Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteThe Indian stock market crash of 2025 has left investors anxious and global markets on alert. After years of strong gains, the sudden selloff in Nifty 50 and Sensex wiped out billions in market capitalization, with foreign portfolio investors (FPIs) pulling out record sums and the Indian rupee hitting new lows.

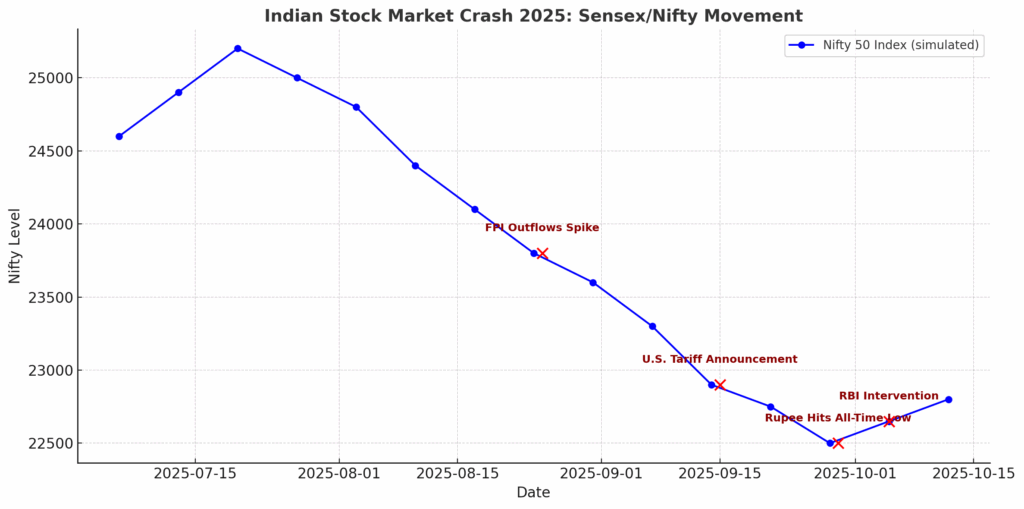

Timeline of the Crash

- August–September 2025: Heavy FPI outflows of over $2.7 billion in September alone, taking year-to-date withdrawals above $17 billion.

- Late September: The rupee touched an all-time low near ₹88.80 per USD, sparking panic selling.

- October 2025: Sensex and Nifty faced repeated declines, with banking and financials leading losses, before stabilising slightly.

This sequence shows how external shocks combined with structural weaknesses to trigger the crash.

Causes of the Indian Stock Market Crash

The Indian stock market crash of 2025 did not come from a single trigger. It was the result of multiple domestic and global pressures converging. Below are the main causes in depth:

Heavy Foreign Portfolio Investor (FPI) Outflows

India’s stock market is highly dependent on foreign liquidity. When FPIs sell, it puts pressure on both stock prices and the rupee.

- FPIs pulled out more than $17 billion by September 2025, the highest in years.

- Drivers of this exit included rising U.S. Treasury yields, stronger dollar returns, and higher risk aversion toward emerging markets.

- Global investors also sought safety amid U.S.–India tariff tensions, choosing to move capital to developed markets.

Rupee Depreciation and Currency Shock

A weak rupee worsened investor confidence, fueling a cycle of outflows and further depreciation.

- The rupee fell to a record ₹88.80 per USD in September 2025.

- Depreciation raises costs of imports (oil, raw materials), inflates corporate debt servicing for companies with dollar loans, and reduces returns for foreign investors.

- The Reserve Bank of India (RBI) intervened to smooth volatility but avoided fixing the exchange rate.

U.S.–India Trade and Tariff Tensions

Tariffs not only hurt exports but also threaten foreign investment sentiment, making India look riskier for global capital.

- The U.S. government imposed a 50% tariff on Indian goods in 2025, citing disagreements over India’s purchase of discounted Russian oil.

- This directly hit India’s export competitiveness, especially in textiles, IT services, and manufacturing.

- Markets reacted sharply, pricing in weaker growth and strained diplomatic ties.

Weak Corporate Earnings and Valuation Stress

Overvalued markets with slowing earnings tend to correct sharply when external shocks hit.

