Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat is IPO and how to invest in 2025 listings

In 2025, the global financial markets are surging with activity, and IPOs (Initial Public Offerings) have once again become a major investment hotspot. From tech startups and green energy firms to AI unicorns, many companies are choosing IPOs as a way to raise capital and accelerate expansion—while investors are eager not to miss out on the resulting profit opportunities.

But what exactly is an IPO? How can investors participate in trending global listings? And how can they use Contracts for Difference (CFDs) to flexibly capture post-listing swing profits?

This article will explore IPO fundamentals, market trends, and practical strategies to help investors seize the next wave of wealth in the trading arena.

What Is an IPO?

An Initial Public Offering (IPO) refers to the process by which a company offers its shares to the public for the first time, raising funds from the broader market and listing on a stock exchange, where shares are sold to investors through the exchange.

It marks a company’s transition from being privately held to publicly traded, signifying a major milestone that brings the business into a new era of transparency and capital market regulation.

Why Do Companies Go Public?

- Raise Capital: IPOs allow companies to raise substantial funds for expansion, R&D, or debt repayment.

- Increase Brand Visibility and Trust: Listed companies typically enjoy stronger brand recognition and investor confidence.

- Attract Talent and Provide Exit Options: Public markets enable companies to offer employee stock options, improve talent retention, and offer liquidity or exit opportunities for early investors and founders.

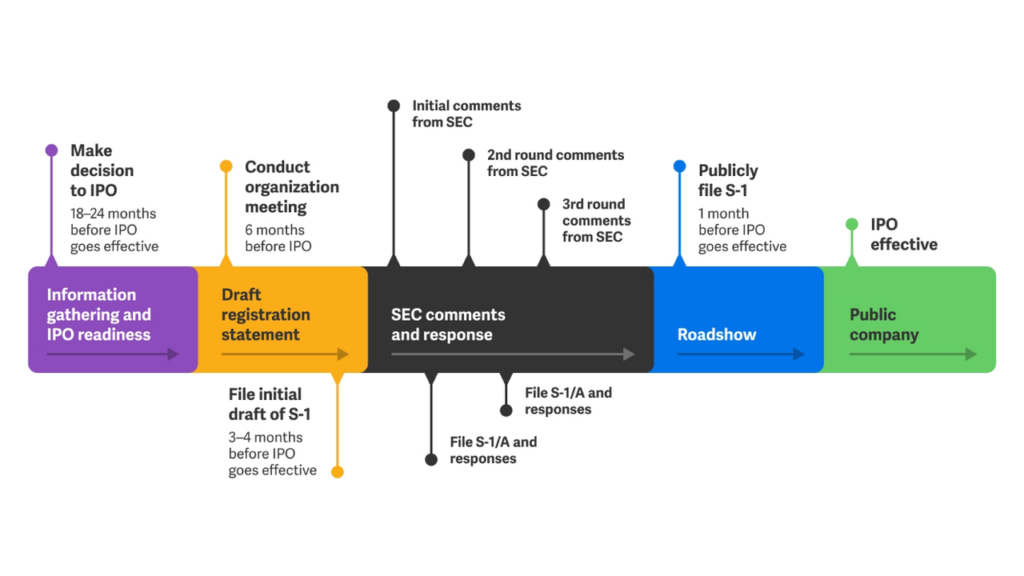

IPO Process Overview:

From internal decision to retail subscription, the full cycle usually takes 6–12 months:

- Stage ① Internal Preparation: The company decides to go public and appoints investment banks as underwriters.

- Stage ② Filing and Review: The company conducts financial audits and submits a prospectus to the stock exchange or OTC market.

- Stage ③ Regulatory Review: Regulatory bodies (such as Taiwan’s TWSE or the U.S. SEC) review the submitted documents.

- Stage ④ Pricing Roadshow: The company holds roadshows to engage with institutional investors and conduct book building.

- Stage ⑤ Public Offering: The issue price is finalized; retail investors submit subscription requests via brokers and receive allocations through a lottery system.

- Stage ⑥ Listing and Trading: The company officially lists on the exchange, with no price limits during the first five trading days.

Advantages and Risks of Participating in IPOs

An IPO often marks the beginning of a company’s rapid growth phase, offering strong growth potential and short-term price volatility. Many investors aim for outsized returns on the day of listing or shortly afterward. Whether speculative traders or value-oriented investors, many seek to discover the “next Tesla” or “next Google” during the IPO phase.

Advantages:

- Strong First-Day Gains: Many high-profile IPOs surge over 20% on the first day of trading.

- High Market Attention: Buzzworthy sectors such as AI, green energy, and EVs attract capital inflows due to heightened media and investor attention.

- Long-Term Value Potential: Some IPO stocks offer sustainable revenue growth, making them suitable for long-term portfolios.

Risks:

- High Volatility: IPO stocks can experience sharp swings due to speculative capital flows in the early trading days.

- Limited Transparency: IPO firms often have short public track records and limited financial disclosures, making analysis more challenging.

