: Deals with top AI firms and hyperscaler integrations are accelerating adoption.

- Revenue Visibility: The $455B RPO ensures multi-year growth potential.

Bearish Considerations

- Execution Risk: Scaling to $18B+ in OCI revenue this year requires significant infrastructure expansion.

- Competitive Pressure: AWS, Azure, and Google Cloud remain strong rivals with larger ecosystems.

- Capital Intensity: Heavy investment in data centres could pressure margins in the near term.

Conclusion

Oracle’s Q1 FY2026 results show a company rapidly pivoting into the AI and cloud era. With $455B in backlog, a 77% growth forecast for OCI, and multi-billion-dollar AI contracts, Oracle has positioned itself as a serious contender in the cloud infrastructure race. While competition and capital intensity remain risks, the long-term growth outlook makes Oracle an attractive option for investors seeking exposure to AI-driven demand.

At Ultima Markets, we help traders stay ahead of opportunities like this by combining accurate market analysis with global insights. Whether you’re tracking tech giants such as Oracle or diversifying into other sectors, our resources are designed to help you make informed, confident trading decisions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.