Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteFutures Trading Strategies You Need to Know

What Are Futures and Why Trade Them?

Futures are a type of futures contract that obligate traders to buy or sell an asset at a predetermined price on a specific future date. They exist for commodities, indices, currencies, and more. Traders use futures contracts to hedge against risk, speculate on price movements, or gain exposure to markets with leverage.

The value of a futures contract is determined by the underlying asset’s price. Trading futures offers unique opportunities because it allows you to profit from both rising and falling markets. However, the high leverage and volatility also mean that trading without a clear strategy can quickly lead to losses. This is where futures trading strategies become essential for balancing risk and reward.

To trade futures, a trader needs to open an account with a broker or trading platform.

Understanding Futures Contracts

Futures contracts are the backbone of futures trading. Each contract specifies the asset, contract size, delivery date, and price, ensuring transparency and standardisation on regulated exchanges like the Chicago Mercantile Exchange (CME).

By trading futures, investors can profit whether markets rise or fall, depending on whether they take a long (buy) or short (sell) position. Understanding contract mechanics—including pricing and settlement—is essential for risk management and executing effective strategies.

Why Futures Trading Strategies Matter

A good strategy provides a roadmap for making decisions in complex and fast-moving markets. With the right approach, traders can:

- Manage risk by defining entry and exit points.

- Identify opportunities across different market conditions.

- Enhance consistency, avoiding impulsive decisions based on emotions.

Remember, trading without a strategy is reactive. By using futures trading strategies, your approach will be more disciplined and structured, increasing long-term profitability in return.

Futures Market Analysis

Successful futures trading relies on thorough futures market analysis. This process involves evaluating both technical indicators and fundamental factors to anticipate price movements and identify trading opportunities. Technical indicators—such as moving averages, the relative strength index (RSI), and Bollinger Bands—help traders spot trends, gauge momentum, and pinpoint potential breakout points in the market.

In addition to technical analysis, fundamental analysis plays a crucial role. By examining factors like supply and demand, economic reports, and geopolitical events, traders can better understand what drives the underlying asset’s price. For example, a sudden change in commodity demand or a major economic announcement can significantly impact futures prices.

By combining technical indicators with fundamental insights, traders gain a comprehensive view of the futures market. This balanced approach enables more accurate predictions, helping traders decide when to enter or exit trades and ultimately improving their chances of success.

Popular Futures Trading Strategies

Let us see some of the most widely used futures trading strategies that are adopted by both retail and professional traders:

| Strategy | What It Does | Example / Tip |

| Trend Following | Trades in the market’s direction (long in bullish, short in bearish trends) | Use moving averages or MACD. Watch support and resistance levels. |

| Spread Trading | Profits from price differences between related futures | Trade corn vs. wheat when the price relationship shifts. Reduces exposure. |

| Scalping | Captures small price movements quickly | Focus on liquid contracts like S&P 500 futures. Mind fees and commissions. |

| Swing Trading | Targets medium-term price swings | Use RSI or Fibonacci retracements. Track technical and fundamental signals. |

| Hedging | Protects existing investments | Offset exposure in commodities or stocks using futures. |

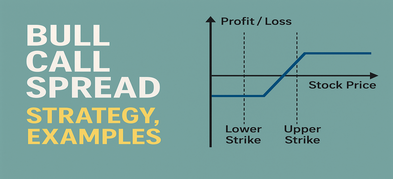

| Options on Futures | Adds flexibility, limits risk | Buy call/put options to protect capital while keeping upside potential. |

Breakout Trading is another approach: entering positions when prices cross key resistance/support levels.

Each strategy suits different market conditions. Scalping is fast-paced; trend-following or swing trading works for medium to long-term trends. Always consider fees, commissions, and margin requirements.

Now that you’ve read about all the strategies, you may be wondering: how do you choose the right one for your trading style? Let’s take a look.

How to Choose the Right Futures Trading Strategy

Selecting the right futures trading strategy depends on your personal trading style, goals, and risk tolerance:

- Match strategy to trading style: Day traders often prefer scalping or trend-following, while swing traders may opt for medium-term setups.

- Assess risk tolerance: Aggressive traders might use leverage and trend-following, while conservative traders might hedge or use options on futures.

- Backtesting and practice: Test your strategies with historical data or paper trading to refine your approach without risking real capital.

By choosing a strategy that aligns with your style and risk profile, you increase your chances of consistent performance.

Before executing any trade, always verify all order details, including fees, commissions, and margin requirements, to ensure accuracy and avoid costly errors.

Tools and Indicators for Futures Trading Strategies

Technical analysis tools support strategy execution:

- Trend indicators: Moving Averages, MACD, Bollinger Bands

- Momentum indicators: RSI, Stochastic Oscillator

- Volume analysis: Confirms liquidity and volatility

These tools give you a clear view of market conditions and help make data-driven decisions. However, even with the best tools and analysis, the market can be unpredictable. That’s why risk management is just as crucial.

Risk Management in Futures Trading

Even the best strategies can fail without proper risk management. Key considerations include:

- Position sizing: Avoid risking too much capital on a single trade.

- Stop-loss orders: Limit potential losses automatically.

- Diversification: Spread risk across different assets or contracts, similar to how investors diversify in the stock market to manage risk and reduce volatility.

- Leverage awareness: Futures amplify both gains and losses; use leverage wisely.

A disciplined risk management plan ensures that even if a trade goes against you, your overall portfolio remains protected.

Conclusion

Futures trading offers tremendous opportunities, but success requires strategy, discipline, and risk management. By mastering futures trading strategies, you can navigate volatile markets, make informed decisions, and maximise potential returns while protecting your capital.

Start by understanding what futures are, test strategies using historical data, and always align your trades with your risk tolerance. With the right approach, futures trading can become a powerful tool for achieving your trading goals.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.