Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomCryptocurrency markets are open 24/7, offering traders constant opportunities to react to price swings. Day trading crypto means buying and selling digital assets within the same day to capture intraday volatility. For beginners, this guide explains what day trading is, how to start, key risks, strategies, and indicators that can help.

Risk reminder: Crypto is highly volatile, and most new traders lose money. Always use stop-loss orders, manage your risk, and never trade with funds you can’t afford to lose.

What Is Day Trading?

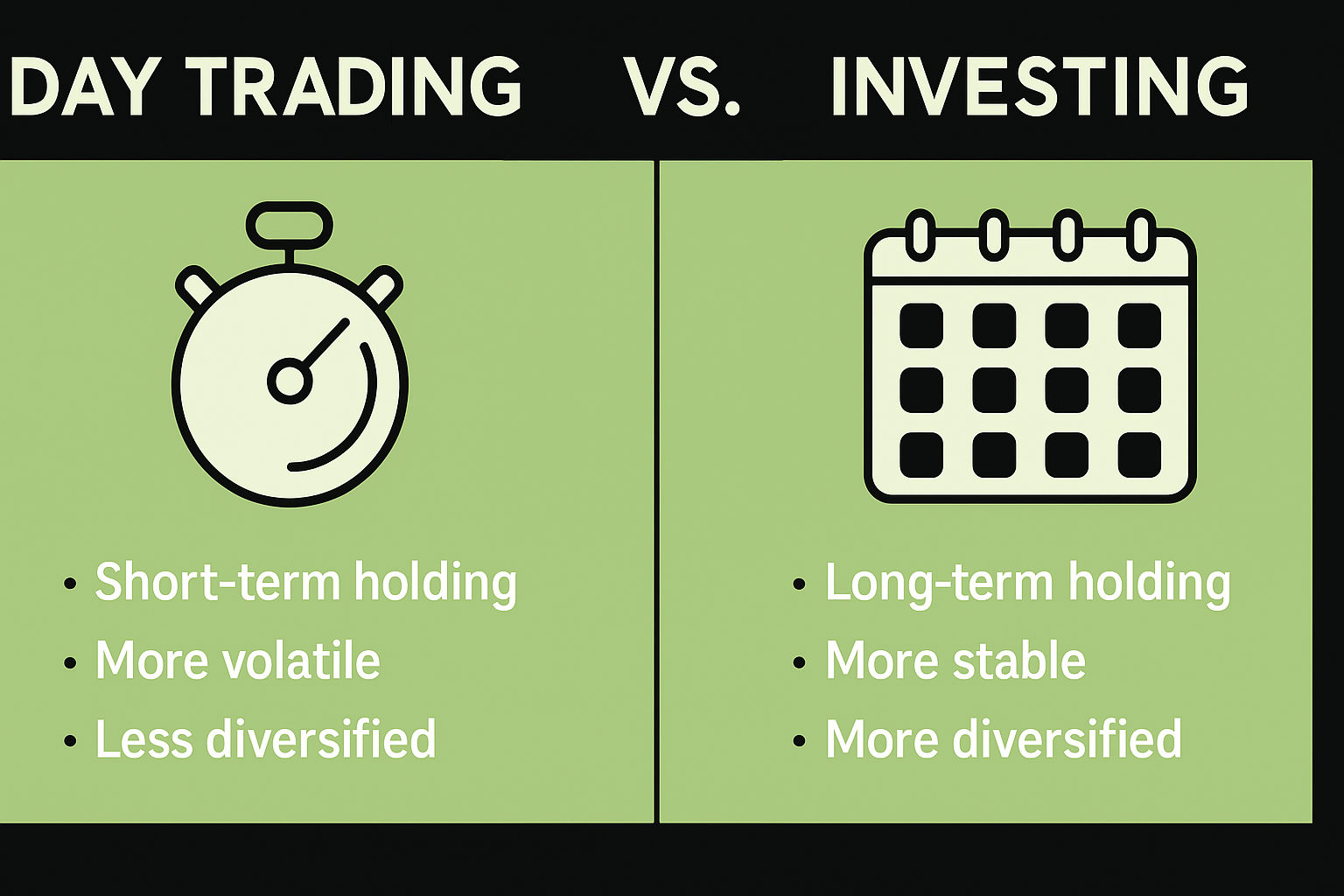

Day trading is a short-term strategy where traders open and close positions within the same day. The aim is to profit from intraday price moves rather than holding for the long term.

