Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteIraqi Dinar Future Prediction 2025

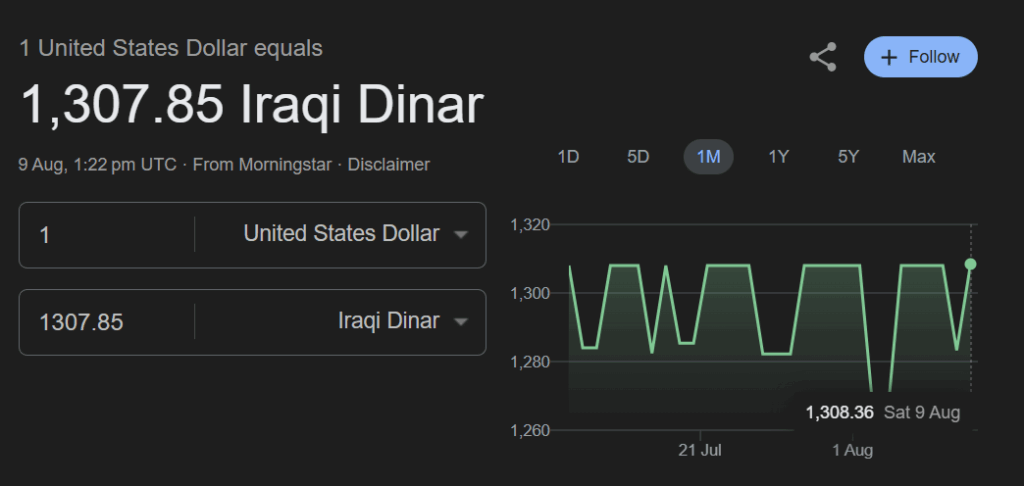

Market outlook for the Iraqi dinar in 2025 points to stability with minimal fluctuation, rather than rapid appreciation. Projections indicate the exchange rate could ease slightly toward around 1,318 IQD per USD by year-end. Forecast ranges place the USD/IQD between 1,307.84 and 1,317.17 IQD, averaging near 1,309.73 IQD, which represents a modest overall change and a potential return of just 0.62%.

Current market data also shows that as of 9 August 2025, the rate holds steady at 1,310.00 IQD/USD, highlighting the currency’s ongoing lack of volatility. Overall, the Iraqi dinar is expected to remain range-bound and largely flat throughout 2025, with no credible indicators of a sharp revaluation in the near term.

What Is Iraqi Dinar?

The Iraqi dinar (IQD) is the official currency of Iraq, issued by the Central Bank of Iraq (CBI). As of 9 August 2025, the exchange rate stands at 1 USD = 1,307.85 IQD

Iraq operates under a managed exchange rate system, meaning the CBI pegs the dinar close to a set rate against the US dollar. This peg limits large currency swings but also caps short-term appreciation potential.

Exchange Rate of the Iraqi Dinar:

Historical Performance of the Iraqi Dinar

The Iraqi dinar (IQD) has undergone significant fluctuations driven by political instability, wars, economic sanctions, and shifts in global oil prices. Before the 1990s, the dinar was one of the strongest currencies in the Middle East, supported by Iraq’s robust oil exports. However, after the Gulf War and the imposition of UN sanctions, its value dropped sharply, leading to hyperinflation and reduced purchasing power. In the mid-2000s, following the currency redenomination, the dinar stabilized but remained relatively weak against major currencies like the US dollar.

Today, the IQD’s performance continues to depend heavily on Iraq’s oil revenues, monetary policy, and political stability, making it a closely watched currency in global forex markets.

Will the Iraqi Dinar Go Up?

Short-term forecasts suggest very limited upside for the Iraqi dinar, with expected movement within the 1,307–1,318 IQD/USD range. The peg and monetary policy framework significantly constrain sudden appreciation.

What Could Drive the Iraqi Dinar Up?

Increase in Foreign Currency Supply via Official Channels

The Central Bank of Iraq (CBI) has recently attributed periods of IQD appreciation to increased availability of foreign currency through official banking channels—lessening reliance on the parallel (black) market.

Growth in Oil Revenues and Reserves

Iraq’s economy is heavily oil-dependent. Higher oil export earnings bolster foreign reserves, enabling the CBI to maintain or potentially strengthen the dinar.

Central Bank’s Monetary Policy Stability

The CBI continues to use its managed exchange rate policy as a tool for price stability. Strategic interventions in FX windows and the banking system help dampen volatility and support currency value.

Economic Reforms & Digital Banking Enhancements

Improvements like enhanced digital payments, stronger banking regulation, and better investor protections can improve confidence in IQD and reduce informal dollar usage—possibly nudging the dinar upward.

Seasonal and Political-Fiscal Developments

Historical trends show seasonal fluctuations certain months like February to April occasionally see slight appreciation, influenced by public budget timing, FX supply, and political events.

Despite these potential drivers, the CBI’s fixed-rate policy and cautious monetary stance make a sudden appreciation unlikely in 2025. Without a policy shift, the IQD will likely remain in its current range with only minor fluctuations.

Is Investing in Iraqi Dinar a Good Idea?

Investing in the Iraqi dinar is generally considered high-risk and speculative rather than a mainstream forex strategy. The currency operates under a managed exchange rate set by the Central Bank of Iraq, currently around 1 USD = 1,307.85 IQD (as of August 9, 2025). This peg means the dinar does not float freely in the global forex market, and large gains from sudden appreciation are unlikely without significant economic or policy changes.

While Iraq’s vast oil reserves and potential reforms could support gradual stability, persistent challenges including heavy reliance on oil exports, political uncertainty, limited economic diversification, and external monetary pressures continue to cap growth prospects. Most credible analysts, including those cited by the IMF and Investopedia, caution that the dinar is not a quick-profit vehicle and is better suited for those with a high tolerance for long-term risk and limited liquidity.

Will the Iraqi Dinar Be Revalued?

The possibility of an Iraqi dinar revaluation has been widely debated among investors and currency traders. While some speculate that Iraq’s improving oil revenues, political stability efforts, and economic reforms could strengthen the dinar over time, no credible international financial institution or Iraqi government authority has confirmed any large-scale revaluation plans.

The Central Bank of Iraq has maintained a managed exchange rate policy to stabilize the economy and control inflation. Historically, sudden revaluations are rare in global currency markets, as they can disrupt trade, investment, and fiscal planning. Any future change in the dinar’s value is more likely to occur gradually, reflecting real economic growth rather than an overnight surge.

Conclusion

In conclusion, the Iraqi dinar’s future in 2025 will largely depend on Iraq’s ability to maintain economic stability, control inflation, and boost oil-driven revenue while attracting foreign investment. Although significant revaluation remains unlikely in the short term, gradual appreciation could occur if reforms and global oil demand remain strong. Traders and investors should closely monitor Iraq’s fiscal policies, central bank actions, and geopolitical developments.

At Ultima Markets, we provide the latest market insights, currency forecasts, and expert analysis to help you navigate opportunities and risks in emerging market currencies like the Iraqi dinar.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.