Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomShorting Bitcoin allows traders to profit from its price declines. This strategy involves borrowing Bitcoin, selling it at the current market price, and repurchasing it later at a lower price. If the price drops, the trader can buy back the Bitcoin at a reduced cost, returning it to the lender and keeping the difference as profit.

What Is a Short in Bitcoin?

A short position in Bitcoin is a bet that its price will decrease. Traders borrow Bitcoin from an exchange or another party, sell it at the current market price, and aim to repurchase it at a lower price. This strategy is commonly used in both traditional and cryptocurrency markets to capitalize on declining asset prices.

How to Short Bitcoin? 7 Methods

Margin Trading

Margin trading involves borrowing funds from a broker to trade Bitcoin. By borrowing Bitcoin and selling it, traders can profit if the price declines. However, this method carries significant risks, including the potential for liquidation if the market moves against the position.

Futures Contracts

Bitcoin futures are agreements to buy or sell Bitcoin at a predetermined price at a future date. Traders can sell Bitcoin futures contracts to profit from price declines. These contracts are available on regulated exchanges like the Chicago Mercantile Exchange (CME).

Options Trading

Options give traders the right, but not the obligation, to buy or sell Bitcoin at a specific price within a set time frame. Purchasing put options allows traders to profit from price declines. This method provides limited risk, as the maximum loss is the premium paid for the option.

Exchange-Traded Funds (ETFs)

Inverse Bitcoin ETFs are designed to profit from Bitcoin price declines. These funds aim to deliver the opposite performance of Bitcoin, allowing traders to short Bitcoin without directly borrowing the asset. However, such ETFs may have limited availability depending on the region.

Contract for Difference (CFD)

CFDs allow traders to speculate on Bitcoin’s price movements without owning the asset. By entering into a CFD contract, traders can profit from both rising and falling Bitcoin prices. However, CFDs are not permitted in all jurisdictions, such as the United States.

Peer-to-Peer (P2P) Platforms

Some P2P platforms facilitate borrowing Bitcoin from other users to sell at current prices, aiming to repurchase at lower prices. These platforms offer an alternative to traditional exchanges but come with their own set of risks and considerations.

Prediction Markets

Prediction markets allow traders to bet on the outcome of specific events, including Bitcoin’s price movements. By participating in these markets, traders can profit from price declines if their predictions are correct.

Factors to Consider While Shorting Bitcoin

Shorting Bitcoin can be a profitable strategy, but it comes with inherent risks due to the cryptocurrency’s volatility and market dynamics. Before entering a short position, it’s essential to consider factors such as market volatility, liquidity, leverage, and transaction fees. Understanding these elements helps traders manage risks effectively and make informed decisions, maximizing the potential for profit while minimizing the chance of significant losses.

Volatility:

Bitcoin is known for its extreme price fluctuations. These large swings in price can present both opportunities and risks for short traders. If the market moves in your favor, the volatility can lead to significant gains, but if it moves against you, it can result in substantial losses. The unpredictable nature of Bitcoin’s price makes timing and strategy critical when shorting.

Liquidity:

Liquidity refers to how easily you can enter or exit a position without significantly affecting the market price. If the market lacks liquidity, it might be harder to execute trades at the desired price, potentially reducing profitability. In less liquid markets, slippage can occur, where the price you pay or receive differs from the expected price.

Leverage:

Leverage allows traders to control a larger position than their capital would allow by borrowing funds. While this can amplify profits if the market moves in your favor, it also increases the risk. High leverage can lead to liquidation if the price moves against your position, potentially causing large losses. It’s important to carefully manage leverage and use it with caution.

Fees:

When shorting Bitcoin, traders may incur various fees, such as borrowing fees for margin trading, transaction fees for buying and selling, and platform fees. These fees can eat into potential profits, especially for short-term trades. It’s crucial to factor in all associated costs when calculating the profitability of a short position.

Can You Make Money Shorting Bitcoin?

Yes, it is possible to profit from shorting Bitcoin if its price declines. However, this strategy carries significant risks, including the potential for substantial losses if the market moves against the position. Effective risk management, such as setting stop-loss orders and using appropriate leverage, is essential for success.

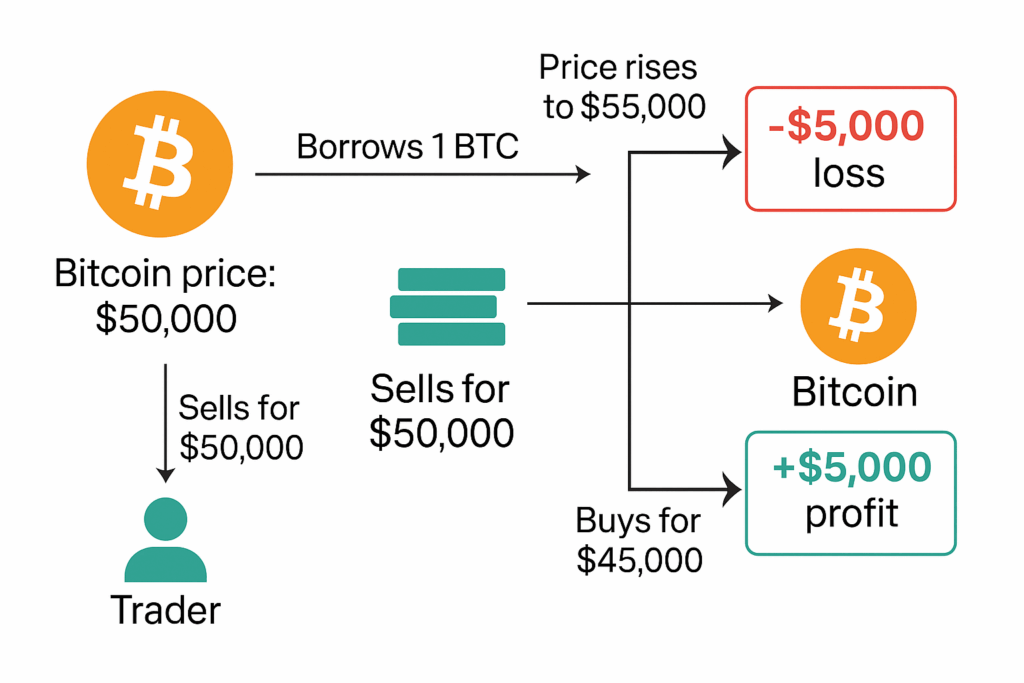

Example of Bitcoin Short-Selling

Suppose Bitcoin is trading at $50,000. A trader borrows 1 BTC and sells it at the current price, receiving $50,000. If the price drops to $45,000, the trader repurchases 1 BTC for $45,000, returns the borrowed Bitcoin, and keeps the $5,000 difference as profit. Conversely, if the price rises to $55,000, the trader incurs a $5,000 loss.

Conclusion

Shorting Bitcoin can offer lucrative opportunities for experienced traders, but it’s essential to understand the risks involved, such as volatility, liquidity, leverage, and fees. At Ultima Markets, we provide the tools and resources to help you navigate the complexities of crypto trading with confidence. Whether you’re new to shorting or an experienced trader, our platform offers secure, reliable services and a range of advanced features to support your trading strategy. Stay informed, trade wisely, and leverage our resources to make the most of Bitcoin’s market movements.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.