Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomHow to Spot Inverted Cup and Handle Pattern

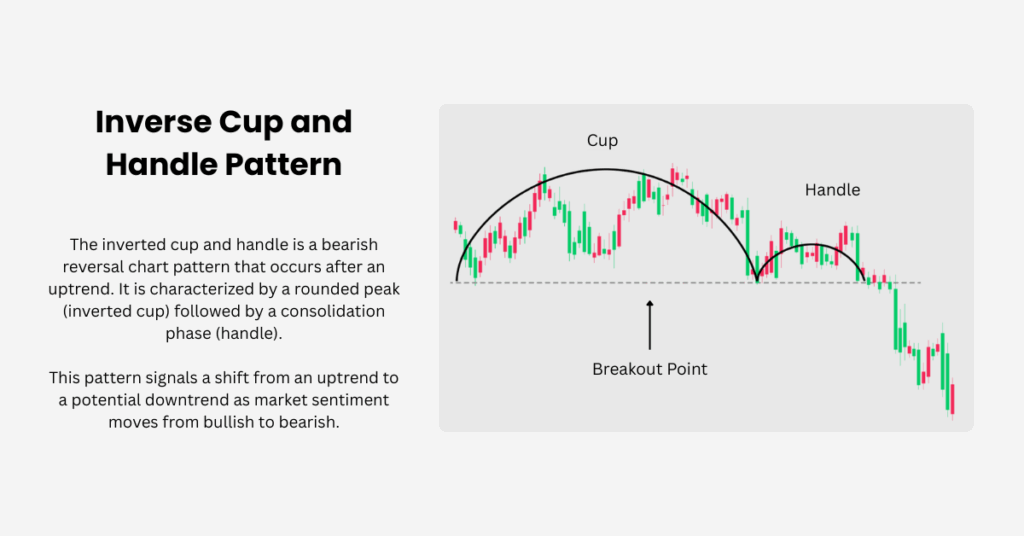

When it comes to chart patterns, the cup and handle pattern is one of the most well-known, but did you know that its inverted version also holds great significance for traders? The inverted cup and handle pattern is a bearish reversal formation that signals a potential downward move after an uptrend.

While many associate the cup and handle pattern with stocks, it’s important to note that it works just as effectively across different markets, including Forex and commodities. As we explore the inverted version of this pattern, we’ll see how versatile it really is and how traders can use it in various markets.

What is the Inverted Cup and Handle Pattern?

The inverted cup and handle is essentially the opposite of the traditional cup and handle pattern. It is considered a bearish chart pattern, signaling a shift in market psychology from optimism to pessimism. Rather than signaling the continuation of an uptrend, this pattern occurs after an uptrend and signals a possible reversal into a downtrend. It’s characterised by a rounded top, also known as an upside-down cup or reverse cup, where the price action forms a rounded peak before entering a consolidation phase, creating the “handle.”

Once the price breaks below the handle’s support level, it indicates that the downtrend may be beginning, confirming the pattern’s validity.

The Cup and Handle Pattern: A Bullish Counterpart

For comparison, the cup and handle pattern is widely recognised as the bullish counterpart to the inverted cup and handle. In the bullish pattern, the price forms a rounded decline, creating the “cup,” followed by a small upward retracement, forming the “handle.” Once the price breaks above the resistance of the handle, the pattern signals a continuation of the uptrend.

Unlike the inverted cup, which signals a potential downward movement, the cup and handle pattern is used to identify bullish opportunities. The handle typically forms after the cup, reflecting a brief pause in the uptrend before the breakout.

Key Characteristics

- Uptrend Preceding the Pattern: Before the inverted cup and handle pattern begins, you’ll typically see a strong uptrend. This provides the context for the pattern, showing a clear shift from bullish to bearish.

- Rounded Top (The Cup): The first part of the pattern is the rounded top, resembling the cup in the traditional pattern but flipped upside down. This is formed when the market starts to show signs of weakness, with prices reaching a peak before retreating in a rounded formation.

- Handle Formation: After the rounded top, the price enters a consolidation phase, forming the handle. This handle should not be too steep or prolonged and ideally should create a horizontal or slightly downward-sloping formation. The handle forms as brief consolidation, and traders watch to see whether it’s bullish or bearish.