Unlike stocks, the crypto market never closes, meaning more opportunities but also more exposure to risk and overtrading.

How to Day Trade Crypto for Beginners

With these five core steps, learn, choose wisely, start small, manage risk, and practice. You’ll have a solid foundation to begin day trading cryptocurrency.

Learn the Basics

- Before you place your first trade, take time to understand how crypto markets work:

- 24/7 trading: Unlike stocks, crypto never closes, which creates constant opportunities but also increases risk of burnout.

- Volatility: Prices can move sharply within minutes, both up and down.

- Leverage risk: Some exchanges offer leverage, but beginners should avoid it until they gain experience.

- Costs: Trading fees and spreads can eat into profits, so always factor them in.

Pick a Trusted Exchange

- Your exchange is where all your trades will happen, so security and reliability are non-negotiable:

- Security: Look for platforms with a clean track record, strong regulation (if possible), and features like cold storage and 2FA.

- Liquidity: High-volume exchanges make it easier to buy and sell quickly without slippage.

- Fees: Compare maker/taker fees and hidden costs, since frequent trading makes these add up.

- User experience: For beginners, a simple interface can help you focus on trading instead of figuring out the platform.

Start Small

- Jumping in with large sums is one of the biggest mistakes beginners make. Instead:

- Deposit only what you can afford to lose.

- Begin with small trades (micro amounts or test trades) to practice executing orders.

- Focus on learning consistency, not chasing big profits.

Use a Trading Plan & Risk Controls

- Day trading without a plan is like gambling. A clear framework helps remove emotions:

- Define entries and exits: Decide in advance what signals you’ll use to enter and when to exit.

- Always use stop-loss orders: This automatically limits your downside if the market moves against you.

- Limit risk per trade: A common rule is to risk no more than 1–2% of your account on a single trade.

- Avoid revenge trading: Stick to your rules even after a loss, discipline is what separates traders from gamblers.

Practice Before Going Big

Day trading is a skill built over time, not overnight:

- Demo accounts: Many exchanges offer simulated trading where you can practice without risking real money.

- Track your trades: Keep a journal of entries, exits, and results to refine your strategy.

- Scale slowly: Only increase trade size once you’ve proven your method works over a significant sample.

What Should You Look For When Day Trading Crypto?

When scanning the market:

- Liquidity: Choose coins with high daily volume.

- Volatility: More movement means more opportunities.

- News catalysts: Regulatory updates, exchange listings, or macroeconomic events can spark sharp moves.

- Chart patterns: Support, resistance, and candlestick signals help identify setups.

