Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is the Gold Price Chart 10 Years Telling Us

Amid ongoing global economic and geopolitical turbulence, gold’s role as a safe-haven asset has become increasingly critical. This article, through the lens of the “Gold Price Chart 10 Years,” provides an in-depth analysis of the gold price trends over the past decade, explores key factors driving its fluctuations, and offers a forward-looking outlook to help investors make more informed decisions.

Gold Price Chart 10 Years: A 2015–2025 Price Review

Key Stages of Gold Price Movement

- 2015–2018: Gold prices remained relatively stable during this period, primarily influenced by the U.S. economic recovery and Federal Reserve rate hikes, fluctuating within the $1,100–$1,300 per ounce range.

- 2019–2020: Rising global economic uncertainty and the outbreak of COVID-19 drove gold prices to a historic high of $2,075 per ounce in August 2020.

- 2021–2023: With widespread vaccine distribution and gradual economic recovery, gold prices declined slightly but remained within the $1,700–$1,900 per ounce range.

- 2024–2025: Renewed geopolitical tensions and inflationary pressure pushed gold prices higher. In February 2025, gold reached a new record high of $2,860.67 per ounce.

Highs and Lows of Gold Prices Over the Past 10 Years

An analysis of the gold price chart over the past decade reveals pronounced volatility, which strongly demonstrates gold’s dual function as an inflation hedge and safe-haven asset.

▲Historical International Gold Prices – Unit: USD/Ounce

Key Factors Affecting Gold Price Trends

Macroeconomic Conditions and Interest Rate Policies

Interest rates and inflation are among the primary drivers of gold prices. Since 2021, a series of tightening policies by global central banks pushed up real interest rates, putting pressure on physical gold demand. However, by 2024, some central banks slowed their rate hikes, reigniting safe-haven demand.

Geopolitical Risks

The continuation of the war in Ukraine and heightened tensions in the Middle East in 2025 triggered safe-haven buying, helping gold prices stay elevated at the beginning of the year.

Central Bank Gold Purchases

According to the World Gold Council, global central banks purchased 1,045 tonnes of gold in 2024, marking the third consecutive year with over 1,000 tonnes of purchases. This reflects strong confidence in gold as a reserve asset and further supports its price.

USD Index and the XAU/USD Relationship

The U.S. Dollar Index is negatively correlated with gold: when the dollar weakens, gold—being a dollar-denominated asset—tends to benefit. In Q1 2025, the Dollar Index dropped by 2.5%, leading to an over 8% increase in gold prices.

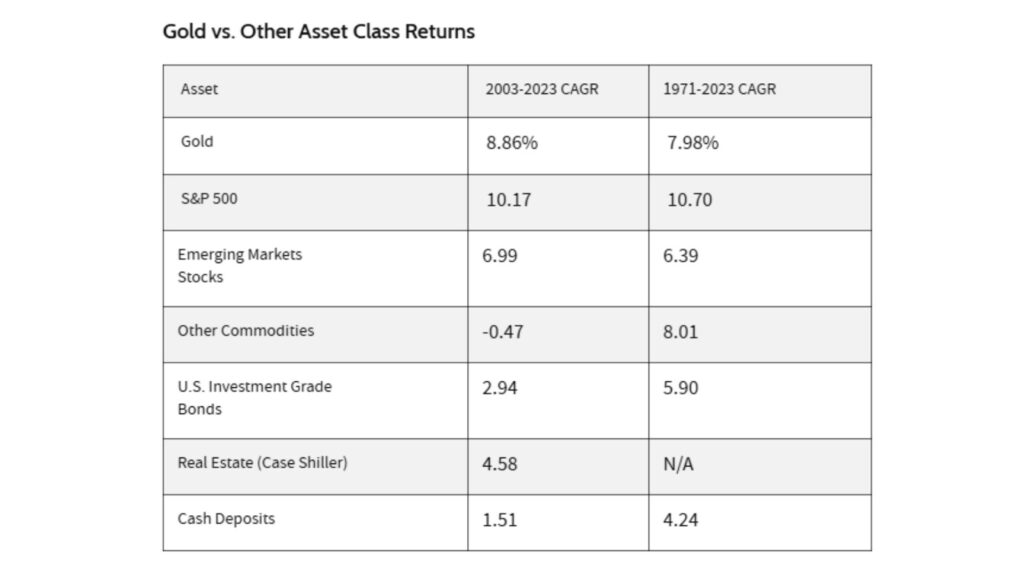

3. Annualized Gold Returns vs. Other Assets

From a 10-year perspective, the annualized return of gold from 2015 to 2025 stands at approximately +8.7%, outperforming the S&P 500 Index’s +7.5% over the same period, but falling short of the U.S. 10-year Treasury yield, which posted an annualized +9.2% (as of end-2024).

According to the chart of highs and lows in gold prices over the past decade, investors who exited at the 2015 peak missed an 80% subsequent rally; conversely, those who entered at the 2020 low could achieve nearly 210% returns by the end of 2025.

4. Forecast and Risk Management

2025 Gold Price Outlook

Based on historical patterns and forward-looking forecasts, experts generally believe that gold still has 5–10% upside potential in the second half of 2025, with prices expected to fluctuate between $3,300 and $3,600. However, a sharp global interest rate hike or strong rebound in the U.S. dollar may trigger short-term correction pressure.

Key Risk Management Tips:

- Set dynamic stop-loss orders, with an initial level suggested at 5% below the entry price;

- Use leverage prudently, keeping it below 1:100 to avoid liquidation;

- Diversify your portfolio by combining gold with bonds and equities to reduce concentration risk.

How to Trade Gold with Ultima Markets

To seize opportunities in the ever-changing gold market, a robust, transparent, and secure trading platform is essential. Ultima Markets, a professional forex broker regulated by international authorities, offers investors a superior gold trading experience.

Platform Advantages of Ultima Markets

Ultima Markets supports leading platforms MT4 and MT5, along with WebTrader and the proprietary UM App, catering to varied trading preferences. Whether on desktop or mobile, investors can easily stay updated with market movements, place orders in real time, and manage positions seamlessly around the clock.

In terms of trading costs, UM offers competitive spreads and commission structures. For ECN accounts in particular, the average spread is just 0.2 pips, with low commissions of only $5 per lot, making gold trading more efficient and cost-effective. Additionally, with leverage of up to 1:2000 and a two-way trading mechanism (long or short), traders can respond flexibly to market trends and maximize potential gains.

Security and Protection

When choosing a trading platform, fund security is a critical concern. Ultima Markets is regulated by three major international bodies: Cyprus CySEC (EU), Australia’s ASIC, and Mauritius’ FSC, demonstrating strong compliance and credibility.

To safeguard client funds, UM adopts a strict fund segregation policy: all user funds are held in Westpac, a leading Australian bank, and are entirely separated from corporate operating capital, effectively preventing fund misuse. Moreover, UM provides added protection through The Financial Commission. In case of a dispute ruled in the client’s favor, each user is entitled to compensation of up to €20,000, greatly enhancing trading confidence and assurance.

Account Opening Process

Opening an account with Ultima Markets is simple: just fill out your identification details online and complete identity verification to begin trading. New users can also try out a demo account with $100,000 in virtual funds, allowing them to get familiar with the platform in a risk-free environment.

Conclusion

An analysis of the Gold Price Chart 10 Years shows gold’s steady performance and its vital role as a safe-haven asset. In the face of future uncertainties, gold remains an indispensable component of any investment portfolio. If you’re looking to seize opportunities in the gold market, Ultima Markets offers a professional trading platform and comprehensive support to help you take a confident step forward in your gold investment journey.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.