- Breakdown: The key confirmation of the inverted cup and handle is when the price breaks below the bottom of the handle. This breakdown signifies a shift in market sentiment, where selling pressure has overcome buying pressure, indicating that the market may now be moving lower. The breakdown point is where the handle breaks, and declining prices often follow.

Timeframes for the Inverted Cup and Handle Pattern

While this pattern can appear on any timeframe, higher timeframes like the daily or weekly charts tend to provide more reliable signals. Lower timeframes, such as hourly or 15-minute charts, often show more noise and false breakouts. The inverted cup and handle pattern is one of several bearish continuation patterns that work better on higher timeframes due to increased volume and market participation.

Trading the Inverted Cup and Handle Pattern

Once you spot the inverted cup and handle pattern, here’s how you can trade it. The trade inverted cup strategy is a bearish reversal approach that aims to capitalise on a potential downtrend:

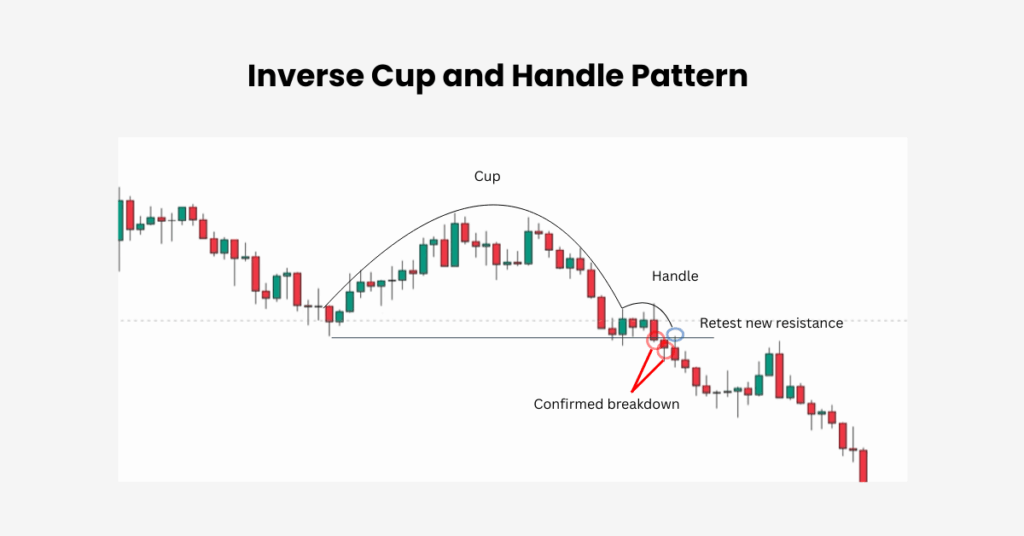

- Confirm the Pattern: Wait for the price to break below the bottom of the handle. This breakout confirms the pattern’s validity and signals a potential downtrend. When the price broke below support, it serves as a strong trigger for entering short trades.

- Entry Point: Ideally, enter after the price breaks below the neckline, confirming the bearish reversal. Some traders prefer to wait for a retest of the neckline as new resistance before entering. Carefully consider your entry price to optimise trade entries and avoid market noise. After confirmation, you can open a short position to take advantage of the expected decline.

- Stop-Loss: Place your stop-loss above the handle’s high or the breakout candle to minimise risk. Effective risk management is essential to help minimise losses and optimise gains when trading this pattern.

- Target Price: To calculate your target, measure the height of the cup (from the top to the lowest point of the handle) and subtract it from the breakout point. Set your profit targets using a distance equal to the height of the cup, projected downward from the breakdown point. Pre-planning profit targets is important to optimise gains and manage risk effectively.

Key Takeaways

- The inverted cup and handle pattern signals a potential bearish reversal after an uptrend.

- Confirm the pattern by waiting for a break below the neckline, followed by a retest or further breakdown.

- This pattern is useful in various markets, including Forex, and is not just limited to stocks.

- Higher timeframes generally provide more reliable patterns and breakouts.

By recognising and trading the inverted cup and handle pattern, traders can capitalise on potential downtrends and enhance their trading strategies.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.