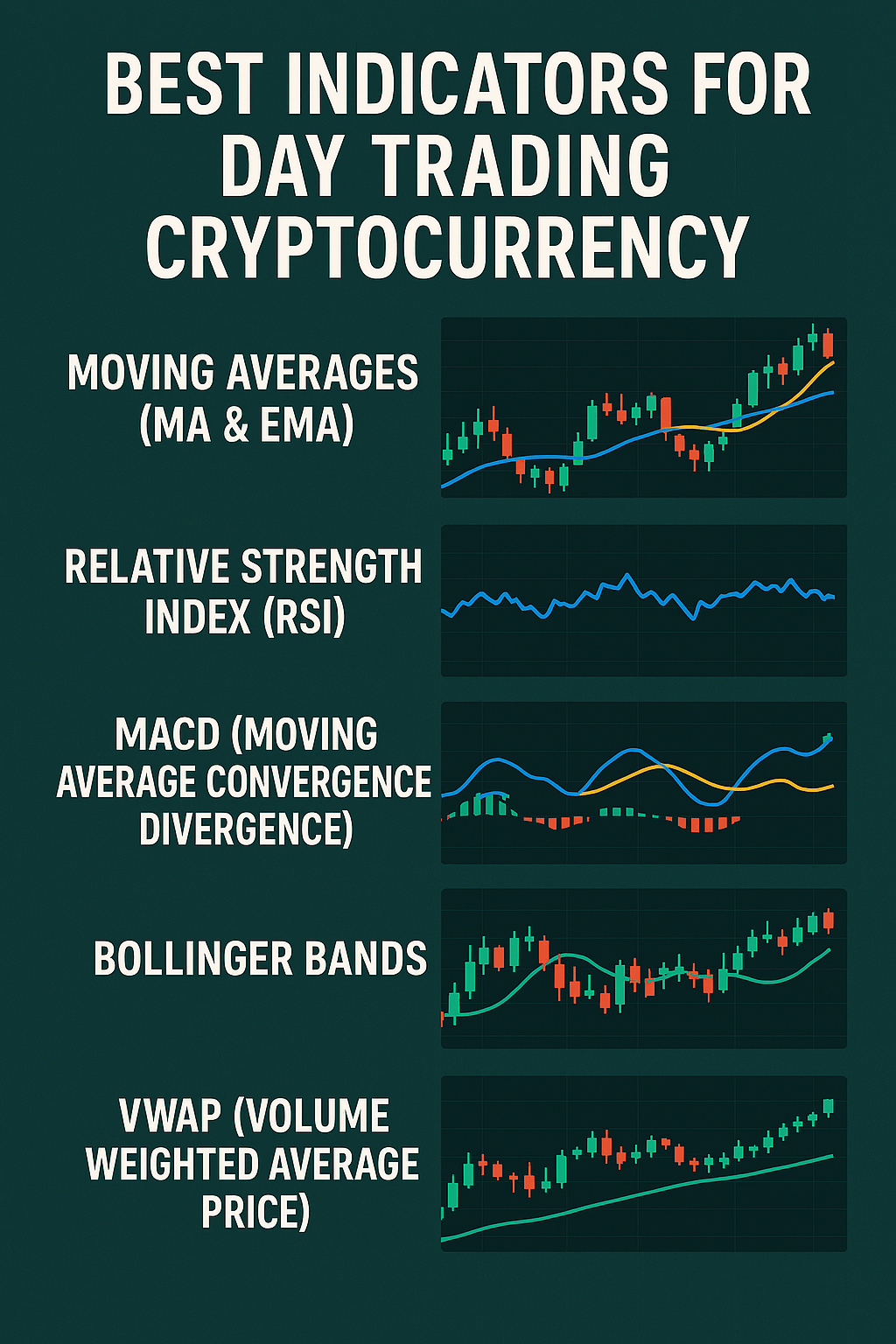

Best Indicators for Day Trading Cryptocurrency

Technical indicators can help traders analyze price action and identify potential entry and exit points. While no single indicator guarantees success, combining a few can give you more confidence in your trades. Here are some of the most effective indicators for day trading crypto:

Moving Averages (MA & EMA)

- What it shows: The average price over a chosen period.

- Why traders use it: Helps identify the overall trend (uptrend, downtrend, sideways).

- Tip: The Exponential Moving Average (EMA) reacts faster to recent prices, making it useful for intraday trading.

- Common strategy: Watch for crossovers (e.g., 9-EMA crossing above 21-EMA may signal bullish momentum).

Relative Strength Index (RSI)

- What it shows: Whether an asset is overbought (typically above 70) or oversold (below 30).

- Why traders use it: Helps anticipate reversals or confirm trend strength.

- Tip: Combine RSI with support/resistance to avoid false signals.

