Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomGrid trading is a systematic strategy where traders place buy and sell orders at predefined intervals above and below a reference price. The goal is to capture small profits as markets fluctuate without needing to predict exact direction. While most common in forex, grid trading has become increasingly popular in crypto and, in certain contexts, stock markets. It is often automated with bots, allowing for precise execution and reduced emotional decision-making.

What Is Grid Trading?

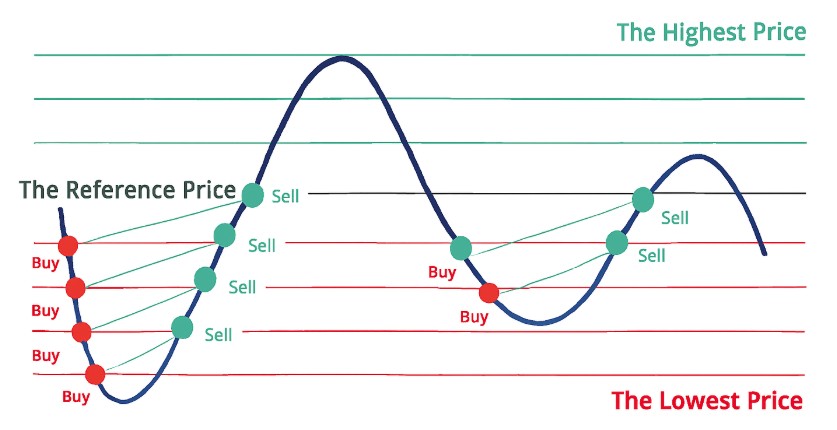

At its core, grid trading creates a “grid” of orders across a price range. When the market dips into buy levels, long positions are opened, and as it rises into sell levels, trades are closed for a profit. The system resets repeatedly, aiming to take advantage of normal price oscillations rather than forecasting major market moves. This makes grid trading attractive for range-bound markets where volatility creates opportunities.

How Does Grid Trading Work?

A trader begins by setting an upper and lower price boundary based on recent highs and lows or technical levels. This range is divided into multiple segments, and pending orders are placed at each level. For example, in a $20 range on EUR/USD, a trader might place buy orders every 20 pips below the base price and sell orders every 20 pips above it. As price moves, the strategy systematically buys low and sells high.

There are two main approaches: against-the-trend grids, designed for sideways conditions, and with-the-trend grids, which scale into trending moves but require strict exit rules. Adaptive or dynamic grids are more advanced, adjusting levels automatically based on volatility.

Grid Trading in Forex, Crypto and Stock Markets

Grid trading can be applied across different financial markets, but its effectiveness and risks vary depending on the asset class.

Forex Trading

In Forex, grid trading has long been a popular approach. Currency pairs such as EUR/USD or GBP/JPY often spend long periods oscillating within well-defined ranges. This makes them suitable for strategies that thrive on repeated small price movements.

Traders can set grids around technical support and resistance levels, letting the system buy when prices dip and sell when they rebound. Because forex is highly liquid and operates 24 hours a day, execution is efficient and automation through expert advisors (EAs) or bots is common. Still, sustained directional trends, for instance, when central banks shift monetary policy can quickly overwhelm a grid if stops are not in place.

Crypto

In Crypto, grid trading has exploded in popularity thanks to the extreme volatility and the fact that the market never closes. Exchanges such as Binance and KuCoin even offer built-in grid bots for retail traders, lowering the barrier to entry. The constant price swings of assets like Bitcoin and Ethereum provide fertile ground for grids to capture small profits around the clock.

However, the same volatility that creates opportunity also magnifies risk. During strong bull runs or market crashes, open positions can accumulate losses quickly, particularly for inexperienced traders who run grids without stop-losses. Costs such as trading fees and funding rates on derivatives also play a bigger role than many anticipate.

Stock Markets

In Stock Markets, grid trading is less widely used but can be applied in certain contexts. Stocks often trend strongly over time, which can be problematic for grids that rely on sideways price action. However, during periods of consolidation.

For example, when a company’s share price trades in a range between earnings reports, a carefully managed grid may generate returns. Traders need to be especially cautious of gaps caused by overnight news or earnings surprises, as these can bypass grid levels and trigger outsized losses. For this reason, grid trading in equities is generally better suited for experienced traders who combine it with strict risk management or use it selectively on range-bound stocks.

Overall, the core principle of grid trading remains the same across forex, crypto, and stocks: systematically buy low and sell high within a chosen range. What changes is the environment. Forex offers liquidity and stability, crypto provides volatility and 24/7 action, while stocks demand careful timing and risk control due to gaps and trends. Understanding these market-specific dynamics is critical to deciding where and how to deploy a grid trading system effectively.

Types of Grid Trading Strategies

Grid trading strategies vary depending on market conditions. Static grids use fixed spacing and levels, while dynamic grids adapt to changing volatility. Another distinction is between arithmetic grids, where levels are equally spaced in price terms, and geometric grids, where spacing is based on percentages.

Recent research has proposed Dynamic Grid-based Trading (DGT) for crypto markets, which resets levels in response to new price action. Backtests on Bitcoin and Ethereum between 2021 and 2024 showed improved performance versus traditional grids, though these are historical simulations and not guarantees.

Pros and Cons of Grid Trading

The appeal of grid trading lies in its systematic nature. It can work well in choppy, range-bound conditions, generating frequent small gains. Because execution can be automated, it helps reduce emotional decision-making and provides consistency.

However, there are real risks. In strongly trending markets, losing positions can accumulate quickly, especially without stop-loss protection. Transaction costs, spreads, and funding fees can also erode profitability. Grid trading is not “set and forget”; it requires monitoring and adjustments to avoid outsized drawdowns.

How to Set Up a Grid Trading System

Setting up a grid requires thoughtful preparation. First, define the market and instrument, whether forex pairs, cryptocurrencies, or equities. Next, determine a price range based on support and resistance zones or recent volatility. Within that range, divide levels evenly using arithmetic or percentage spacing.

Orders are then placed on each grid line, typically as limit orders. Risk controls such as stop-loss orders beyond the outer boundary are essential to prevent runaway losses. Position sizing should remain conservative, as open positions can accumulate quickly. Many traders test their systems in demo accounts first to refine spacing, sizing, and cost assumptions before committing real capital.

Is Grid Trading Profitable?

Grid trading can be profitable in the right environment, particularly when markets are oscillating within a range. Its edge comes from structure and automation rather than forecasting. Still, profitability depends heavily on execution quality, cost management, and strict risk control. Without discipline, especially in trending conditions, losses can mount quickly.

Conclusion

Grid trading offers a structured way to capture profits from market fluctuations without having to predict exact direction. It can be effective in forex, where liquidity supports smooth execution, in crypto, where volatility creates frequent opportunities, and in stocks, where range-bound conditions occasionally allow grids to thrive. At the same time, traders must remain aware of the risks: strong directional moves, transaction costs, and poor risk management can quickly erode potential gains.

For traders who want to explore strategies like grid trading in a secure and professional environment, Ultima Markets provides access to forex, crypto CFDs, and global indices under robust regulation. With advanced platforms, educational resources, and risk management tools, Ultima Markets helps you apply structured approaches such as grid trading with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.