Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow Much Money Is There In The World 2025?

In 2025, the total amount of money in the world is estimated at $150 trillion USD based on the broadest definition of money (M3). The broadest estimates, including physical currency, bank deposits, and liquid assets (M3), put the total at approximately $150 trillion USD. This number grows to over $500 trillion USD when you include global assets like real estate, equities, and commodities.

So now you know how much money is in the world but how much is there in USD?

How Much Money Is In The World In USD?

As of 2025, the total amount of money in the world is estimated at $150 trillion USD using the broadest measure (M3).

The estimated total amount of money in the world, depending on the definition used, is:

- M0 (Physical cash): ~$8.3 trillion USD

- M1 (Cash + Checking deposits): ~$65 trillion USD (estimated globally)

- M2 (M1 + Savings accounts + Small time deposits): ~$123 trillion USD

- M3 (M2 + Large time deposits + Institutional money): ~$150 trillion USD

These numbers represent the different layers of liquidity in the global economy. The broader the measure (from M0 to M3), the more inclusive it is of assets considered “money.”

How Much Money Is There in the World per Person?

With a global population of approximately 8.1 billion in 2025, the average money per person depends on the money supply metric:

- M0 per person: ~$1,025

- M1 per person: ~$8,025

- M2 per person: ~$15,185

- M3 per person: ~$18,520

Note: These averages are purely mathematical. Wealth distribution is extremely uneven, with the top 10% of individuals owning over 70% of global wealth.

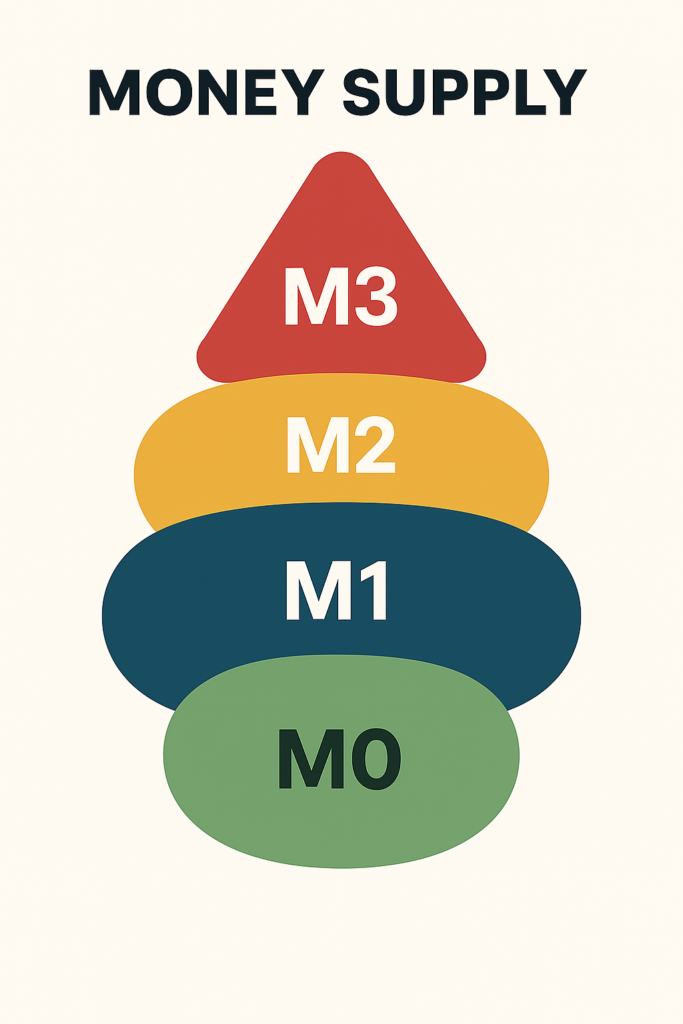

So, the article has mentioned M0, M1, M2, and M3 but what do these terms actually mean? Let’s break it down simply.

What Does Global Money Supply Mean?

The global money supply is the total amount of money circulating in the world economy. It includes physical cash and various types of bank deposits. Economists categorize this money into different levels based on how easily it can be accessed or spent:

- M0 – This is the most basic form: physical cash like coins and banknotes.

- M1 – Includes M0 plus money in checking accounts. It’s the most liquid form money you can spend right away.

- M2 – Adds savings accounts and small time deposits to M1. It’s money that’s still fairly accessible but not used for daily spending.

- M3 – Includes M2 plus larger, institutional deposits. This is money that flows more slowly and is often used by big banks or corporations.

Each level helps economists measure how much money is actually available in the financial system from your wallet to global markets.

What’s the Difference Between M1, M2, M3 and M4 Money Supply?

Each money supply term like M0, M1, M2, and M3 represents a different layer of liquidity, or how quickly money can be used for spending. We need these categories because not all money is equally available. Some money sits in savings or investments, while some is ready to be spent instantly.

Here’s how they differ:

| Money Supply | What It Includes | Liquidity | Who Uses It |

| M0 | Physical cash only (coins, notes) | Most liquid | Everyday people |

| M1 | M0 + Checking accounts | Very liquid | Consumers and small businesses |

| M2 | M1 + Savings accounts + Small deposits | Moderately liquid | Households, retail banks |

| M3 | M2 + Large deposits + Institutional funds | Least liquid | Governments, big investors |

Why These Differences Matter:

- Central banks use these categories to monitor inflation and set interest rates.

- Economists use them to understand how much money is really available to fuel the economy.

- Traders and investors track these to predict market movements and liquidity trends.

So, in simple terms: the more “M” you add, the broader and less liquid the money becomes. M0 is your wallet, M3 is Wall Street.

Are M1 and M2 Really Money?

Yes, M1 and M2 are both considered real money. M1 includes cash and money in checking accounts like funds you can use immediately. M2 includes M1 plus savings accounts and time deposits, the money you can access easily, but not typically used for daily spending.

What Happens When Money Supply Increases?

An increase in money supply can stimulate economic growth if it matches productivity. When the money supply increases especially through central bank actions like printing money or lowering interest rates, it can have significant effects on the economy. The outcome depends on whether the increase in money matches economic productivity.

Short-Term Effects: Stimulates Growth

In the short run, more money in the economy means:

- Consumers have more to spend, boosting demand for goods and services.

- Businesses can borrow more cheaply, encouraging investment and hiring.

- Interest rates usually fall, making loans more attractive.

This is why central banks often increase the money supply during economic downturns to avoid recessions and keep the economy moving.

Medium-Term Effects: Risk of Inflation

If the money supply grows faster than the economy can produce goods and services, it leads to too much money chasing too few goods. This causes:

- Inflation – prices rise because demand exceeds supply.

- Weaker purchasing power – your money buys less than before.

- Asset bubbles – money flows into stocks, real estate, or crypto, inflating prices unsustainably.

Long-Term Effects: Devaluation and Instability

If the increase continues unchecked over time:

- Currency devaluation may occur—foreign investors lose confidence in the currency.

- Savings lose value – especially harmful for retirees and fixed-income earners.

- In extreme cases, hyperinflation can happen (e.g. Zimbabwe, Venezuela).

Conclusion

Understanding what happens when the money supply increases helps you anticipate interest rate changes, inflation risks and investment opportunities or threats. Whether you’re trading forex or planning long-term investments, tracking central bank policies on money supply is crucial to staying ahead of market trends.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.