- Indian equities were trading at high price-to-earnings ratios compared to peers.

- Earnings downgrades in financials, IT, metals, and consumer discretionary highlighted a disconnect between valuations and fundamentals.

- Slowing consumption growth and rising borrowing costs worsened the outlook.

Banking and Financial Sector Weakness

Financials are a large weight in Nifty and Sensex when banks fall, the index almost always suffers.

- Banking stocks bore the brunt of the selloff.

- Example: IndusInd Bank disclosed irregularities in derivative exposure, causing its shares to crash nearly 30%.

- Broader NBFCs (Non-Banking Financial Companies) also faced stress from tighter liquidity and non-performing loans.

Derivative and Structural Market Risks

Derivative unwinds accelerate volatility, turning corrections into steep crashes.

- High leverage in futures and options markets amplified the crash.

- SEBI investigated expiry-day manipulation in Bank Nifty trades involving global market-maker Jane Street, freezing billions in suspicious gains.

- Margin calls triggered forced selling across retail and institutional accounts.

Global Macro and Liquidity Factors

Global liquidity cycles heavily influence emerging markets like India. Tight global conditions make India vulnerable.

- A strong U.S. dollar and higher global interest rates diverted funds away from India.

- Concerns about a global slowdown, especially in China, reduced appetite for emerging markets.

- Crude oil prices spiked due to geopolitical issues, worsening India’s current account deficit.

The crash was not just about one event. It was a perfect storm such as foreign outflows, rupee weakness, trade tariffs, high valuations, financial sector fragility, and global liquidity tightening.

Sectoral Impact

- Worst Hit: Banking, financials, IT, metals, and consumer discretionary stocks.

- Relatively Resilient: FMCG, utilities, and select infrastructure plays.

- Investor Impact: Retail investors faced margin calls; FPIs saw double pressure from equity losses and rupee depreciation; leveraged traders bore the brunt.

Government and RBI Response

These steps aim to restore stability but recovery will depend on trade talks and earnings revival.

- RBI: Intervened in currency markets to slow volatility but avoided a fixed-rate defense.

- SEBI: Tightened scrutiny on derivatives after expiry-day manipulation cases.

- Government: Signaled fiscal support and potential reforms to stabilise investor sentiment.

Will the Market Recover?

Yes, the Indian stock market is expected to recover, but the pace depends on key factors such as foreign investor flows, rupee stability, earnings growth, and U.S.–India trade relations. Analysts outline three possible paths:

- V-shaped rebound if trade tensions ease and FPIs return.

- Gradual recovery with selective sector strength and stable policy support.

- Prolonged weakness if tariffs persist, earnings stay muted, and global liquidity tightens.

Why Recovery Is Likely Over the Long Term

- India’s structural growth drivers (domestic consumption, digital economy, infrastructure spending) remain intact.

- RBI and SEBI interventions are helping stabilize currency and derivatives markets.

- Corporate earnings are projected to improve in late 2025 and 2026.

