Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomInvesting in Nuclear Fusion Stocks

In the world of clean energy, nuclear fusion stocks are becoming increasingly intriguing as a potential game-changer. Unlike nuclear fission, which splits atoms to release energy, fusion combines atomic nuclei to produce energy, the same process that powers the sun.

The promise of nuclear fusion lies in its ability to generate abundant, clean energy without harmful byproducts like radioactive waste. Despite being in its early stages, nuclear fusion stocks are gaining momentum, and investors are increasingly looking for opportunities in this emerging field.

Among the leading companies in the race to bring fusion energy to the grid is Commonwealth Fusion Systems (CFS), a key player that has garnered significant attention from investors.

Among the leading companies in the race to bring fusion energy to the grid is Commonwealth Fusion Systems (CFS), a key player that has garnered significant attention from investors.

What is Nuclear Fusion and Why Does It Matter?

Nuclear fusion works by combining light atomic nuclei, such as deuterium and tritium, to form heavier elements, releasing immense amounts of energy. This energy is far greater than what’s produced by traditional chemical reactions or nuclear fission. The fuel for fusion (deuterium and tritium) can be derived from water and lithium, ensuring a virtually unlimited, clean fuel source.

What makes fusion so appealing is its environmental benefits. Unlike fission, which creates long-lasting radioactive waste, fusion produces little to no harmful byproducts. Furthermore, it holds the promise of delivering almost limitless power without contributing to greenhouse gas emissions, making it an essential component in the global fight against climate change.

Breakthroughs in Fusion Energy

Over the past few years, significant strides have been made in nuclear fusion research. One of the most notable milestones occurred in December 2022, when scientists at the National Ignition Facility in California achieved a historic breakthrough. For the first time, they produced more energy from a fusion reaction than was used to initiate it. This achievement brought fusion energy closer to reality and sparked an influx of investment in fusion technologies.

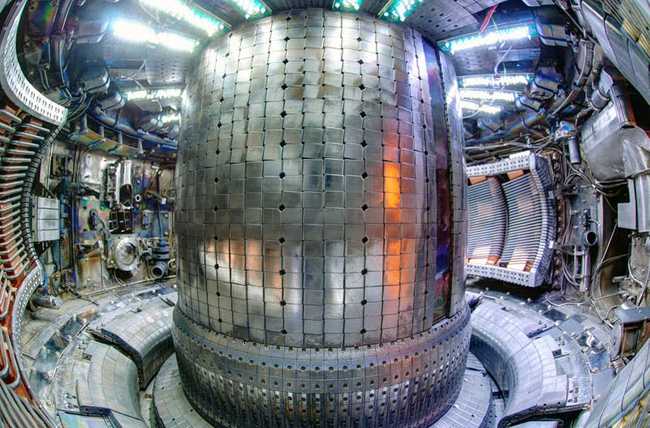

As research institutions make progress, private companies are also playing a pivotal role. One of the most promising firms in the fusion space is Commonwealth Fusion Systems (CFS), a startup spun out of MIT. CFS is focused on developing compact fusion reactors that could bring fusion energy to market much faster than traditional designs. With major backing from investors like Google, Nvidia, and Breakthrough Energy, CFS is a company to watch.

Commonwealth Fusion Systems: A Stock to Watch?

As fusion energy moves closer to commercialization, Commonwealth Fusion Systems has emerged as one of the most exciting opportunities in the field. The company raised $1 billion in funding, demonstrating strong investor confidence in its potential. With its SPARC reactor, CFS aims to produce more energy than it consumes, achieving a significant milestone in fusion energy.

Though Commonwealth Fusion Systems is not yet publicly traded, the company’s growth has sparked interest in the stock market, and it may eventually offer a direct way for investors to gain exposure to the fusion energy revolution.

For now, investors can look to the company’s major investors and partners as a way to indirectly benefit from CFS’s advancements. Companies like Google (GOOG), Nvidia (NVDA), and Breakthrough Energy have made substantial investments in CFS, and their stocks may benefit from the growth of fusion energy as it becomes a more viable technology.

How to Invest in Nuclear Fusion Stocks

While Commonwealth Fusion Systems is not yet available for direct investment, there are several ways to gain exposure to the nuclear fusion sector. Here are some options for investors looking to capitalize on the growing fusion energy industry:

1. Investing in Publicly Traded Companies with Exposure to Fusion

Although most fusion companies are privately held, there are publicly traded companies involved in the fusion space or benefiting from fusion technology.

These include companies like Alphabet Inc. (GOOG) and Microsoft (MSFT), which have made investments in fusion technology startups like TAE Technologies and CFS. These investments could position these tech giants to profit as fusion energy becomes a reality.

2. Energy Companies Investing in Fusion

Several major energy companies are positioning themselves for the future of fusion energy. For instance, Eni S.p.A. (E), an Italian oil major, has made significant investments in fusion through its stake in Commonwealth Fusion Systems. Similarly, Chevron Corp. (CVX) has invested in fusion through its backing of Zap Energy, a company developing a modular nuclear reactor with fusion capabilities.

These companies offer an opportunity for investors to benefit from both the current energy market and the future potential of fusion technology. By investing in these established energy firms, you gain indirect exposure to the growing fusion energy sector.

3. Private Fusion Startups and Venture Funds

For investors with access to venture capital or private equity, there are opportunities to invest directly in fusion startups like CFS, Helion Energy, and TAE Technologies.

These companies are working on bringing fusion energy to market, and early-stage investments could yield significant returns if these technologies succeed. However, such investments are often limited to accredited investors due to the private nature of these companies.

4. Clean Energy ETFs

If yIf you’re looking for a more diversified way to invest in nuclear fusion stocks and other clean energy technologies, exchange-traded funds (ETFs) focused on renewable energy or clean technology are a good option.

While most of these funds don’t focus exclusively on fusion, many include companies involved in fusion research, such as Google, Microsoft, and other companies supporting clean energy innovation.

The Future of Nuclear Fusion Stocks

Nuclear fusion holds the potential to completely transform the energy landscape. If fusion technology can be successfully commercialized, it could provide virtually limitless, clean energy, offering a long-term solution to the world’s growing energy needs. While the technology is still in its early stages, the significant advancements made over the past few years suggest that we’re getting closer to making fusion a reality.

For investors, the road to fusion energy is full of challenges, but also tremendous opportunity. Companies like Commonwealth Fusion Systems, though not yet publicly traded, are leading the way. By investing in companies supporting fusion research or those with strategic partnerships in the fusion space, investors can position themselves for the future of clean energy.

Conclusion

Nuclear fusion could be one of the most significant breakthroughs in energy technology, providing an abundant and clean source of power. While direct investment in nuclear fusion stocks remains limited, companies like Commonwealth Fusion Systems are leading the charge, and several major firms are positioning themselves to profit from fusion energy’s potential.

For investors willing to take on some risk and with a long-term perspective, the future of nuclear fusion represents an exciting frontier in the world of clean energy.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.