Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteGoogle Nano Banana AI: Stock Market Buzz

When Google launched its new Nano Banana AI in August 2025, it sounded like another quirky experiment. Instead, the tool went viral, pulling in more than 10 million new Gemini users and generating over 200 million image edits in just a few days.

Much of the excitement has played out on Instagram, where Nano Banana edits quickly became a trend, filling feeds with surreal transformations and creative challenges.

Behind the playful name lies something investors and traders can’t ignore: a new growth driver that could influence Alphabet’s (NASDAQ: GOOGL) stock performance.

Instagram Hype and Investor Confidence

The success of the Nano Banana AI is not just about technology, it’s about adoption at scale. On Instagram, creators and influencers embraced the tool almost overnight. This kind of organic virality is valuable because it shows Nano Banana isn’t a niche feature. It is already part of the broader social conversation, which strengthens its chances of converting free users into paying customers.

For investors, this social traction signals potential revenue growth. Google charges about $30 per one million tokens, or roughly $0.04 per image, for professional Nano Banana usage through its API. If even a fraction of this viral engagement turns into subscriptions or enterprise adoption, it could open up a new income stream that analysts will quickly bake into earnings forecasts.

On Instagram, the Nano Banana AI became a viral phenomenon. Users weren’t just applying filters, they were transforming profile pictures into lifelike action figures, fantasy characters, and surreal edits that looked like digital collectibles. These playful creations sparked hashtags and challenges, making the tool one of Instagram’s fastest-spreading AI trends of the year.

For example, let’s create an action figure version of Inter Milan’s star striker, familiar to us at Ultima Markets through our proud partnership with the club.

For Google, this virality isn’t only about entertainment. It creates a pipeline of engaged users who may convert into paid subscribers or professional API customers. The fact that millions are experimenting with Nano Banana for personal branding, digital collectibles, and storytelling suggests the tool could have staying power well beyond the initial meme cycle.

How Nano Banana Stacks Against Competitors

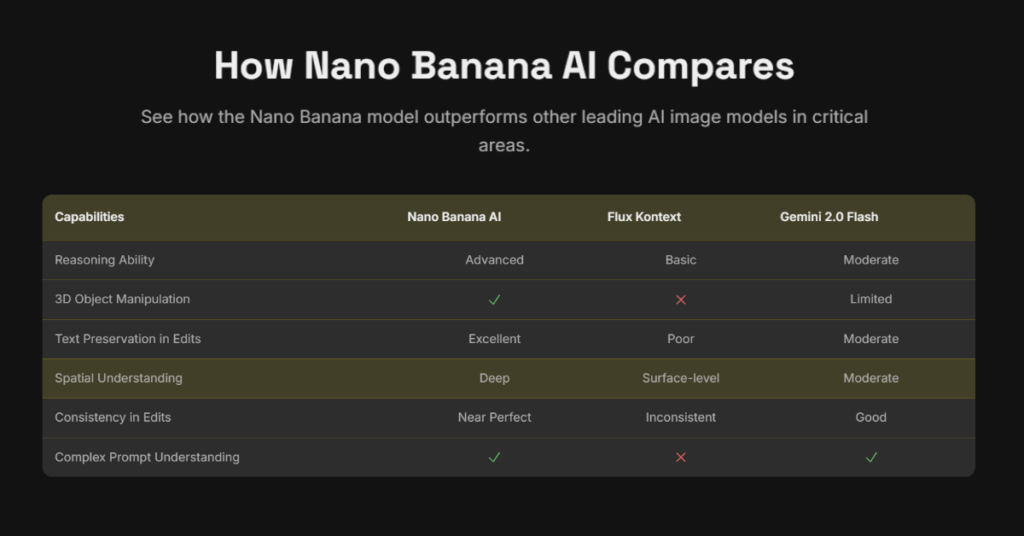

This cultural buzz matters even more when you consider the competitive landscape. The AI race is crowded, but Nano Banana is making a mark. Independent testing shows it can generate images up to 6 times faster than ChatGPT-5, while also delivering stronger consistency in details such as clothing, objects, or scenery. Benchmark scores place it ahead of rivals like GPT-Image-1 and Flux-Kontext-Max, giving Google an edge in a space where it has often been seen as playing catch-up.

This competitive strength matters financially. Business Insider has already described Nano Banana as a potential rival to Adobe Photoshop, while industry analysts point out that better visuals can boost e-commerce conversion rates by 30 percent and consistent branding by 23 percent.

If Nano Banana delivers that quality at scale, businesses may integrate it into their creative workflows, in turn expanding demand well beyond casual Instagram use.

Market Sentiment of the Google Nano Banana AI

For traders, the Nano Banana launch introduces new dynamics around Alphabet stock. Short-term, it could serve as a catalyst for speculation ahead of earnings if investors expect Google to showcase the tool’s success. Options activity may increase as retail traders position themselves for volatility, and AI-themed ETFs holding Alphabet could benefit from momentum flows.

Long-term, the real question is whether Google can sustain adoption and tie Nano Banana into its wider Gemini ecosystem. If so, the tool could strengthen Google’s role in AI monetisation, supporting growth not just in consumer products but in advertising, cloud services, and enterprise solutions.

Risks Beneath the Hype

Of course, not all hype translates into revenue. Instagram trends can fade quickly, and if daily use drops, so will the financial upside. There are also risks around misinformation: Nano Banana’s edits are so seamless that they can blur the line between truth and fiction, which may invite regulatory pushback.

To counter this, Google has embedded an invisible SynthID watermark in every Nano Banana image. Unlike traditional metadata, this watermark remains even if the image is cropped or screenshotted, allowing authenticity to be verified. This safeguard may help reduce regulatory risk and preserve brand trust, but challenges around misuse will remain.

Competitors like OpenAI and Midjourney are also likely to respond, potentially eroding Google’s current advantage.

Conclusion

The rise of the Google Nano Banana AI is a reminder that innovation can move markets as much as it entertains consumers. Viral adoption on Instagram shows cultural staying power, while the monetisation model gives Google a path to turn creativity into revenue. For traders and investors, this mix of hype and financial potential makes Nano Banana a story worth tracking closely.

Whether it becomes a cornerstone of Google’s AI strategy or fades as just another viral moment, one thing is certain: the Nano Banana launch has already given Alphabet stock watchers a fresh reason to pay attention.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.