Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is Copy Trading?

Copy trading, also known as social trading or mirror trading, is a trading strategy that allows individuals (especially beginners) to automatically copy the trades of experienced and successful traders. It enables users to replicate the trades of professional traders in real time, without the need for extensive knowledge of the markets or active trading involvement.

Is Copy Trading Profitable?

Yes, copy trading can be profitable, but it depends on several factors such as the trader you’re copying, market conditions, and your chosen trading platform.

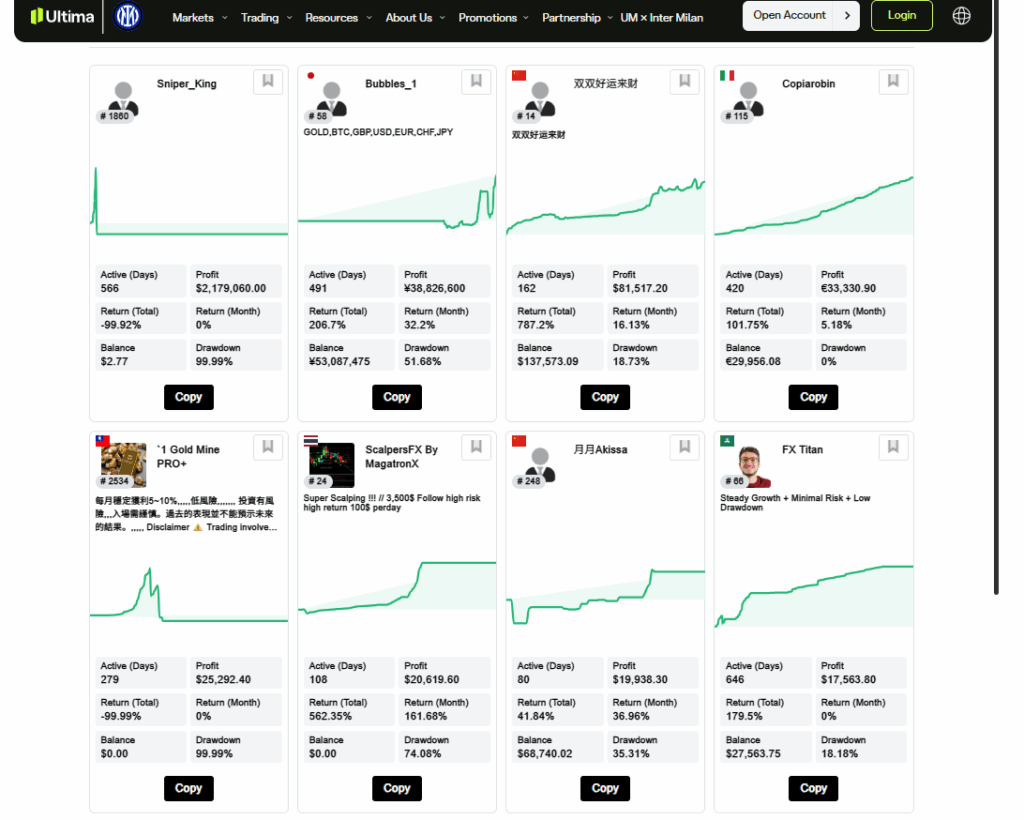

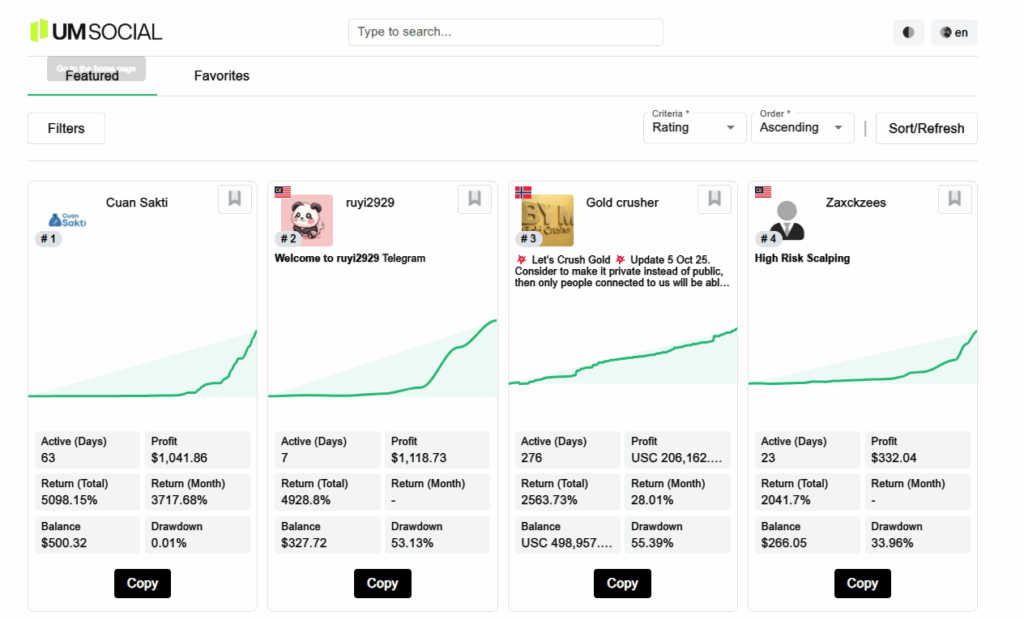

- Choosing the Right Trader to Copy: The profitability of copy trading largely depends on selecting experienced traders with a consistent track record of success. Platforms like Ultima Markets often provide leaderboards with performance metrics, allowing you to choose top traders to follow.

- Market Conditions: Like any form of trading, copy trading is impacted by market volatility. Even skilled traders can incur losses during unfavorable market conditions.

- Platform and Strategy: The success of your copy trading also depends on the platform’s features, such as real-time tracking and risk management tools. It’s important to choose a platform with high transparency and low fees.

Tips to Maximize Profits in Copy Trading

