Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Is Gearing Ratio?

Gearing ratio is a financial metric that measures the proportion of a company’s capital that comes from debt compared to equity. It indicates how leveraged a company is and reflects the level of financial risk it carries.

In simple terms, it shows how much a company relies on borrowed money to finance its operations versus using funds from shareholders.

Why It Matters:

- High Gearing = Higher debt, higher potential returns, but greater risk.

- Low Gearing = Lower debt, greater financial stability, but limited growth leverage.

Traders use gearing ratio to assess a company’s solvency, funding strategy, and risk profile especially in volatile or high-interest environments.

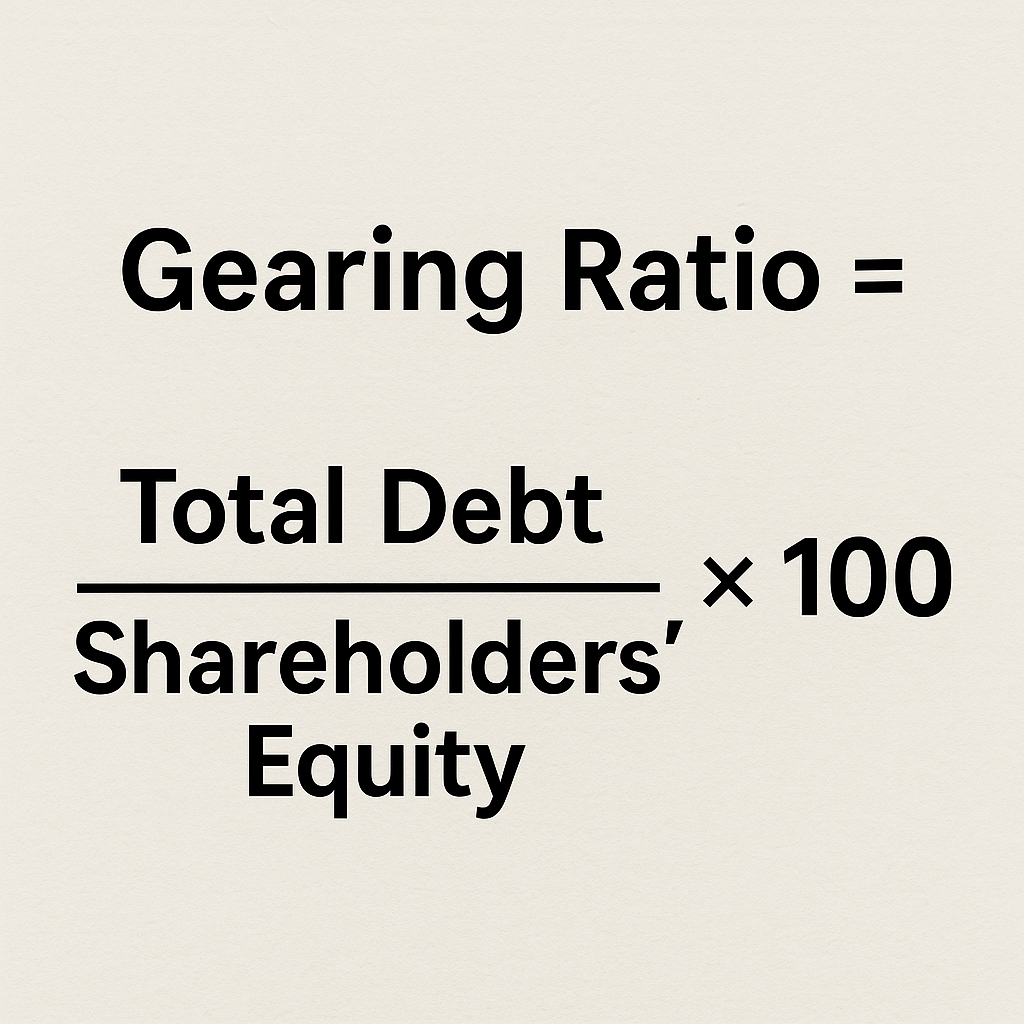

What Is Gearing Ratio Formula?

The gearing ratio formula is used to calculate the proportion of a company’s capital that comes from debt compared to equity. It is expressed as a percentage.

Gearing Ratio Formula:

Gearing Ratio = (Total Debt / Shareholders’ Equity) × 100

- Total Debt: Usually includes long-term liabilities such as bank loans or bonds.

- Shareholders’ Equity: The total capital contributed by shareholders plus retained earnings.

A higher ratio suggests the company is more leveraged, this could lead to higher returns during strong performance but also increases financial risk during downturns.

How to Calculate Gearing Ratio Formula

To calculate gearing, use figures from the company’s balance sheet:

Example Calculation:

- Long-term Debt: $4 million

- Shareholders’ Equity: $6 million

Gearing Ratio = (4,000,000 / 6,000,000) × 100 = 66.7%

This means 66.7% of the company’s capital is financed by debt, which can be seen as moderately high.

Example of Calculating Gearing Ratio

Let’s look at a real-world case:

Company A Balance Sheet:

- Total Liabilities: $8 million

- Equity: $2 million

- Gearing Ratio = (8M / 2M) × 100 = 400%

This is considered high gearing, which means the company may face challenges repaying its obligations if cash flow tightens.

