Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

How Does Google Stock Price Move in 2025?

Google (Alphabet Inc., NASDAQ: GOOGL), as a global tech giant, has always been in the spotlight for investors. In June 2025, Google’s stock experienced significant volatility, with Class A shares dropping nearly 4%, leading the decline in tech stocks. The main reasons were the EU’s antitrust fines and the threat that Apple may replace Google as the default search engine in Safari.

For investors, now is a critical time to evaluate forecasts for Google’s stock price. Whether you’re bullish or bearish, trading Google shares via Contracts for Difference (CFDs) offers flexibility in responding to market volatility.

Google Stock Price Overview (as of June 2025)

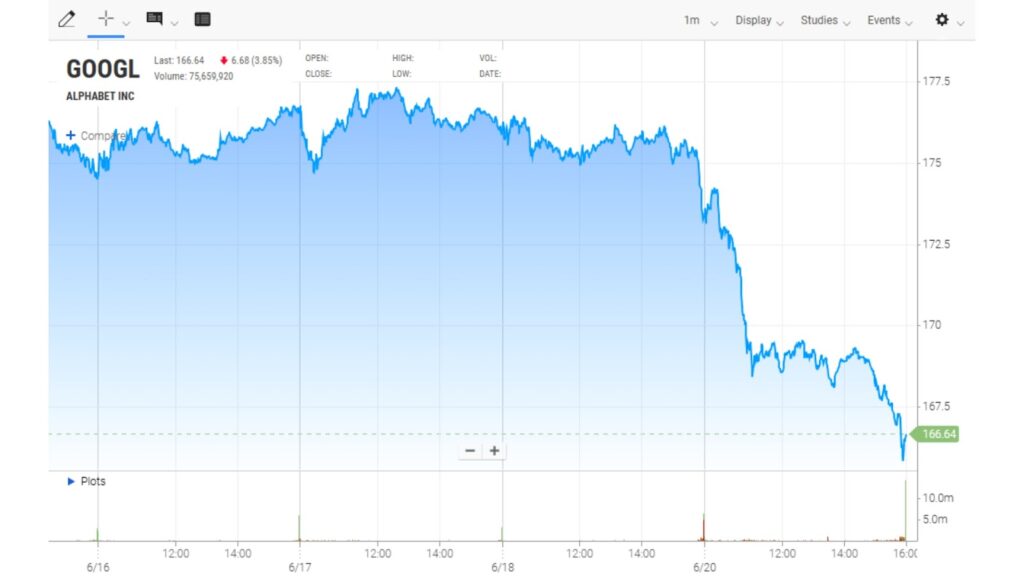

Google’s stock remains highly discussed among investors. As of June 20, 2025, Alphabet Inc. Class A closed at USD 166.64, down 3.81%, with a cumulative three-day drop of 5.76%. Trading volume has also significantly increased.

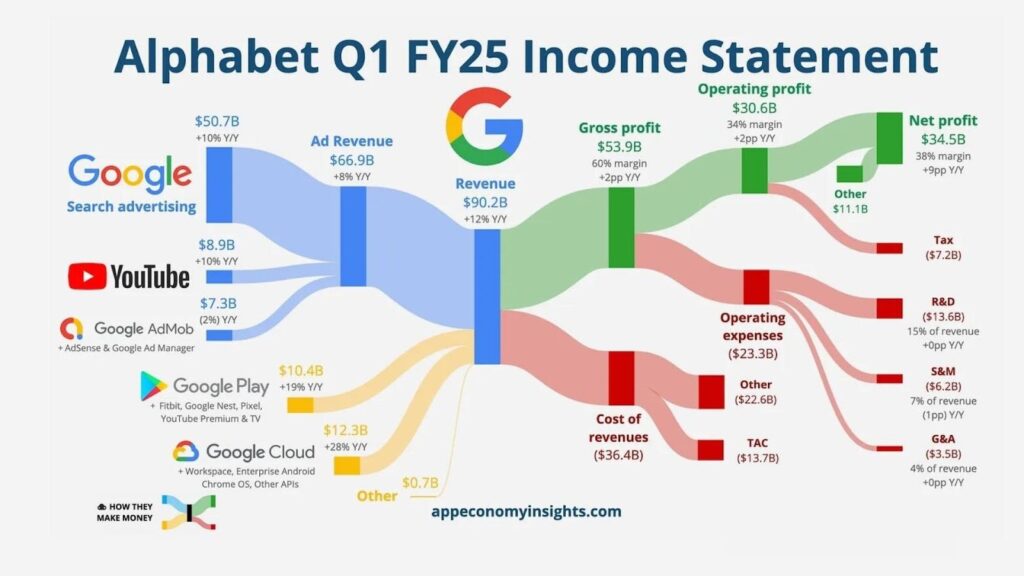

Alphabet, Google’s parent company, operates core businesses across search advertising, YouTube, cloud services, the AI ecosystem (including Gemini), and hardware. In 2024, it recorded USD 350 billion in revenue and around USD 100 billion in net profit, demonstrating strong internal cash generation capacity.

Why Did Google’s Stock Drop Today?

Earnings and Technical Volatility

Q1 2025 earnings were considered pristine—revenue rose by 12%, and YouTube income increased by 10%. However, concerns about macroeconomic and legal risks limited the stock’s upside momentum.

Uncertainty Around AI Transition

Although Google I/O boosted AI search and Gemini business growth (with a 5% rise to around USD 172), growing competition from OpenAI and Apple’s exploration of AI search adds pressure.