- Overvaluation Risk: Some IPOs may be overpriced, leading to the “pop and drop” effect post-listing.

2025 IPO Highlights

According to IPO research firm Renaissance Capital, 44 companies filed for IPOs in the U.S. during Q1 2025, raising an estimated total of USD 9.4 billion. Key sectors included AI, semiconductors, green energy, and fintech.

Notable Global IPO Cases:

- CoreWeave

CoreWeave is an innovative company focused on AI cloud computing. Formerly an Ethereum mining operation, it has transformed into a key GPU compute provider relied on by giants like NVIDIA. On Friday, March 28, CoreWeave successfully went public on Nasdaq, raising USD 1.5 billion—making it the largest VC-backed tech IPO in the U.S. since 2021.

- Newsmax

Newsmax, one of the fastest-growing conservative media platforms in the U.S., listed on the NYSE on March 31 to expand its news and streaming presence. On its IPO debut, the stock surged 735.10%, triggering over 10 trading halts. The share price skyrocketed from its IPO price of USD 10 to USD 83.51, pushing its total market cap beyond USD 10 billion.

- Chagee

Chagee, a leading Chinese premium tea beverage brand, was listed on Nasdaq on April 17. With its Eastern-inspired packaging and high-end tea positioning, it has gained popularity among Gen Z consumers. The IPO raised approximately USD 411 million, with the stock opening at USD 33.75—over 20% higher than its USD 28 issue price.

Taiwan IPO Highlights:

Looking ahead to 2025, Taiwan’s IPO market is expected to continue its listing momentum. Sectors likely to benefit include companies with policy tailwinds, spin-offs from mid-sized groups, and themes around AI and sustainability.

How Can Taiwanese Investors Participate in IPOs?

For Taiwanese investors, there are two main ways to participate in IPOs:

Traditional Public Subscription (Taiwan Stock Market)

- Apply through a broker’s public subscription process by submitting a lottery application form.

- Qualified investors may also join the competitive bidding process for initial share allocation.

- If allocated shares via lottery, the investor pays the amount and awaits the listing.

However, the allotment rate for local IPOs is relatively low. Popular companies often attract hundreds of thousands of applicants, so allocation is not guaranteed.

Participating in International IPOs and Post-Listing Trading

To participate in U.S. or Hong Kong IPOs, investors need a broker with international access or a CFD platform. Most Taiwanese retail investors are ineligible for IPO allocations abroad. However, they can use CFD trading platforms to quickly capture post-IPO price movements without owning the actual shares.

How to Capture Post-IPO Opportunities via CFDs?

Newly listed stocks often experience extreme volatility, especially in the first 30 trading days, with a high likelihood of sharp price swings. Statistics show that many hot IPO stocks fluctuate over 15% within 30 days of listing, presenting excellent short- and medium-term trading opportunities. Using CFDs at this stage allows you to trade price movements without holding the actual shares, offering greater flexibility.

Five Key Advantages of Trading IPOs via CFDs:

- Bidirectional Trading: Go long or short to respond to market rallies or pullbacks.

- Leverage: Maximize your trading capacity with limited capital.

- Instant order execution with built-in stop-loss and take-profit functions.

- No lottery risk, no lock-up restrictions.

- Access global IPOs beyond local market limitations.

Why Choose Ultima Markets as Your Go-To Platform for Post-IPO Trading

As one of the fastest-growing CFD trading platforms in the Asia-Pacific region in 2025, Ultima Markets offers diversified IPO trading opportunities designed specifically for active investors.

Trade Global High-Profile IPO Stocks

Whether it’s Stripe, Shein, or Reliance Jio—once listed on a major exchange, they’re tradable via the Ultima Markets platform.

Low-Cost, High-Efficiency Trading Environment

- ECN accounts offer spreads as low as 0.0 with commissions at just USD 5 per lot.

- Minimum trade size of 0.01 lots, ideal for flexible entry and exit.

- Supports MT4, MT5, WebTrader, and the proprietary Ultima Markets App.

Regulated and Secure with Expert Support

- Client funds are held in segregated accounts at Westpac Bank, Australia.

- As a member of The Financial Commission, clients are protected with compensation coverage up to €20,000.

- Offers demo accounts and Trading Central’s expert analysis to help investors develop effective entry strategies.

Conclusion

The IPO market in 2025 remains full of excitement, but both opportunity and risk go hand in hand. Whether you favor IPO lotteries or post-listing trading, true success lies in understanding company fundamentals, reading market sentiment, and using flexible trading tools.

Rather than relying on luck in IPO allocations, choose a professional platform like Ultima Markets. Combine global IPO access with the flexibility of CFD trading to take control of your strategy and profit potential.

Frequently Asked Questions

Q1: What’s the difference between an IPO and listing? A: An IPO is the process of going public; listing is the result after the IPO is completed.

Q2: Can you short IPO stocks? A: Not in the traditional spot market, but you can short IPOs using Contracts for Difference (CFDs).

Q3: Are IPO investments suitable for beginners? A: It’s recommended to practice using a demo account to understand market volatility and platform tools before live trading.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.