Company B:

- Debt: $1 million

- Equity: $5 million

- Gearing Ratio = (1M / 5M) × 100 = 20%

This is low gearing, suggesting a more conservative capital structure and stronger solvency.

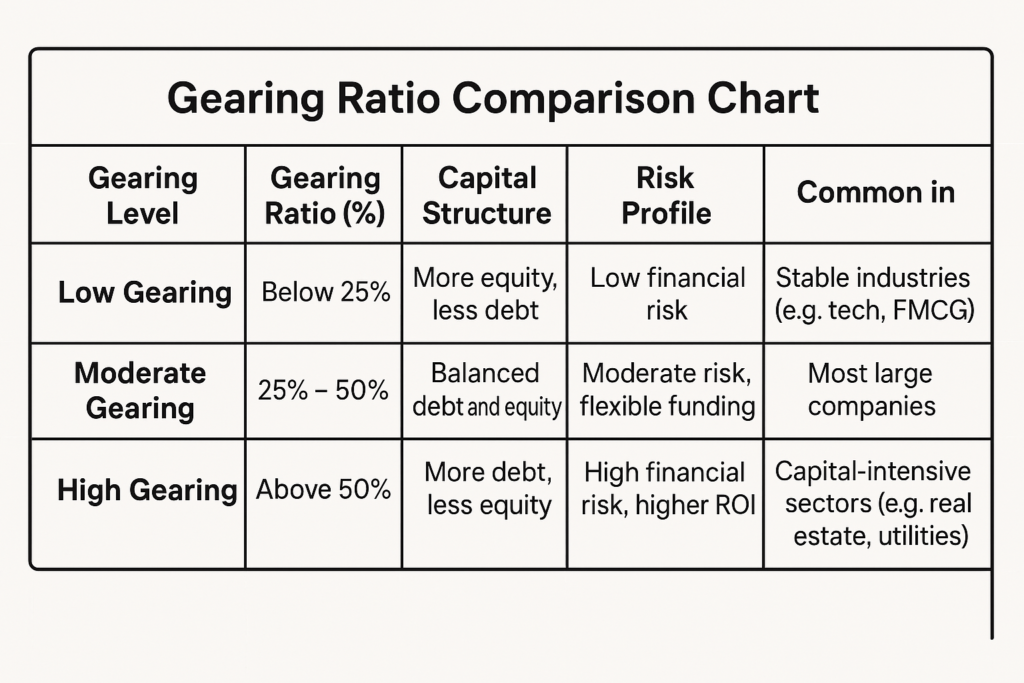

What Is Considered a Good or Bad Gearing Ratio?

There is no universal “good” or “bad” ratio, it depends on the industry and economic environment.

| Gearing Level | Ratio (%) | Implication |

| Low | Below 25% | Financially conservative, low risk |

| Moderate | 25%-50% | Balanced use of debt and equity |

| High | Above 50% | Higher risk, aggressive financing |

Capital-intensive sectors (like utilities or real estate) tend to have naturally higher gearing levels.

From a trader’s view, high gearing may offer higher returns when markets are favorable but increases downside risk in downturns.

Pros and Cons of Gearing Ratios

The gearing ratio offers valuable insights into a company’s financial structure, but like any metric, it comes with both advantages and limitations.

Pros:

- Enhanced Returns: Debt can amplify returns on equity when business performs well.

- Tax Benefits: Interest on debt is tax-deductible in many jurisdictions.

- Capital Access: Companies can scale operations without diluting equity.

Cons:

- Increased Risk: High debt levels increase vulnerability during economic stress.

- Higher Interest Costs: Especially if interest rates rise.

- Credit Rating Impact: Excessive gearing may lead to downgrades, raising borrowing costs.

Understanding the pros and cons of gearing ratios helps traders evaluate a company’s risk-reward profile and make more informed decisions based on prevailing market conditions.

How Companies Reduce Their Gearing

Companies can manage or reduce their gearing ratios in several ways:

- Debt Repayment: Using excess cash flow to reduce long-term liabilities.

- Equity Financing: Issuing more shares to raise capital, increasing equity base.

- Asset Sales: Disposing of non-core or underperforming assets to reduce debt.

- Retained Earnings: Reinvesting profits rather than distributing dividends to boost equity.

A company reducing its gearing ratio may signal a shift toward a more conservative risk profile — something traders and long-term investors should track.

Why Gearing Matters to Traders

Gearing ratio is a critical tool for traders because it reveals how sensitive a company’s earnings are to changes in the broader economic environment. Highly geared companies carry more debt, which can amplify profits during boom cycles, making their stocks attractive in bullish markets. However, this leverage also increases downside risk in bear markets, as interest payments and debt obligations remain constant even if revenue declines.

Traders closely monitor gearing ratios to assess a company’s financial resilience, especially when interest rates are rising or market volatility is high. Companies with low or moderate gearing are generally considered safer, particularly in uncertain macroeconomic conditions. Meanwhile, firms with high gearing might offer short-term opportunities for aggressive traders but they require careful risk management.

Ultimately, gearing ratio helps traders balance risk versus reward, identify potential volatility, and align their strategy with the company’s financial structure.

To make smarter, data-driven decisions, consider trading with Ultima Markets, a trust broker offering advanced market analytics, professional charting tools, and transparent pricing.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.