Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Is ASTS a Good Stock to Buy?

If you’re asking is ASTS a good stock to buy, the real question is whether you can handle a high-volatility company that’s still proving execution, financing, and scale. ASTS can be a good stock to buy for high-risk, long-term investors who want exposure to direct-to-device satellite broadband and who understand this is not a traditional earnings-driven stock today.

AST SpaceMobile is trying to build something ambitious: a satellite network that connects ordinary smartphones directly to space, extending mobile coverage to places where towers don’t reach. The upside is huge if the network scales. The downside is also real if timelines slip, costs rise, or service quality fails to meet expectations.

What Does AST SpaceMobile Do?

AST SpaceMobile (NASDAQ: ASTS) is building a space-based cellular broadband network designed to connect standard 4G and 5G phones directly to satellites. The goal is to support calls, messages, and data in underserved areas like rural regions, mountains, oceans, and disaster zones.

Instead of competing with telecoms, AST works with mobile network operators through a wholesale-style model, positioning the service as a coverage extension rather than a replacement network.

Key points of the business model:

- Focus on direct to device (D2D) connectivity

- Targets regions with limited mobile coverage

- Partners with mobile network operators rather than competing with them

- Long term revenue potential from global roaming and wholesale capacity

This positioning places ASTS at the intersection of telecommunications, space infrastructure, and mobile data growth.

Is ASTS a Good Stock to Buy Right Now?

So, is ASTS a good stock to buy today? It depends on what you expect from the investment.

ASTS may suit you if:

- You have a multi-year horizon

- You can tolerate major swings up and down

- You’re comfortable with “execution first, profits later” businesses

ASTS is less suitable if:

- You need stable revenue and earnings now

- You prefer predictable valuation anchors

- You want lower volatility

A realistic way to frame it is this: is ASTS a good stock to buy for cautious investors? Usually not. But for investors who specialise in high-upside tech themes and can hold through volatility, ASTS can be compelling.

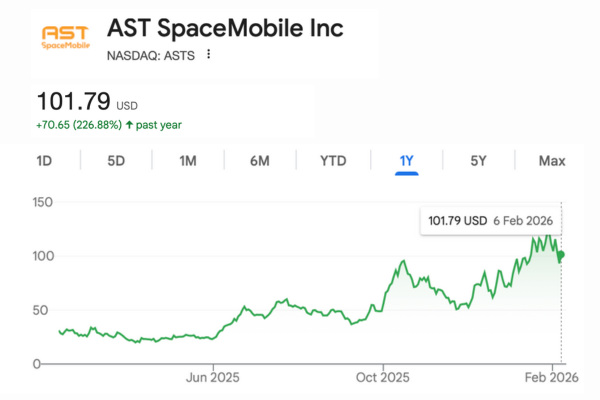

AST SpaceMobile ASTS Stock Price Performance

On January 2026, ASTS shares have recently traded in the triple-digit range (~$100+), hitting new highs after strong market interest and defense contract news. Recent daily gains include a 14%+ jump on positive news about strategic contracting opportunities.

Shares of AST SpaceMobile jumped sharply because the company was named a prime contractor for a major U.S. defense program (the Missile Defense Agency’s SHIELD initiative), part of the broader Golden Dome national security project.

This new government recognition expanded investor expectations beyond just consumer and telecom markets, suggesting potential future defense-related revenue opportunities. Even though ASTS still generates minimal revenue, the defense contract status boosted confidence in its technology and commercial reach, driving the stock higher.

Why Is ASTS So Popular?

ASTS became popular due to major progress in satellite deployment. The company recently announced the completion of BlueBird 6 and plans to deploy 45-60 satellites by the end of 2026. This milestone significantly boosted investor confidence, leading to a surge in stock price, hitting an all-time high.

Additionally, Barclays raised its price target to $60, further fueling optimism. The stock outpaced its peers, and short-sellers were forced to reconsider their positions, adding to the momentum.

Why Investors Are Interested in ASTS Stock

Investors are interested in ASTS stock because it targets a large, unmet global demand with a differentiated technology model, supported by industry scale data and measurable milestones.

Massive Addressable Market

According to GSMA estimates, billions of people globally still experience mobile coverage gaps, especially in rural and remote regions. AST SpaceMobile targets these dead zones by extending coverage beyond traditional cell towers, significantly expanding the reachable user base for mobile operators.

Direct-to-Device Technology Advantage

Unlike traditional satellite services that require special devices, AST SpaceMobile’s satellites are designed to connect directly to standard 4G and 5G smartphones. This lowers adoption barriers and increases potential usage compared with satellite phones or terminals.

Telecom Partnership Model

AST SpaceMobile collaborates with mobile network operators (MNOs) rather than competing with them. This wholesale model aligns incentives and allows operators to monetize existing subscribers without building costly terrestrial infrastructure in low-density areas.

Growing Demand for Mobile Data

Global mobile data consumption continues to rise annually, driven by streaming, messaging, and digital services. Even modest penetration of off-grid users could translate into meaningful long-term revenue per satellite once the network is operational.

First-Mover Positioning in a New Segment

Direct-to-device satellite broadband remains an early-stage market. Investors see ASTS as one of the earliest pure-play equities offering exposure to this theme, similar to how early telecom or mobile internet infrastructure attracted capital before revenues matured.

Optionality-Driven Valuation

ASTS stock is valued primarily on future network scale and adoption, not current earnings. This creates upside optionality if deployment milestones, regulatory approvals, and commercial launches progress as planned.

Investors are drawn to ASTS because it combines a large underserved market, differentiated satellite technology, telecom-aligned partnerships, and long-term data demand, while accepting that near-term financial risk and volatility remain high.

Key Risks You Must Consider

Technology Risk

AST SpaceMobile must prove direct-to-device connectivity works reliably at scale. If the network underperforms, requires redesigns, or faces launch and testing setbacks, commercialization can slip.

Funding Risk

ASTS continues to invest heavily in building its constellation. If costs rise or timelines extend, the company may need more funding, which can mean share dilution or less favourable financing terms.

Regulatory Risk

ASTS depends on spectrum access and approvals across multiple regions. Licensing, spectrum coordination, and cross-border telecom rules can slow rollout and limit where services launch first.

Competition Risk

The direct-to-device space is getting crowded. Competing satellite and telecom players may launch faster, secure better partnerships, or win key spectrum resources, which can pressure ASTS market share and pricing.

Conclusion

In conclusion, ASTS (AST SpaceMobile) presents a high-risk, high-reward opportunity for investors who are comfortable with speculative growth stocks. The company’s innovative direct-to-device satellite technology could revolutionize mobile connectivity in underserved areas, offering significant long-term potential.

However, the high technical, regulatory, and funding risks require careful consideration. For investors with a long-term investment horizon and a high risk tolerance, ASTS could be a promising stock, but it’s crucial to monitor ongoing progress, regulatory hurdles, and competition closely.

If you’re ready to take your investment journey to the next level, open a live account with Ultima Markets and access a wide range of trading opportunities. With advanced tools, expert insights, and a secure trading platform, Ultima Markets is designed to help you make informed decisions and trade confidently.

Open your live account today and start trading on global markets, including stocks, forex, and commodities!

FAQs

ASTS is a high-risk, speculative stock with significant long-term growth potential but faces challenges in technology, funding, and competition. It’s suitable for investors with a high risk tolerance.

ASTS soared due to being named a prime contractor for a U.S. defense project, expanding its commercial and defense revenue potential.

Predicting if ASTS will reach $100 is speculative. It depends on successful technology rollout, partnerships, and execution of its business model. The stock’s volatility makes such a target uncertain.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.