MACD (Moving Average Convergence Divergence)

- What it shows: Momentum and trend direction by comparing two EMAs.

- Why traders use it: Great for spotting trend changes and momentum shifts.

Key signals:

- Line crossover: When the MACD line crosses above the signal line → potential bullish move.

- Histogram: Shows the strength of momentum.

Bollinger Bands

- What it shows: A moving average with two standard deviation bands above and below it.

- Why traders use it: Measures volatility and helps spot potential breakouts.

Tip:

- Price touching the upper band = overextended (possible pullback).

- Price hugging the band with high volume = continuation trend.

VWAP (Volume Weighted Average Price)

- What it shows: The average price of an asset based on both price and volume.

- Why traders use it: Acts as a benchmark for intraday trading.

Tip:

- Price above VWAP = bullish sentiment.

- Price below VWAP = bearish sentiment.

Often used by professional traders to gauge fair value intraday.

For beginner traders, don’t rely on one tool. Combine 2–3 indicators for stronger confirmation (e.g., RSI + MACD + support levels).

How Much Can a Crypto Day Trader Make?

There is no guaranteed income from day trading. Earnings vary based on market conditions, skill, and discipline.

Regulators such as the U.S. SEC caution that many day traders lose money, especially when trading volatile markets like crypto. Success requires consistent risk management and experience, and profits should never be assumed.

Can Day Trading Make Money?

Yes, but only for a small portion of traders who develop the right skills and discipline. Most beginners lose money because of underestimating volatility, overusing leverage and lack of a trading plan. It’s possible to make money, but the majority of traders fail to do so consistently.

Is Crypto Day Trading Worth It?

It depends on your personality and goals:

- Advantages: High liquidity, round-the-clock trading, potential for quick gains.

- Disadvantages: High stress, fast decision-making required, steep learning curve, high risk of losses.

For some, the flexibility and opportunities are appealing. For others, longer-term strategies like swing trading or investing may be more sustainable.

What Are Other Cryptocurrency Trading Strategies?

Day trading is only one of many ways to trade cryptocurrencies. Depending on your goals, time commitment, and risk tolerance, you may prefer one of the following strategies:

- Swing trading involves holding positions for several days or even weeks, aiming to capture medium-term price moves. It works because cryptocurrencies often move in cycles, giving traders the chance to ride trends without reacting to every minor fluctuation.

- Scalping is an intense short-term method where traders make many small trades within minutes or hours. The strategy works by exploiting tiny price movements that add up over time, provided transaction costs and slippage are kept low.

- Position trading takes a longer-term view, with traders holding coins for months based on broader market trends and fundamentals. It works by filtering out daily volatility and focusing on sustained directional moves.

- HODLing, which started as a meme, simply means buying and holding crypto for years regardless of short-term swings. It works for those who believe in the long-term adoption of blockchain technology and are willing to endure volatility for potential growth.

- Arbitrage trading takes advantage of price differences for the same asset across different exchanges. It works because crypto markets are fragmented, and prices don’t always align instantly, creating opportunities for quick profits.

- Algorithmic or bot trading uses automated systems to execute trades based on pre-set rules. This works by removing emotions, reacting instantly to signals, and allowing strategies to run around the clock, something human traders can’t do.

Conclusion

Day trading crypto can be exciting, but it’s also one of the riskiest trading styles. Success requires discipline, patience, and effective risk management. For beginners, starting small, using clear strategies, and exploring alternative approaches like swing trading or HODLing can help build confidence while limiting exposure to unnecessary risk.

At the end of the day, there’s no single “right” strategy, the best approach depends on your goals, time commitment, and risk tolerance. What matters most is learning continuously, protecting your capital, and trading responsibly.

Ultima Markets supports traders on this journey by offering a secure, regulated platform, advanced trading tools, and educational resources to help you sharpen your skills. Whether you’re testing your first strategy or refining your approach, with Ultima Markets you can trade smarter and trade with purpose.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.