- Start with a Demo Account: Many platforms offer demo accounts where you can practice copy trading without financial risk.

- Diversify Your Investments: Spread your investments across multiple traders to reduce risk.

- Monitor Performance Regularly: Stay updated on the performance of traders you’re copying and adjust your strategy if necessary.

Copy trading can indeed be profitable, but it requires careful selection of traders, understanding market conditions, and using reliable trading platforms. Always manage your risk and monitor your portfolio to maximize potential returns.

How Does Copy Trading Work?

In copy trading, a trader (the “follower”) selects an experienced trader (the “leader”) to copy. When the leader places a trade, the follower’s account automatically mirrors that trade, typically in the same proportion, allowing the follower to profit or incur losses based on the leader’s trading performance.

Key Features of Copy Trading:

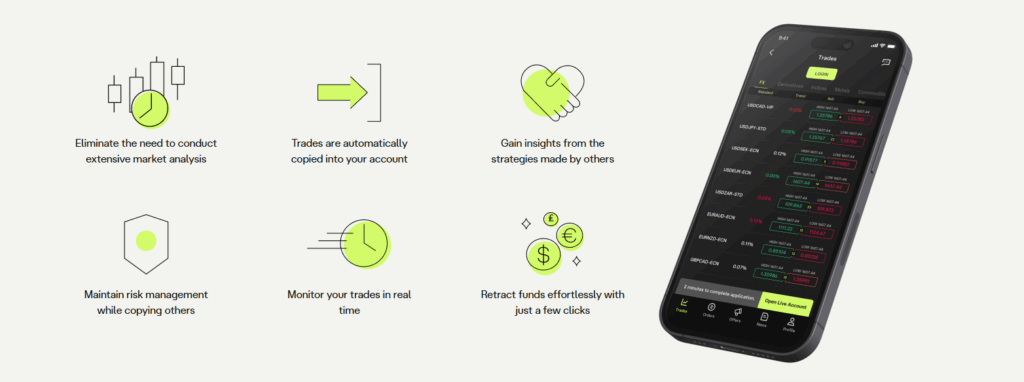

- Automated Process: Once you choose a trader to copy, the system automatically copies their trades on your behalf. This removes the need for manual intervention in each trade.

- Real-Time Execution: Copy trading happens in real-time, meaning the follower’s account mimics the leader’s actions as soon as the trade is executed.

- Transparency: Most platforms provide transparency about the performance of traders, allowing followers to evaluate and choose traders based on metrics like success rate, risk level, and past performance.