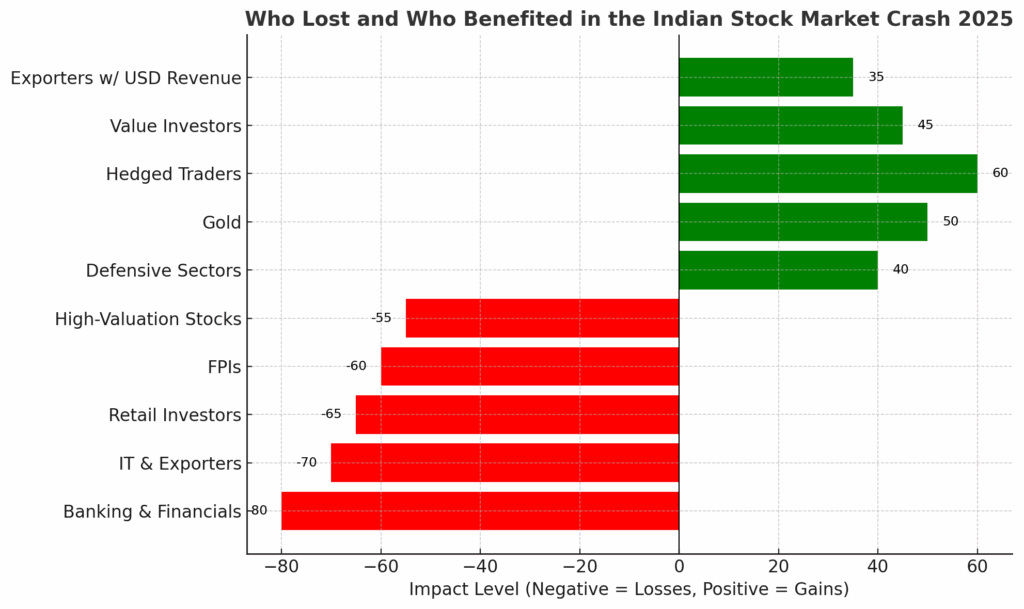

Who Lost and Who Benefited During the Crash?

The Indian stock market crash 2025 did not affect all investors and sectors equally. Some suffered deep losses, while others managed to benefit from volatility and defensive positioning.

Biggest Losers

- Banking and Financials: Heavy selloffs in private banks and NBFCs after derivative exposures and non-performing loan concerns.

- Export-Driven Sectors: IT services and manufacturing companies were hit by U.S.–India tariff tensions.

- Retail Investors: Many faced margin calls as leveraged positions in futures and options were liquidated at a loss.

- Foreign Portfolio Investors (FPIs): Lost on both fronts — equity declines and rupee depreciation, which reduced repatriated returns.

- High-Valuation Growth Stocks: Companies priced for perfection saw steep corrections once earnings downgrades came through.

Beneficiaries and Relative Winners

- Defensive Sectors: FMCG, utilities, and healthcare stocks held up better as investors sought stability.

- Gold and Safe-Haven Assets: Gold gained demand as a hedge against equity and currency volatility.

- Short-Sellers and Hedged Traders: Those who shorted Nifty futures, bought protective puts, or positioned for volatility profited from the downturn.

- Long-Term Value Investors: Investors with cash reserves could accumulate quality companies at cheaper valuations.

- Exporters with Dollar Revenues: Select companies with U.S. dollar earnings benefited from the rupee’s record weakness.

What Traders and Investors Should Do

The Indian stock market crash 2025 has created both risks and opportunities. Success now depends on having the right strategy and discipline:

For Traders

- Use volatility wisely: Trade short-term moves with strict stop losses and position sizing.

- Hedge positions: Protect downside risk using options, futures, or index hedges.

- Avoid over-leverage: Margin calls and forced liquidations can magnify losses.

- Track flows and data: Monitor FPI activity, derivatives open interest, and RBI moves to gauge market sentiment.

For Long-Term Investors

- Focus on quality stocks: Companies with strong balance sheets, low debt, and stable earnings potential.

- Accumulate gradually: Use market dips to build positions rather than chasing rebounds.

- Diversify portfolios: Spread exposure across sectors (IT, banking, FMCG, infrastructure) and asset classes (equities, bonds, gold).

- Think beyond short-term noise: India’s structural growth story remains intact despite near-term volatility.

For Everyone

- Stay alert to risks: Watch for updates on U.S. Fed policy, rupee stability, trade negotiations, and banking sector stress.

- Maintain liquidity: Keep cash buffers to handle uncertainty or seize opportunities.

- Stay disciplined: Stick to your trading plan or investment strategy without letting fear or greed drive decisions.

Conclusion

The Indian stock market crash of 2025 serves as a reminder that global capital flows, currency pressures, trade disputes, and valuation risks can collide to trigger sharp declines. Yet, India’s long-term fundamentals from domestic consumption to digital transformation remain strong, leaving room for recovery once volatility stabilises.

For traders, this is a time to stay disciplined, use hedging strategies, and manage risk carefully. For investors, focusing on quality companies and maintaining a diversified portfolio can turn downturns into long-term opportunities.

At Ultima Markets, we believe that knowledge and preparation are the strongest tools in navigating uncertain markets. With our regulated platform, educational resources, and research insights, we aim to empower traders and investors to trade with purpose and confidence whether markets rise or fall.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.