Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow to Manage ETF Overlap: Is it bad?

ETF overlap happens where multiple exchange-traded funds (ETFs) in your portfolio hold the same underlying securities or stocks. For example, if you invest in both a global diversified ETF and a sector-specific ETF, they may end up holding the same companies, creating redundancy in your portfolio.

This concept, often referred to as fund overlap, also applies to other investment vehicles such as mutual funds, where holding multiple funds with similar or identical holdings can reduce overall diversification.

While ETF overlap isn’t inherently bad, it can result in unintended risks, such as reduced diversification or higher exposure to specific sectors or stocks. This can lead to less-than-optimal portfolio performance. Therefore, it’s important to review all important information about your funds, including holdings and disclosures, to fully understand potential overlap and its implications.

Why Does ETF Overlap Matter?

ETF overlap matters because it can skew your portfolio’s balance. When two or more ETFs hold the same stocks, your investment may be overly concentrated in those stocks at the individual security level, reducing your overall diversification. This overlap can increase your portfolio’s exposure to certain stocks or sectors, amplifying risks if those stocks or sectors underperform.

For example, you may have one ETF tracking a global index and another focused on a specific sector like technology. Both ETFs might hold stocks like Apple or Microsoft, giving you more exposure to these companies than you might have intended, which could increase the risk in your portfolio. The point here is that excessive overlap can lead to overexposure, making it important to monitor your portfolio’s exposure to each security.

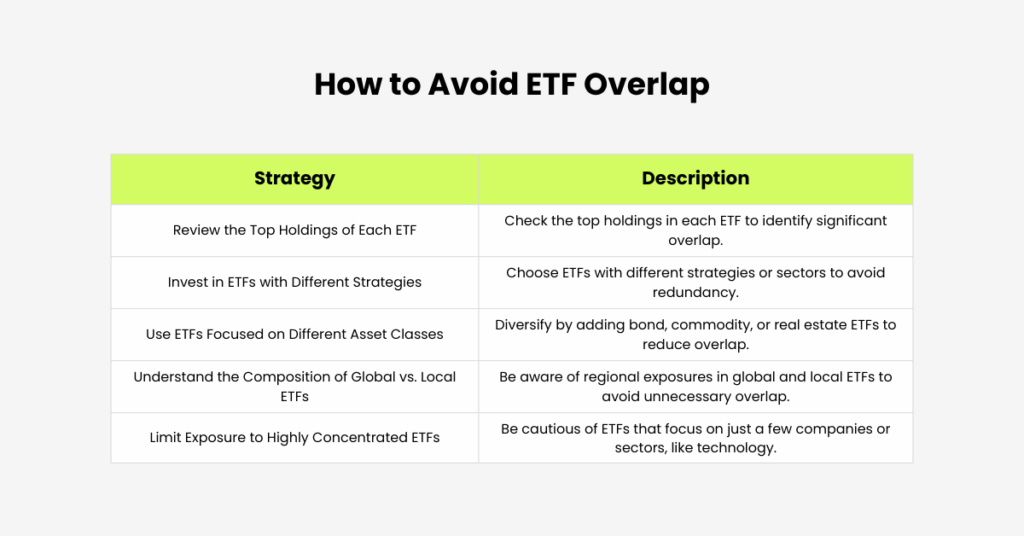

How to Avoid ETF Overlap Without Sacrificing Diversification

1. Review the Top Holdings of Each ETF

The first step in avoiding ETF overlap is to review the top holdings of each ETF you own. By leveraging data to analyse ETF holdings, you can identify whether there’s any significant duplication of stocks across different funds. Many ETF providers make their holdings available online, so checking them regularly can help you keep track of overlap.

- Tip: Use portfolio analysis tools like ETF Tracker, provided by a company specialising in investment solutions, to visualise your ETF holdings and spot any overlap between ETFs. Some tools can also generate a report highlighting overlap and concentration risk.

2. Invest in ETFs with Different Strategies

One way to avoid ETF overlap is by selecting ETFs that follow different investment strategies or track different sectors. For example, if you own an ETF that tracks the S&P 500, avoid adding another general-market ETF.

Instead, consider investing in sector-specific ETFs (e.g., technology, healthcare) or thematic ETFs (e.g., clean energy, AI), which will expose you to different stocks and industries. When choosing among these options, also consider the cost of each ETF, as lower-cost ETFs can help reduce your overall investment expenses.

- Tip: Diversify by adding international ETFs or fixed-income ETFs to reduce concentration in a single market or sector. When selecting ETFs, compare their expenses and fees to avoid unnecessary overlap and minimise the impact of costs on your returns.

3. Use ETFs Focused on Different Asset Classes

To achieve a truly diversified portfolio, consider adding ETFs that focus on different asset classes, such as bonds, commodities, or real estate. By diversifying across asset classes, you not only reduce ETF overlap but also hedge against sector-specific downturns.

- Tip: A mix of equity ETFs and bond ETFs or commodity ETFs can provide stability to your portfolio. Diversification is especially important for retirement portfolios, as it helps maintain long-term growth and manage risk.

4. Understand the Composition of Global vs. Local ETFs

Global ETFs often have significant exposure to local markets, but they can also provide access to the entire world market. For example, a global diversified ETF might have a large portion of its holdings in U.S. stocks, while an ETF that focuses on the U.S. market would obviously hold the same stocks, creating overlap. You can avoid this overlap by understanding the geographic and market exposures of each ETF before investing.

- Tip: If you want global exposure, consider global all-market ETFs instead of buying two funds or multiple regional ETFs that could overlap, as holding two funds with similar regions may reduce diversification.

5. Limit Exposure to Highly Concentrated ETFs

Some ETFs, especially those focused on a specific sector (like technology or large-cap stocks), can be very concentrated in a few companies. For instance, an S&P 500 ETF may allocate a large percentage of its weight to the top five companies, such as Apple, Microsoft, and Amazon. When paired with a sector ETF like FANG (focused on tech stocks), you could be unintentionally overexposing yourself to those companies.

- Tip: Pay close attention to the concentration of stocks in sector-focused ETFs and avoid purchasing additional funds that concentrate too heavily in the same stocks. You may need to sell overlapping ETFs to improve diversification, and making a trade to rebalance your portfolio can help manage overlap.

Practical Example: How to Avoid ETF Overlap

Let’s say you have $10,000 to invest and are considering two ETFs: one is a global diversified ETF (with 40% U.S. exposure) and the other is a U.S.-focused ETF (with 50% overlap in U.S. stocks). If you invest $5,000 in each, you’re essentially doubling your exposure to U.S. stocks.

Instead, investing the entire $10,000 in the global diversified ETF gives you broader geographical diversification and reduces unnecessary overlap in the U.S. market.

How to Allocate Your Funds Without Overlap:

- Global ETF (40% U.S. exposure): $10,000 in a global diversified ETF with different geographical exposures.

- U.S. ETF: Avoid this ETF to reduce overlap and ensure broader diversification.

When reallocating, consider tax implications as changes in your portfolio can affect your tax obligations and overall tax efficiency.

Conclusion: Stay Aware, Stay Diversified

ETF overlap isn’t inherently bad, but it can reduce diversification and expose you to unnecessary risks. By regularly reviewing your ETF holdings and your overall investments to ensure proper diversification and avoid unnecessary overlap, choosing funds that track different sectors or asset classes, and leveraging tools to monitor overlap, you can ensure your portfolio remains diversified and well-balanced.

Remember, diversification is the key to a resilient portfolio. By managing ETF overlap carefully, you can achieve your investment goals without sacrificing exposure to a broad range of opportunities.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.