- Diverse Options: Many platforms offer a range of traders to copy, including forex traders, stock traders, and cryptocurrency traders, providing a diverse selection depending on the market of interest.

What Makes Copy Trading Profitable?

Choosing the Right Trader to Copy

To make copy trading profitable, you need to choose the right trader to copy. This is the most important factor. When you copy someone’s trades, you’re essentially investing based on their decisions.

- Look for experienced traders with a proven track record. Many platforms, like eToro, allow you to see how well a trader has performed over time.

- Traders who are consistent in making profits and have a good risk management strategy are ideal to follow.

The Platform You Choose

- Transparency and Fees: A good platform should show you real-time data on the trades being copied, so you can track performance. Some platforms also charge fees for copying, so make sure to check these costs, as they can eat into your profits.

- User-Friendly Tools: Platforms that offer advanced tools like risk management (e.g., setting stop-loss limits) help reduce losses if a trade goes against you.

Market Conditions

The market is always changing, and market conditions can impact how profitable copy trading is.

- Even top traders have bad days when the market moves against them, especially in volatile times. For example, news events, economic reports, or global crises can cause sudden changes in the market.

- Risk Management: Some traders you copy might use strategies to limit losses during tough market conditions, but this is not guaranteed.

Diversifying Your Investments

To increase your chances of profitable copy trading, consider diversifying. This means copying multiple traders instead of just one.

- If one trader experiences a loss, the others might still be profitable, helping balance the overall risk.

- Different strategies: Diversifying across traders with different strategies (e.g., long-term vs short-term trades) can help reduce risk and improve your chances of consistent profits.

Monitoring Your Performance

Even though copy trading is hands-off, you should keep an eye on your portfolio. Make sure to:

- Review your trader’s performance regularly. If a trader starts losing money consistently, you can stop copying them and find a better one.

- Adjust your strategy as needed based on market changes. While you don’t need to trade actively, staying informed will help you make better decisions.

To sum up, copy trading can be profitable for beginners if you choose the right traders, use a reliable platform, understand market risks, diversify your investments, and monitor your performance regularly.

By doing these things, you’re more likely to see profits, but remember, like all trading, there’s always risk involved, and success isn’t guaranteed. The key is to stay informed, be patient, and use strategies that work for you.

Pros of Copy Trading

Copy trading offers several benefits, making it an attractive choice for both beginners and experienced traders:

Hands-off Investment

Copy trading is a passive strategy, allowing you to benefit from professional traders’ strategies without having to actively trade.

Access to Professional Traders

With copy trading platforms, you gain access to traders with proven success, giving you the opportunity to mirror their trades and potentially earn profits without deep market knowledge.

Diversification

By copying multiple traders with different strategies, you can diversify your portfolio, reducing risk and improving the chances of consistent returns.

Cons of Copy Trading

While copy trading can be profitable, there are some risks to consider:

Dependence on Others

Your copy trading success is closely tied to the performance of the traders you copy. If they experience losses, so will you.

Lack of Control

As a copy trader, you give up control over your trades. This might feel unsettling for those who prefer to make their own decisions.

Risk of Loss

Like all trading, copy trading involves the risk of loss. Even top traders can face setbacks, especially in volatile markets.

Latest Trends in Copy Trading

The copy trading industry is constantly evolving. Here are some of the latest trends:

Increased Regulation

As copy trading grows, more platforms are being regulated by financial authorities such as the FCA and ASIC to ensure transparency and safety.

AI and Machine Learning

Some platforms now use AI to help select traders or predict market trends, making the process more automated and efficient.

Social Trading

Many platforms combine copy trading with social trading, allowing users to interact with and learn from professional traders.

Conclusion

At Ultima Markets (UM), our UM Social copy trading platform empowers you to trade smarter by following top traders and copying their strategies in real-time. Whether you’re a beginner or an experienced trader, UM Social makes it easy to participate in the markets without the complexity, allowing you to leverage the expertise of professionals.

With UM Social, you gain access to a community of successful traders, transparent performance tracking, and the ability to diversify your investments, all within a secure, user-friendly environment.

Ready to take the next step? Join UM Social today and start profiting from the insights and strategies of the best traders. It’s time to trade with purpose, connect with experts, and grow your financial future with Ultima Markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.