What Is a Shooting Star Candlestick and How Do You Trade It?

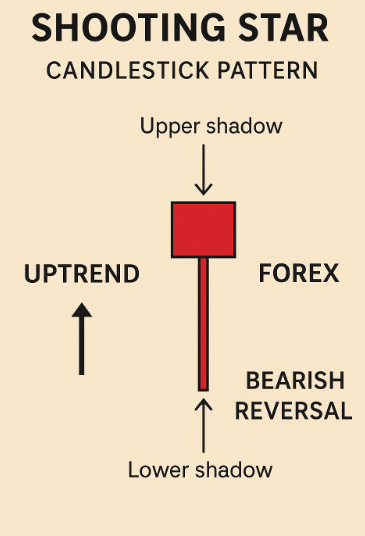

The shooting star candlestick pattern is a bearish reversal pattern that appears at the top of an uptrend. It signals a potential trend reversal, suggesting that the price of an asset may start to decline. This pattern can provide traders with early indications of a shift in market sentiment.

What Are the Characteristics of a Shooting Star Candlestick?

A shooting star candlestick has a few key characteristics that make it recognisable:

- Small Body: The real body of the candlestick, representing the open and close prices, is relatively small.

- Long Upper Shadow: The upper shadow, extending above the real body, is long, at least twice the length of the body. This long shadow represents the price’s attempt to move higher, which was ultimately rejected by the market.

- Short or Non-Existent Lower Shadow: The lower shadow, if present, is very short or non-existent. This indicates that there wasn’t much selling pressure during the period.

- Appearance at the Top of an Uptrend: The shooting star appears after a price has generally been rising, signalling potential exhaustion of the upward momentum.

Visually, it resembles a shooting star falling from the sky, hence the name. Its distinct shape sets it apart from other candlestick patterns.

What Does the Shooting Star Candlestick Pattern Indicate?

The shooting star candlestick pattern indicates a potential reversal from an uptrend to a downtrend. It suggests that the bulls, who were previously in control, are losing their grip, and the bears are starting to take over.

Traders often interpret the shooting star as a warning sign. It doesn’t guarantee a reversal, but it suggests an increased probability of one. Confirmation is frequently sought through subsequent price action.

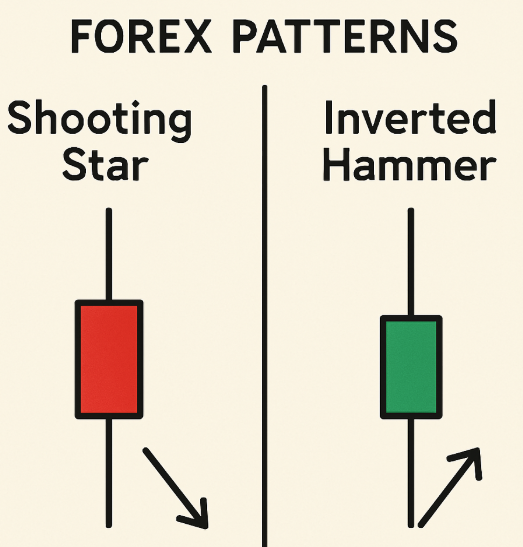

Differences Between Shooting Star and Inverted Hammer

At first glance, the shooting star candlestick and the inverted hammer candlestick share similar visual traits, but they convey different market implications. Here’s how they differ:

| Feature | Shooting Star | Inverted Hammer |

| Trend Context | Appears after an uptrend | Forms after a downtrend |

| Market Signal | Bearish reversal signal | Bullish reversal signal |

| Upper Wick | Long upper wick | Long upper wick |

| Lower Wick | Little to none | Little to none |

| Real Body | Small, at the lower end of the range | Small, at the lower end of the range |

The primary distinction lies in their placement within a trend. While the shooting star suggests a potential bearish reversal in an uptrend, the inverted hammer signals a possible bullish reversal after a downtrend. Traders use the shooting star to anticipate selling opportunities, whereas the inverted hammer is associated with buying opportunities.

Advantages of Using the Shooting Star Candlestick Pattern

Using the shooting star candlestick pattern offers several advantages:

Early Warning Signal: It can provide an early indication of a potential trend reversal, allowing traders to prepare for potential price declines.

- Easy to Identify: The pattern’s distinct shape makes it relatively easy to identify on a price chart.

- Can be Used in Conjunction with Other Indicators: Traders can combine the shooting star with other technical indicators, such as volume or moving averages, to increase the reliability of the signal.

- Helps in Setting Stop-Loss Orders: The pattern can assist traders in setting appropriate stop-loss levels to manage risk.

Disadvantages of Using the Shooting Star Candlestick Pattern

Despite its advantages, the shooting star pattern also has some limitations:

- Not a Foolproof Indicator: Like any technical indicator, the shooting star is not always accurate. False signals can occur, leading to losses.

- Requires confirmation: Look for confirmation of the reversal through subsequent price action. A single shooting star isn’t enough to make a trade.

- Subjectivity in Identification: While the general characteristics are clear, some subjectivity can be involved in identifying a ‘true’

shooting star. Traders may have slightly different interpretations. - Works Best in Specific Market Conditions: The shooting star pattern is most effective in trending markets. In choppy or sideways markets, its reliability can be diminished.

Shooting Star Trading Strategy

Several trading strategies can be employed when using the shooting star candlestick pattern:

- Confirmation Is Key: Don’t immediately enter a trade based on the shooting star alone. Wait for confirmation, such as a bearish candlestick in the following period or a break below a support level. Increased volume on the confirming candle adds weight to the signal.

- Combine with Other Indicators: Use the shooting star in conjunction with other technical indicators, like the Relative Strength Index (RSI) or moving averages, to filter out false signals and improve the accuracy of your trades. For instance, if the RSI is also overbought when a shooting star appears, it strengthens the bearish signal.

- Set Appropriate Stop-Loss Orders: Place a stop-loss order above the high of the shooting star to limit potential losses if the price continues to rise. This helps manage risk effectively.

- Target Potential Support Levels: Identify potential support levels where the price might find buyers. These levels can serve as price targets for your trades.

- Consider the Overall Trend: The shooting star is most effective when it appears at the top of a well-defined uptrend. Be cautious about using it in other market conditions.

- Practice and Experience: The best way to master trading with the shooting star pattern is through practice and experience. Use a demo account to test different strategies before risking real capital.

Conclusion

The Shooting Star candlestick is a reliable signal for spotting potential bearish reversals at the top of an uptrend. When confirmed by strong resistance zones, high volume, or bearish indicators like RSI divergence, this pattern can offer high-probability trade setups.

To maximize your edge, always combine candlestick patterns with sound risk management and market context.

Start applying these strategies with a trusted broker like Ultima Markets, where you gain access to advanced charting tools, real-time data, and institutional-grade execution.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.