Antitrust Risk

The US Department of Justice and the EU have both identified Google Search as monopolistic, with potential outcomes including forced divestment of Chrome or Android. In the worst case, the stock could plunge 15–25%.

Considering the above factors, short-term volatility is apparent, though long-term potential remains based on confidence in Google’s AI transition.

Forecast and Technical Analysis for Google Stock in H2 2025

According to a consensus of 73 analysts, more than half recommend a strong buy on Google stock. The target price range is between USD 171 and 235, with an average estimate of around USD 199 to 205, implying an upside potential of about 19%.

From a fundamental perspective, Google Cloud continues to expand and is expected to be a key driver of stock growth in the second half of the year. Based on 2026 projected EV/EBITDA multiples, the fair valuation lands around USD 185.

However, the market must also be alert to potential risks, including the EU fine hearing in July and the US antitrust ruling in August. Unfavorable outcomes could drag the stock down to its USD 144 support level. Overall, Google’s stock retains upward potential but must contend with policy uncertainty.

Overall forecast: Google’s stock price in the second half of 2025 is projected to range between USD 180–200, suggesting room for recovery. Technical indicators and key support/resistance levels can be set up via the UM platform.

How Can Beginners Check Google’s Real-Time Stock Price?

Common ways to check stock prices include a Google search or visiting the Nasdaq website. For Taiwanese investors, the Ultima Markets platform offers a more convenient way to access Google’s live stock price.

UM App and WebTrader

With Ultima Markets’ App and WebTrader, investors can track real-time changes in Google’s stock price and access Trading Central technical analysis to quickly view candlestick charts, MACD, RSI, and other key indicators.

The platform interface is user-friendly, supporting custom charting and multi-timeframe switching—ideal for short-term swing trading or trend breakout tracking. Whether on mobile or web, users can stay updated on market moves anytime, enhancing decision-making efficiency.

It is recommended to register a demo account on Ultima Markets to access all features and view Trading Central’s technical reports.

Is Now a Good Time to Buy Google Stock?

Institutional and Analyst Perspectives

According to recent forecasts by major Wall Street investment banks, the second half of 2025 is a key period to evaluate investing in Google stock. J.P. Morgan has set a year-end target of USD 232, suggesting nearly 39% upside from current levels, citing AI expansion and strong search ad performance as primary growth drivers. Morgan Stanley and Citi are also optimistic, with target ranges around USD 185–200.

Despite some short-term regulatory risks, Google stock still shows mid-to-long-term upside based on fundamentals and market trends. Investors looking to position early may consider trading Google stock CFDs via Ultima Markets, which offers low entry barriers, leveraged trading, and bidirectional strategies—allowing flexibility whether going long or engaging in strategic shorting.

Short- and Long-Term Strategies

Whether one sees it as a short-term technical pullback or a long-term bet on AI applications, the investment potential remains.

Opening a CFD account with UM enables small-volume trading (as low as 0.01 lot), with support for bidirectional trading and high leverage (up to 1:2000), making it suitable for flexible strategy execution.

Where Is the Most Cost-Effective Place to Buy Google Stock?

Traditional Broker vs CFD Platform

| Category | Traditional Broker (Stock Ownership) | CFD Platform (e.g., Ultima Markets) |

| Ownership | Owns physical shares | No ownership; trades price differences |

| Minimum Trade Size | Usually high (must buy at least 1 full share) | As low as 0.01 lot, low capital requirement |

| Fees | Typically includes transaction and platform fees | Mainly spread-based; some accounts charge fixed commissions |

| Currency Conversion | Common, especially when converting TWD to USD | UM supports multi-currency accounts to reduce conversion costs |

| Tax Treatment | Subject to securities and capital gains taxes | No securities tax; simpler tax handling |

| Leverage | None or very limited | Up to 1:2000 leverage on UM |

| Short Selling | Limited (requires margin account, complex rules) | Easily trade both long and short positions |

| Real-Time Quotes & Tools | May be delayed or require additional fees | UM provides real-time data and Trading Central tools |

| Trading Flexibility | Limited to market hours | 24-hour trading support, fast and flexible |

If you value low entry thresholds, flexible trading, access to leverage, and transparent costs, using the CFD platform provided by Ultima Markets will better meet modern investment needs.

Where Can You Buy Google Stock at the Lowest Cost?

The ECN account at Ultima Markets offers spreads as low as zero and transparent commissions, resulting in lower trading costs than traditional brokers. A demo account is also available to test spreads and swap costs, enhancing user confidence.

Frequently Asked Questions

Does Google Stock Pay Dividends?

GOOG/GOOGL Class C pays quarterly dividends of approximately USD 0.21, with an average yield of 0.3–0.5%.

Can I Buy Google Stock Using TWD?

Yes, platforms like UM allow automatic conversion from TWD to USD for trading, with transparent exchange rate feedback.

What Are the Risks of Investing in Google Stock?

Risks include high price volatility, regulatory threats (such as antitrust actions), and macroeconomic factors. Stop-loss settings and capital management are recommended.

What’s the Difference Between CFDs and Physical Shares?

CFDs do not involve ownership but allow for bidirectional trading; they offer high leverage but may incur overnight and trading costs. Physical shares involve actual ownership with no overnight charges.

Conclusion

Despite notable volatility in H1 2025, most institutions forecast upward potential for Google stock in the second half. For Taiwanese investors interested in riding this growth wave or engaging in swing trading, trading Google stock CFDs via the Ultima Markets platform provides a cost-effective, flexible, and compliant market entry.

If you’re ready, click the link below to register a demo account with UM and immediately experience real-time pricing, technical analysis, and strategy learning.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.